These are not happy charts:

These are not happy charts:

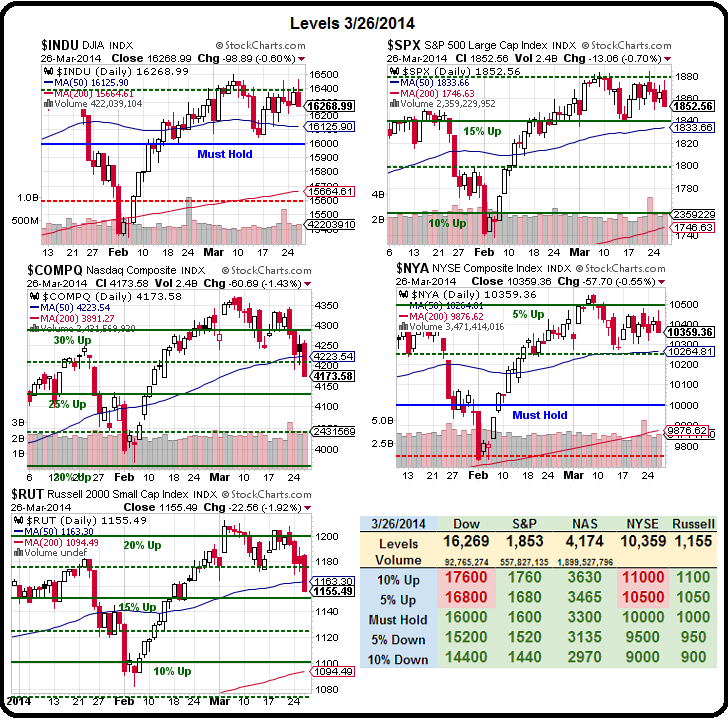

The Nasdaq and Russell have gone from Spitting to Vomiting Cobra patterns, with 10% drops certainly looking like they are in the cards as things play out. The Dow, S&P and NYSE are still putting on brave faces but, since we are coming into the end of Q1, we have to assume there's a window-dressing factor to keeping up appearances.

In our Futures Trading Seminars (and we have a big, live one coming next Tuesday, you can register for HERE), we teach our Members to short the laggards when 2 of 3 or 3 of 5 of the contracts they are watching cross. Well, here we have a similar opportunity with the slower-moving indexes as the Nasdaq may confirm a downtrend by crossing it's 25% line at 4,125 and the Russell will back that up by failing it's 15% line at 1,150. If so, you can short the laggard (we already shorted the Russell, of course – it was our key short all month!), most likely the Dow.

In fact, had IBM not popped 10 points in the past week, the Dow would already be 100 points lower, so it's a wonderful way to play catch-up at 16,269. Again, our Members are already up $750 per contract shorting the Dow, as our first call of the morning in yesterday's Member Chat Room (8:34 am) was:

In fact, had IBM not popped 10 points in the past week, the Dow would already be 100 points lower, so it's a wonderful way to play catch-up at 16,269. Again, our Members are already up $750 per contract shorting the Dow, as our first call of the morning in yesterday's Member Chat Room (8:34 am) was:

Durable Goods orders were not good. Hard to blame the weather on that one but I'm sure they will.

Dow 16,350 (/YM) is the best shorting line confirmed by /ES 1,865, /NQ 3,640 and /TF 1,180 – all still over so far. Oil $99.65 is a no short ahead of inventories, gold $1,312, Dollar 80.19. Siver $20.025, copper $2.9865, nat gas $4.39 and gasoline $2.89 and don't forget we expect a build in gasoline and distillates due to the ship channel closed but maybe a big draw in oil for the same reason.

Keep in mind that the Futures don't exactly coincide with the indexes and that we took the money and ran at the day's end but, this morning, we're at 16,200 on the Dow Futures and, at $5 per point, per contract, that's a $750 per contract gain in 24 hours! S&P Futures are at 1,845 and those pay $50 per point, per contact for a $1,000 per contract gain.

Keep in mind that the Futures don't exactly coincide with the indexes and that we took the money and ran at the day's end but, this morning, we're at 16,200 on the Dow Futures and, at $5 per point, per contract, that's a $750 per contract gain in 24 hours! S&P Futures are at 1,845 and those pay $50 per point, per contact for a $1,000 per contract gain.

