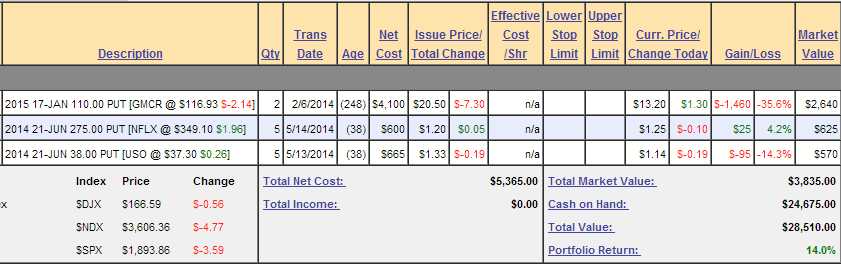

$25,000 Portfolio Review ($25KP):

Not much to report here, GMCR burned us but now we can turn that into a nice winner if it comes back down. Since we made $5 on the short puts, our break-even is $14.50 and we're almost there already. USO not going to well but not worth adjusting either. I'd like to roll up to the $39 puts, now $1.99 for .50 or less if oil goes higher (now $102.45). NFLX we just added today.

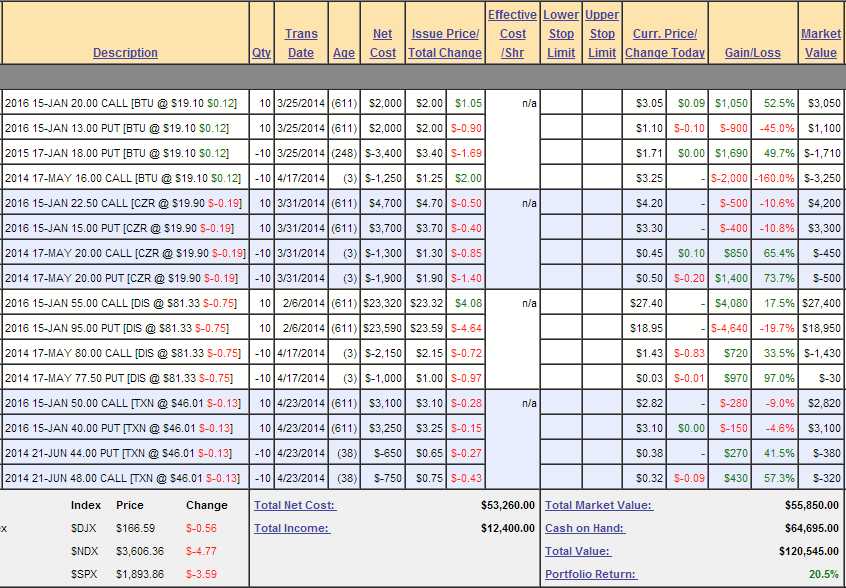

Butterfly Catching Portfolio:

I cannot stress enough how great this portfolio is for the conservative investor. We're using just 1/6 of our buying power and generating 20% profits on the whole portfolio. That means that 1/6th that's working is up 120% so far! You never want to go more than 50% invested - just in case one of your positions blows out and you have to adjust but we have plenty of room to add more - when we identify another stock with options that are priced more volatile than we expect the stock to be. It's a rough criteria but we seem to find them often enough. The low VIX makes it rough at the moment. Still, up 5% since last month - not too shabby!

- BTU - That one has been a wild ride and we'll need to roll the May $16 caller ($3.15) to the Sept $17 calls ($2.70) for net .45. We're getting more confident in the long story here, so we'll spend $450 to move up $1,000 in strike on our 10 contracts. Don't forget, these trades don't terminate in 2016 - we'll simply roll our long positions out to 2017 or 2018 when the time is right and keep on rolling the short positions - RAWHIDE!

- CZR - This one is like a little cash machine.