Would you like a 20x return on your investments?

Would you like a 20x return on your investments?

In our Weekly Webcast on Tuesday (replay available here), we discussed various ways you can make a nice retirement nest-egg for yourself as well as various stock and option strategies (and 9 new trade ideas to go with them) that can put you on the road to becomming a millionaire.

Unfortunately, none of these are "instant" – these are not lottery tickets but long-term, time-tested strategies that can give you everything you ever dreamed of – IF you are willing to work for it.

These same strategies can also be applied to generate an income off your retirement savings without digging back into your principal each year.

We don't sell magic beans at Philstockworld, we teach our Members HOW to invest and put them on the road to wealth but it requires hard work and dedication on your part. If you are willing to make the effort, though, we are happy to show you how to make the climb.

In the Webinar, we discussed turning $100,000 into $1M, $2M and $5M over various periods of time but we neglected to talk about strategies for people starting our with smaller amounts, say $25,000 to start. We do run a virtual $25,000 Portfolio for our Members – to identify simple trades that require no margin and no day-trading (you really can't day-trade with $25,000 and, most likely, you have a job to do during the day anyway!) yet are still able to generate nice returns.

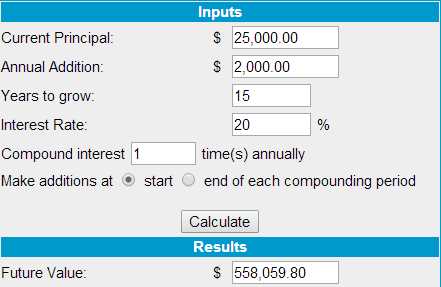

Before we start, I want to get you comfortable with the math involved. Money Chimp has a very nice Compound Interest Calculator which I'm using for my calculations and on the left is the model for the base premise of this article. Follow the link and play with it so you can see how different strategies affect your Future Value.

Before we start, I want to get you comfortable with the math involved. Money Chimp has a very nice Compound Interest Calculator which I'm using for my calculations and on the left is the model for the base premise of this article. Follow the link and play with it so you can see how different strategies affect your Future Value.

For instance, notice I'm going to tell you to add $2,000 a year to your account. That gets you to $558,000 after 15 years. What if you don't add $2,000 a year to your account? Then you only have $385,000! Not putting away $166 a month for 15 years ($30,000) costs you $173,000 in $15 years. So every Dollar you save (or spend) today is $5 in your retirement!

And, once I teach you how to consistently make 20% annual returns on your money (see our training video, "The Secret to Consistent 20-40% Annual Returns" for a nice summary), you'll begin to realize that buying yourself just one extra cup of Starbucks now, will cost you two cup of Starbuks for the rest of your life!

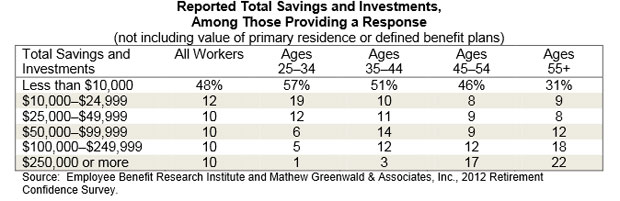

Why is that? Because we are going to take that cup of coffee and compound it over 15 years and turn it into 11 cups of coffee and then, each year, those 11 cups will yeild 2.2 more cups in your retirement. The same goes for the extra vacations you take, the car you buy a year earlier than you have to, the house you stretch to afford and neglect your savings – it all adds up and snowballs into the retirement disaster that is faced by so many Americans. In fact, 34% of all American workers have saved less than $1,000 for their retirement!

The younger you are, the more drastic the impact. 15 years is the target for people around 50 but, if you are in your 30s, say 35, then making 20% on $25,000 for 30 years and putting an additional $2,000 a year into it lets your retire with $8.8 MILLION!

The younger you are, the more drastic the impact. 15 years is the target for people around 50 but, if you are in your 30s, say 35, then making 20% on $25,000 for 30 years and putting an additional $2,000 a year into it lets your retire with $8.8 MILLION!

That's 352 times back on your money. This is not a trick, this is math! When you treat yourself to a $5 mocachino, you are taking $1,760 away from your future self – enough to enjoy a mocachino every single day of the year in your retirement!

Unfortunately, this is not something most people realize until it is far too late.

And, by the way, NOT putting in that extra $2,000 a year for 30 years ($600,000) will cost you $2.9M. Again, every $1 you save today is $5 when you retire and, if we can teach you how to make consistent 20% annual returns, it's also $1 a year you'll have for the rest of your life. Isn't this worth learning?

