Wow, what a recovery!

Wow, what a recovery!

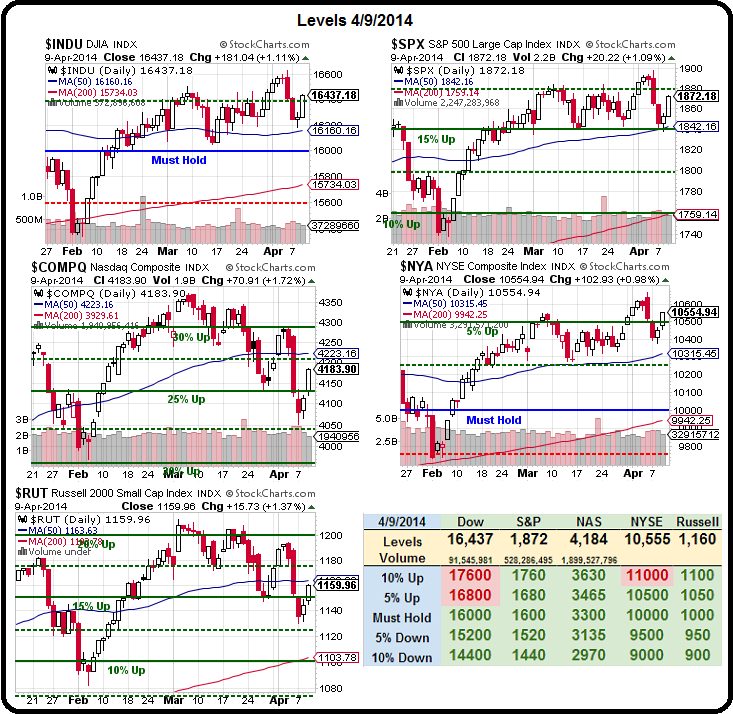

I mean we expected a bounce yesterday on Monday, when we pointed out that there were 3 Fed Doves in a row speaking after the release of the minutes but – WOW! – that was pretty extreme. Still, it only got us right to the 1,160 weak bounce we were looking for on Monday. That's right, 1,160 on the dot was predicted Monday Morning, before the market opened, as the bounce line for the Russell.

As I often remind our Members, I can only tell you what's going to happen and suggest ways to profit from it – what you do with that information is entirely up to you!

What we did with that information on Monday, at 3pm in our Live Member Chat Room, was the following:

That's why I still like buying the f'ing dips on the Futures – worth losing a few while hoping to catch a nice bounce. Now our lines are 16,200 (/YM), 1,835 (/ES), 3,500 (/NQ) and 1,130 (/TF) – any of which can be played bullish if 2 are over the lines.

Needless to say, those lines worked out very well as we're now at 16,330, 1,861, 3,583 and 1,152 and Tuesday Morning's Alert to Members gave us an even better re-entries on the Dow (16,100) and a 230-point bump in the Dow is good for $1,150 per contract!

Needless to say, those lines worked out very well as we're now at 16,330, 1,861, 3,583 and 1,152 and Tuesday Morning's Alert to Members gave us an even better re-entries on the Dow (16,100) and a 230-point bump in the Dow is good for $1,150 per contract!

This is why we LIKE having CASH!!! on the sidelines: We catch a nice down move, cash back out – catch a nice up move, cash back out, etc. and, every night, we go to sleep not at all worried about what's happening. It's not only relaxing, and profitable – it's FUN!

I put out a News Alert this morning (and you can now read those if you follow our Facebook Page, which is also where Members should go if the site ever crashes, so make sure you "Like" it) where we called for a "conviction short" on oil at $103.50 and already this morning (8:30), we're picking up our 2nd $250 gain as it dips back to $103.25. After the Natural Gas Inventories, at 10:30, we hope to get a much better correction and we are positioned for that with USO and SCO trades from the Member Chat room.

I know TA people look at a chart like that on SCO and think "lower" but, as a Fundamentalist, I KNOW that people can't afford $103 gas ($102.50 is actually where we start shorting heavily), as discussed in yesterday's post. While that trend looks ugly, it's not your friend. As Oaktree's Howard Marks says in his excellent letter to shareholders:

“Most great investments begin in discomfort. The things most people feel good about – investments where the underlying premise is widely accepted, the recent performance has been positive and the outlook is rosy – are unlikely to be available at bargain prices. Rather, bargains are usually found among things that are controversial, that people are pessimistic about, and that have been performing badly of late.”

“Suppose I hire you as a portfolio manager and we agree you will get no compensation next year if your return is in the bottom nine deciles of the investor universe but $10 million if you’re in the top decile,” What’s the first thing you would do, he asks, noting no one has ever answered this right. “You have to assemble a portfolio that’s different from those held by most other investors … Being different is absolutely essential if you want a chance at being superior.”

This is what we teach you at Philstockworld – how to be extraordinary. We show you how to make those top-decile returns by BEING THE HOUSE – Not the Gambler. We make long-term Fundamental bets and then we use options for leverage and hedges to maximize our chances for superior returns. It's not easy, it's not quick – but it's very, very worthwhile!

This is what we teach you at Philstockworld – how to be extraordinary. We show you how to make those top-decile returns by BEING THE HOUSE – Not the Gambler. We make long-term Fundamental bets and then we use options for leverage and hedges to maximize our chances for superior returns. It's not easy, it's not quick – but it's very, very worthwhile!

Yesterday morning, for example, TASR dropped low enough that we wanted them again (they are, after all, our stock of the decade). At $17, we sold 10 of the 2016 $15 puts for $3 in our Long-Term Portfolios and that trade idea was ALSO available on our Facebook page. TASR turned around right on that line and finished the day at $17.34. Keep in mind that, by selling 10 $15 puts, we are obligating ourselves to buy 1,000 shares of TASR for $15. Because we are BEING THE HOUSE (yes, I am going to hammer this home) and selling the options, we collected $3 per share ($3,000) in exchange for our promise to buy.

That drops our net entry on TASR to just $12 per share. Owning TASR at $12,000 requires $6,000 of ordinary margin but just $1,275 of options margin so this is a very margin-efficient sale that returns $3,000 against our $1,275 allocation, which is a 235% return on margin in 20 months if TASR stays over $15. Since TASR is currently $17.34, we have a built-in 13% hedge on the stock built-in.

There – that's not so complicated, is it?

As I keep saying, you have to LEARN to be a good investor. Being a bad investor is easy – just go out and buy stuff and sell it and see how much money you end up with. Being a good investor is a PROFESSION and, like any profession, it requires practice and training and it takes time and dedication. If you are a doctor or a lawyer and I tell you I'm a professional investor so therefore I can read a couple of books and do a heart transplant or try a murder case – you'd laugh at me because it's ridiculous, right?

Why then, do you think it's a good idea to just jump in and trade without putting in the time and effort to learn how to do it properly? Think about it.

We weren't all bullish, of course – on Tuesday afternoon's run up we added an aggressive SDS (ultra-short S&P) spread at 2:24 and I reiterated our XRT short as it climbed back to $84.50 – both are May plays as we still think there may be a little more upside before we break down on earnings. As soon as the market turned up yesterday, we covered those bear plays with aggressive short-term plays on TQQQ (ultra-long Nasdaq) April $62 calls at $1.05 and QQQ April $87 calls at 0.85 and we closed them out at $1.45 (up 38%) and $1.29 (up 52%) just 4 hours later (after the Fed), which put us back to being bearish again to end the day.

I put out the bounce lines in the morning news tweet and we're in sort of a watch and wait mode today but, then again, I've been saying that all week and it seems we still find plenty of things to trade!