The Nasdaq pays $20 per point, per contract and, at 3,575 this morning, that's good for a gain of $1,300 per contract and the Russell (/TF) is the one we featured as a shorting opportunity in Tuesday's Live Trading Webcast and this morning, at 1,150 and $100 per point, per contract, that's a very nice $3,000 per contract winner – all in 24 hours!

So, in our Futures trading, we're shorting the laggard and that's still the Dow (as it paid us the least) below the 15,200 line and we simply take a quick loss if it's over (usually $10-25) and we only short if it's confirmed by the S&P below 1,845 and the Russell below 1,150 and, if the Dow fails first and we get confirmation by another – we simply short the laggard. See, not a very complicated strategy!

Of course we take other factors into account, like the general news-flow and the direction of the Dollar and other currencies. As you can see from yesterday's shorting note, it was the Durable Goods report that made us want to go short first thing in the morning, with me making that comment just a few minutes after it was released. That's my main function as the Captain of the ship at PSW – I steer us in a general direction and call out trade ideas that might be useful along the way.

Oil was indeed a massive 6.6M build at 10:30 and we caught that ride down from $100 to $99.50 on the Oil Futures (/CL) and those pay $10 per penny, per contract for a $500 per contract gain. Of course we could also day-trade USO, DIA, SPY, IWM or the Ultras on each to get a similar effect but, once you learn how to trade the Futures and benefit from the low-cost contracts – you are not likely to go back to day-trading ETFs or Options.

The Dow has an ultra-short ETF called SDOW, now $30 – and a 10% drop in the Dow, down to 14,850 (from the 16,500 top) would be a 30% gain on SDOW to about $37.50 and you can play that straight up or limit your risk and buy the May $31 calls for $1.20, which would be worth more than $6.50 (up 440%) if the Dow drops 10%. That makes for a nice hedge since you could get back half of a 10% loss by putting up just 1% of what you think you may lose as insurance.

We don't need to protect our Portfolios because we CASHED our $100,000 Income Portfolio last week (up 6.7% for the year) and our $100,000 Short-Term Portfolio was already bearish (and now down just 3%!) while the $500,0000 Long-Term Portfolio it was protecting is still up 4.5%, so +$22,670 in the LTP less $2,995 in the STP is a nice net gain of $19,675 in our balanced set of virtual portfolios so far this year and right on track for our 15-20% goal.

In our Short-Term Portfolio, we have 20 TZA (ultra-short Russell) July $17/25 bull call spreads which we paid a net of $1.66 for on 2/12. As of yesterday's close, though TZA is still just $16.34, the spread is still $1.20 – that's another hedge I really like. Shorter-term, we were more aggressive with this TZA combo:

| 2014 19-APR 19.00 CALL [TZA @ $16.34 $0.87] | -30 | 2/21/2014 | $-1,890 | $0.63 | $-0.33 | $0.30 | $0.10 | $990 | 52.4% | $-900 | |||

| 2014 19-APR 15.00 PUT [TZA @ $16.34 $0.87] | -30 | 2/21/2014 | $-1,950 | $0.65 | $-0.34 | $0.31 | $-0.29 | $1,020 | 52.3% | $-930 | |||

| 2014 19-JUL 15.00 CALL [TZA @ $16.34 $0.87] | 50 | 3/10/2014 | $9,250 | $1.85 | $0.50 | $2.35 | $0.25 | $2,500 | 27.0% | $11,750 | |||

That's not so much a hedge as it was a bet that the Russell would lead us lower and, as you can see, we got more and more aggressively short as the Russell went the wrong way on us into the March high (1,212). This goes back to something I stress to our Members at Philstockworld, as well as in our weekly Webcasts: You have to know the VALUE of something (not the PRICE) when you are trading it. Just because the PRICE of something moves against you, doesn't mean the VALUE has changed.

If you can learn and live by that one simple concept, all the rest we have to teach you is just some fairly simple cash management techniques to keep you in the game while you wait for your various market ships to come in. Long-term, we prefer to be value players – and I just did a special Webcast on "How to Buy Stocks for a 15-20% Discount" using our key long-term trading strategies that you can check our or check out the Education Section at Philstockworld, which has tons of good articles on the subject.

Hopefully this sell-off won't turn too ugly but what a joy it is to be in CASH!!! while the market is in turmoil. Like the last drop, we will be doing some bargain hunting, looking to build back a few positions in our income portfolio but, for now, there still seems to be some fun to be had on the downside – ESPECAILLY in our Futures Trading!