And, by the way, NOT putting in that extra $2,000 a year for 30 years ($600,000) will cost you $2.9M. Again, every $1 you save today is $5 when you retire and, if we can teach you how to make consistent 20% annual returns, it's also $1 a year you'll have for the rest of your life. Isn't this worth learning?

The most important thing to learn, however, is how to save money. Americans are terrible at this, with the World's lowest rate of savings. If you think China is kicking our asses now – wait until they start to retire with hundreds of times more money than we have!

So, what's the magic formula for saving money? DON'T SPEND IT!!! Our grandparents, who lived through the depression, learned this the hard way and we, who grew up in times of plenty, never understood their concern for turning off the lights and wrapping up the leftovers and covering the seat cushions on the sofa. They had to learn the hard way, watching their parents struggle and struggling themselves, what the long-term value of money was. We are going to learn the hard way too – if we don't change our ways very soon.

Enough about saving – if I haven't convinced you to do it, I'm not likely to by spending more time on it. Now we'll focus on what you can do with your savings to get it to grow. At Philstockworld, we have $25,000, $100,000 and $500,000 virtual portfolios we track for our Members and the $25,000 Portfolio, which we initiated on January 10th, is already up 14% for the year with more than half the year to go. Our $100,000 Butterfly Portfolio uses more complex strategies (which you switch to as your account grows) and is up $23.5% for the year. Our $500,000 Long-Term Portfolio is up 11.2% and our more conservative $500,000 Income Portfolio, for people who are already retired, is up 6.3%.

It's much easier to make money when you already have it and we'll focus on larger portfolios in later articles. This article is focusing on simple option strategies you can use to generate 20% returns on that first $25,000. Since we assume people with only $25,000 are working and not sitting at home trading all day like our high net-worth clients, we try to use trading strategies that are "low-touch".

It's much easier to make money when you already have it and we'll focus on larger portfolios in later articles. This article is focusing on simple option strategies you can use to generate 20% returns on that first $25,000. Since we assume people with only $25,000 are working and not sitting at home trading all day like our high net-worth clients, we try to use trading strategies that are "low-touch".

At Philstockworld, our $25,000 Portfolio is fairly aggressive, as our goal is to get a small account leveled up to a bigger account as soon as possible. That way we can switch to our more profitable (and less volatile Buttefly Strategies, as well as our patented "BE THE HOUSE – Not the Gambler" strategies that rule our other portfolios.

Buying stock is almost never going to make you consistently large returns. You are tied to the fortunes of the markets and the S&P averages less than 8% a year. On the other hand, for example, if you think the S&P will go up this year, you can buy the SPY ($188.05) Jan $180 calls for $12.60 and sell the Jan $190 calls for $6.40 and that's net $6.20 on the $10 spread and, if SPY is over $190 at the end of the year (up 1%), you will get back $10 on your spread for a gain of $3.60 or 56%. Keep in mind January 2015 is only 8 months away – that's how you make 56% in 8 months!

Of course you have to be right as well – that's the tricky part! So we don't commit all of our money to bullish plays but, if we commit $3,100 to 5 contracts, we're using about 10% of our buying power and, if successful, we'll get back $5,000 and profit $1,900 or 7.6% of our entire portfolio off that one trade. Now you should be beginning to see how we'll be able to get to those 20% annual returns.

In fact, we rarely use more than 1/2 of the cash in any of our portfolios – ever – so we can remain flexible enough to profit from up or down market moves. At the moment, in our $25,000 Portfolio, we have short plays on GMCR, NFLX and USO – we've flipped bearish! In each case we've gone with puts and GMCR was part of a bearish spread but now just a put (the Jan $110 puts, now $13.80) and NFLX was 5 June $275 puts we bought for $1.20 ($600) and USO June $38 puts were $665 for $5 ($1.33 each). In our larger portfolios, we prefer selling risk to buying it but, in a $25,000 Portfolio – it helps us to limit the risks.

With GMCR, we originally had the 2015 $110/90 bear put spread (we teach you all this, of course) and the $90 puts were originally sold for $9.50 and we bought them back at $4.90 for a $4.60 gain ($920), which leaves us in the $110 puts for net $15.60. Though they are behind at the moment ($13.80), we're only down net $360, which is just 14% of our typical $2,500 per trade allocation.

Our goal with all our trades is to win more often than we lose but the real key is CASH MANAGEMENT – when we win, we win MORE than we lose. By taking sensible stops on the trades we get wrong (about 20%) and averaging 40% on our winning trades, we can be wrong 2 out of 3 times and STILL make money! If we manage to be right as often as we're wrong – well, there's your 20% per year right there.

