Williams, Yellen, George and Kocherlakota.

Williams, Yellen, George and Kocherlakota.

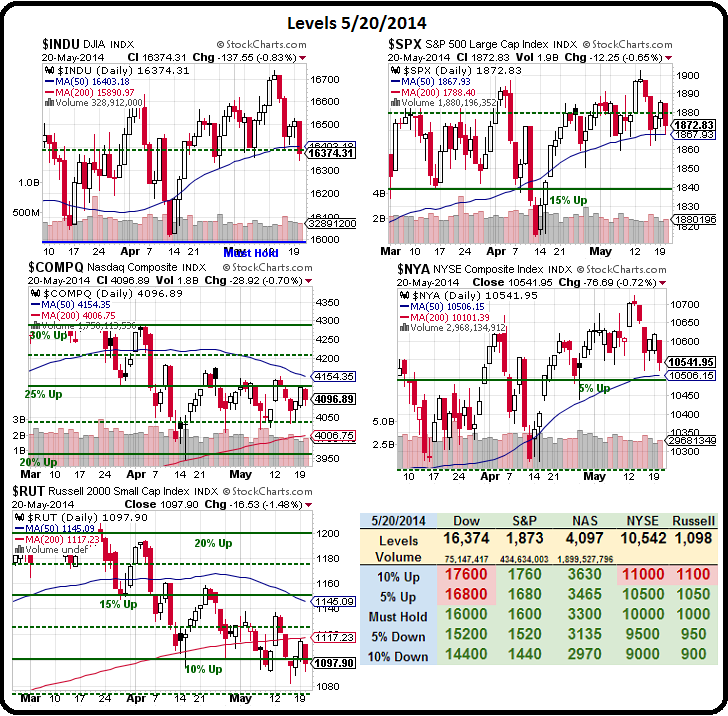

It's the "murderer's row" of economic BS today as, starting at 10am, we have 4 consecutive hours of Fed speeches ahead of the release, at 2pm, of the minutes of the last meeting (4/30), whose statement led to a bit of a sell-off the following week – knocking us down to the mid-April lows. With the Russell already failing those lows and the Dow again failing the 50 dma – the Fed is pulling out all the stops to spin things back to bullish.

It's very hard to be bullish when THIS is the chart of existing home sales in the US. Keep in mind, this is WITH $85Bn per month in stimulus last year and RECORD low mortgage rates. The Fed's Charles Plosser sees "a ticking time bomb" of inflation and, if the Fed is forced to raise rates to combat inflation – how is that going to make housing more desireable?

It's very hard to be bullish when THIS is the chart of existing home sales in the US. Keep in mind, this is WITH $85Bn per month in stimulus last year and RECORD low mortgage rates. The Fed's Charles Plosser sees "a ticking time bomb" of inflation and, if the Fed is forced to raise rates to combat inflation – how is that going to make housing more desireable?

Even this morning, MBA Mortgage Applications were down 3% on purchases. That's 3% lower than last month, when they used the weather as an excuse for that crappy performance. 6 years and $6,500,000,000,0000 worth of stimulus later, we're barely above the level of housing purchases we had after the first S&L crisis in the early 90s and we're still over 60% below our peak housing levels.

Keep in mind that this is the number of home that are sold in the US, so it's a number that should always be rising as the number of homes expands over time. In 1990, there were 35M less homes (97M) than there are now (132M) but between 1990 and 2010, we built 34M homes or about 1.7M per year. In the last 4 years, however, we have built only 720,000 homes or just 180,000 homes per year!

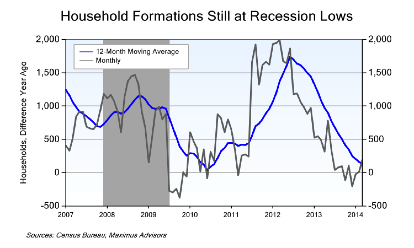

On the one hand, those are horriffic numbers but, on the other hand, it would seem like an opportunity because, at some point, you would think we should go back to building some homes. HOWEVER, the US population is 314M at the moment and that's one home for each 2.37 citizens but, in 1990, there were 250M of us in 97M homes – or one home for each 2.57 of us. On the whole, unless MORE people are moving out on their own (household formation) – we seem to have seriously overbuilt homes in this country.

On the one hand, those are horriffic numbers but, on the other hand, it would seem like an opportunity because, at some point, you would think we should go back to building some homes. HOWEVER, the US population is 314M at the moment and that's one home for each 2.37 citizens but, in 1990, there were 250M of us in 97M homes – or one home for each 2.57 of us. On the whole, unless MORE people are moving out on their own (household formation) – we seem to have seriously overbuilt homes in this country.

As you can see from the chart above, we are NOT forming a lot of new households and last yeare we actually dipped back into negative territory. If we assume that one home for 2.57 citizens is a "correct" number (and that really is skewed for a more prosperous time), then 314M of us should have 122M homes, not 132M homes – there are simply 10M too many homes in the US to be supported by the population.

That is probably why 10% of the units available for rent are vacant, along with 4M other homes in the US (not even including 14M properties in foreclosure). These are NOT numbers that are going to go away overnight or next month, or next quarter or even next year – this is a major, long-term problem that is dragging on our economy.

That is probably why 10% of the units available for rent are vacant, along with 4M other homes in the US (not even including 14M properties in foreclosure). These are NOT numbers that are going to go away overnight or next month, or next quarter or even next year – this is a major, long-term problem that is dragging on our economy.

Student loan debt has exploded over the past 10 years while earnings for people aged 25-34 have declined which means, very simply, that they are unable to afford to form new households. Economics is not that complicated folks – the Fed and the Corporate Media just pretend it is so they can justify the anti-American actions of the Oligarchy, who refuse to pay their fair share of taxes and drive our children into lifetimes of debt so they can transfer more wealth to the top 0.01%.

Don't worry, as long as you are in the top 1%, this is all great for us. It just sucks for everyone else and, if you are only in the top 10% – I hope this motivates you to bust your ass and join the top 1% because it's REALLY going to suck not to be "one of us" over the next couple of decades if this mega-trend continues.

Don't worry, as long as you are in the top 1%, this is all great for us. It just sucks for everyone else and, if you are only in the top 10% – I hope this motivates you to bust your ass and join the top 1% because it's REALLY going to suck not to be "one of us" over the next couple of decades if this mega-trend continues.

We'll find out in November if the American Sheeple are going to roll over and die or if they still have some fight left in them. Meanwhile, fighting the Fed is just silly, which is why we haven't been heavily shorting this market – even though we think it's overbought at the moment.

In fact, just yesterday, we added 6 more bottom-fishing plays to our Watch List in our Live Webinar, bringing our total to 16 (and we'll finish our Watch List next week) and we even added 3 of them (PFE, TEX and NTAP) to our Member Portfolios, making us even more bullish (and we even went long on /TF at 1,090 in the afternoon). As I said yesterday, we do have serious concerns that are keeping us "Cashy and Cautious" but we are also very aware that this is a rigged game – so we'll play along for as long as the Fed can keep these plates spinning – but one hand is firmly on the exit at all times – just in case!