Wheeeee, what a ride!

Wheeeee, what a ride!

I don't think I could have been more clear on Tuesday that CASH!!! was the way to go, with 6 mentions of going to CASH!!! in the morning post alone. All my logic and reasoning is right there and, on Wednesday morning, I was still yammering on about going to CASH!!! Our primary hedge (delivered right to our Subscribers in our Morning post, pre-market) was the TZA April $14/17 spread at $1.05, offset by the sale of the $14 puts at .50. That hedge was net .66 at Tuesday's close (but back to .50 on Wednesday) and .89 yesterday – gaining 35% on a 2.5% drop in the Russell. If TZA stays were it is ($15.60) that spread goes up to $1.60, for a 220% gain from our initial entry.

That means you can protect a $100,000 portfolio against a 2.5% loss with just $1,200 committed to a spread like this. That's what we mean when we teach you to BE THE HOUSE – Not the Gambler.

That means you can protect a $100,000 portfolio against a 2.5% loss with just $1,200 committed to a spread like this. That's what we mean when we teach you to BE THE HOUSE – Not the Gambler.

Today, at noon EST, I'm doing a special Live Webcast where we'll be discussing another Stupid Hedge Fund Trick: "How to Buy a Stock for a 15-20% Discount" and you can click on that link for a FREE sign-up (and we'll Email you a replay if you can't view it live).

If all goes well, we'll get another nice dip to buy into – just like our hugely successful February Trade Ideas – which we just reviewed in Part II of our February Trade Review and SHAME ON YOU if you didn't take those huge profits and get back to CASH!!! when I told you to (over and over and over again).

At the time, we were long on /NKD at 14,500 but yesterday, right in the morning post (which our Members get pre-market EVERY DAY), with the Nikkei at 14,700, we had already gained $3,500 per contract from our 15,400 short call last Friday morning (again, our Members get actionable trade ideas every day) but we weren't done with the short as I said:

One thing that was certain this morning was the collapse of the Nikkei in Japan. That index was down 2.5% for day, finishing at 14,700 on /NKD, which is a nice $3,500 per contract gain from our shorting line at 15,400 from just 5 days ago (Friday, 9:06 am). That was another silly spike up that we had the conviction to short into. We're actually looking for 14,500 or maybe even 14,000 on a proper breakdown so the 14,700 line can now be used as a new entry – with tight stops above.

As you can see from the chart above, /NKD finished yesterday at 14,280 – up another $2,100 per contract from my Wednesday morning call in just 31 hours. I also took the time to lay out the boring fundamentals on the Japan short in the Wednesday post – all very obvious in retrospect, isn't it?

As you can see from the chart above, /NKD finished yesterday at 14,280 – up another $2,100 per contract from my Wednesday morning call in just 31 hours. I also took the time to lay out the boring fundamentals on the Japan short in the Wednesday post – all very obvious in retrospect, isn't it?

Yesterday we turned our attention back to China and I warned that the bad news of the morning should not be ignored -despite the Futures showing positive at the time. I didn't give out any free trades yesterday but, in our Member Chat, we had been watching the 1,870 line on the S&P (/ES Futures) since 7:26am and we caught the cross at 10:24, when I reminded our Members about the short in our live Chat Room, and the S&P was kind enough to fall all the way to 1,845 before stopping out and that little drop was good for profits of $1,250 PER CONTRACT.

But neither the Nikkei nor the S&P were our best trades of the day. Our best trade of the day yesterday was shorting AMZN, as it spiked over $380 in the morning on news that they were raising the rates on their Prime Membership. I did the math for our Members and we decided (at 9:51 in Member Chat) to buy the weekly $375 puts for $1.35 as a day trade. We got a better pullback than we expected – all the way to $3.70, where the puts hit $6.20 – up 359% for the day, where we took the money and ran – with $1,350 on 10 contracts turning into $6,200 in less than 6 hours – not bad for a day's work!

No free trade ideas this morning but you can join us in our Member Chat room or, if you are too cheap to subscribe, you can join us for our FREE WEBCAST at noon (EST) today – I'm sure I'll have an idea or two for you then.

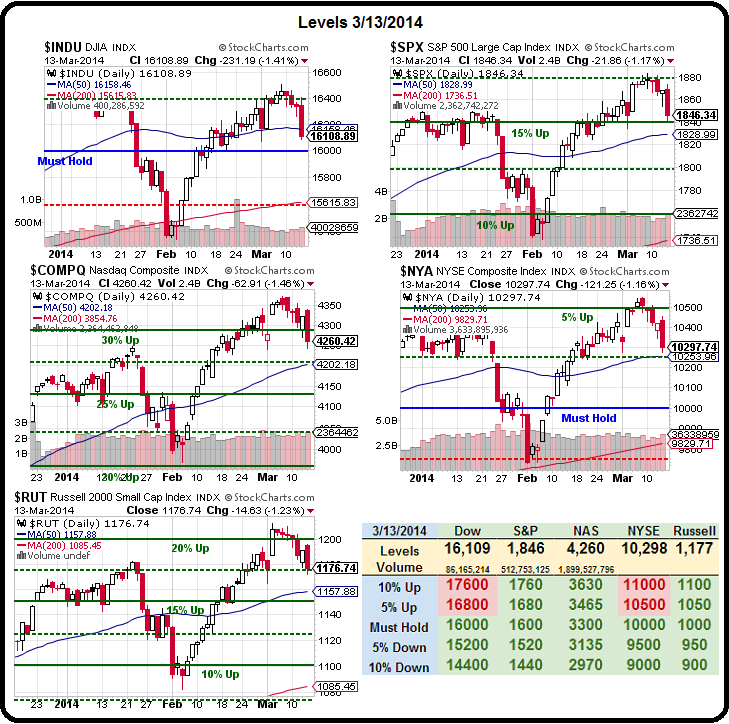

Meanwhile, we'll be watching for the indexes to make at least our weak bounce lines which, using our 5% Rule™, are going to be:

- Dow 16,200 (weak) and 16,300 (strong)

- S&P 1,852 (weak) and 1,860 (strong)

- Nasdaq 4,275 (weak) and 4,300 (strong)

- NYSE 10,350 (weak) and 10,400 (strong)

- Russell 1,182 (weak) and 1,190 (strong)

Failure to hold the weak bounce lines into today's close will be a strong indication that we're set for another leg down, at least to a 5% correction, probably 10%. Only if 3 of those 5 strong bounce lines get taken will we want to move some of our CASH!!! back off the sidelines (have I mentioned how much I like cash lately?) on anything other than some day trades. Of course, with day trades like we had yesterday – what's wrong with that?

Have a great weekend,

– Phil