Keep in mind that our Member's $25,000 Portfolio is aggressive. In this article, we're talking about more conservative trade ideas like that SPY trade. We also pick up the occasional cheap stocks, like LQMT at .18 last week (free tip on a future $1 stock, though we'll take .30 and run) or TASR at $13. TASR is our Stock of the Decade and, so far, we're up from $4 to $13.32 but we got out at $17 and now we're getting back in (knowing how to take profits is lesson #4).

If you'd like to participate in crowd control from the other end of the gun or place your bets on our future security state – TASR is the stock for you and, if you only have $25,000 to spend, there's no need to tie it up in the stock – they don't pay a dividend anyway. What you can do, however, is pick up the Jan 2015 $12/16 bull call spread for $1.60, which has a potential upside, at $16, of $2.20 (137%) just 8 months from now.

If you'd like to participate in crowd control from the other end of the gun or place your bets on our future security state – TASR is the stock for you and, if you only have $25,000 to spend, there's no need to tie it up in the stock – they don't pay a dividend anyway. What you can do, however, is pick up the Jan 2015 $12/16 bull call spread for $1.60, which has a potential upside, at $16, of $2.20 (137%) just 8 months from now.

Again, we teach you all the basics but what you are doing on this trade is buying the $12 calls for $2.60, which give you the right to buy TASR at $12 in January and you are selling the $16 calls to someone else for $1, who then have the right to buy TASR from you for $16. No matter how much over $16 TASR is in January, you will always have a $4 advantage to the calls you sold. Since you are paying net $1.60 for $12 calls, your net cost of TASR is $13.60, so the premium you are paying for the leverage is 0.28.

Once TASR is over $13.60 again, you make every single penny of the gains up to $16. On the downside, your net Delta (again, we will teach you all this) is just .22 so, for every Dollar TASR drops, your spread will lose just .22. Think about that – if you bought the stock, you'd make $1 for a $1 move up but you'd also lose $1 on the way down. This trade pays you $1 on the way up (less the first .28) but only loses .22 on the way down. That's a 5 to 1 reward to risk ratio!

Once TASR is over $13.60 again, you make every single penny of the gains up to $16. On the downside, your net Delta (again, we will teach you all this) is just .22 so, for every Dollar TASR drops, your spread will lose just .22. Think about that – if you bought the stock, you'd make $1 for a $1 move up but you'd also lose $1 on the way down. This trade pays you $1 on the way up (less the first .28) but only loses .22 on the way down. That's a 5 to 1 reward to risk ratio!

This is exciting stuff folks – if we keep making trades that pay 5 times more when we're right than we lose when we're wrong, we don't have to be right all that often to make good money. With $800 returning $2,000 at $16, we don't have to make a big bet (or take a big risk) to have a potentially significant impact on our small portfolio.

One last trick (and we have dozens) I will teach you is how to pull a nice dividend. Step one: Find a cheap stock that pays a good dividend, like NLY ($11.69, pays $1.20 or 10.3%). Step two: Make that stock even cheaper by selling options against it. Step three: Make lots of money.

For step 2 in this example, we can sell the Jan $11 calls for .85 and we can also sell the 2016 $10 puts for $1.20. If we start with 100 shares of NLY at $1,169, we sell on $11 call for $85 and we sell one $10 puts for $120 and our net cost of 100 shares of NLY drops to $964 and we'll collect .30 per share in June, September and December for dividends ($90) and then, if called away at $1,100, that's another $136 for a total of $226 profit on $964 (23%) in 8 months and the worst thing that can happen after that is we end up owning NLY again at $10 (15% off the current price).

So that's 23% on NLY, 137% on TASR, 56% on SPY… you can see how this stuff starts to add up. We try to keep our positions well-diversified and, as I said earlier, we keep plenty of cash on the side because we only need to make 20% a year to hit our retirement goals.

So that's 23% on NLY, 137% on TASR, 56% on SPY… you can see how this stuff starts to add up. We try to keep our positions well-diversified and, as I said earlier, we keep plenty of cash on the side because we only need to make 20% a year to hit our retirement goals.

Even if we're half invested and the market drops 50% so fast that we have no time to stop out and we lose 1/2 of our invested amount, we still have 50% of our original cash on the side which means that, although our portfolio may have dropped 50%, we can now double down on all of our positions at 50% off the original prices and STILL have 25% of our cash on the sidelines.

Think how much money you would have today if you had done that in 2009!

Making good returns is the easy part – the hard part is having the discipline to save and invest your money in the first place.

We will continue this topic in the following weeks – subscribe here to get on our mailing list!