Just a quick post to consolidate our virtual portfolio reviews for easy reference:

Just a quick post to consolidate our virtual portfolio reviews for easy reference:

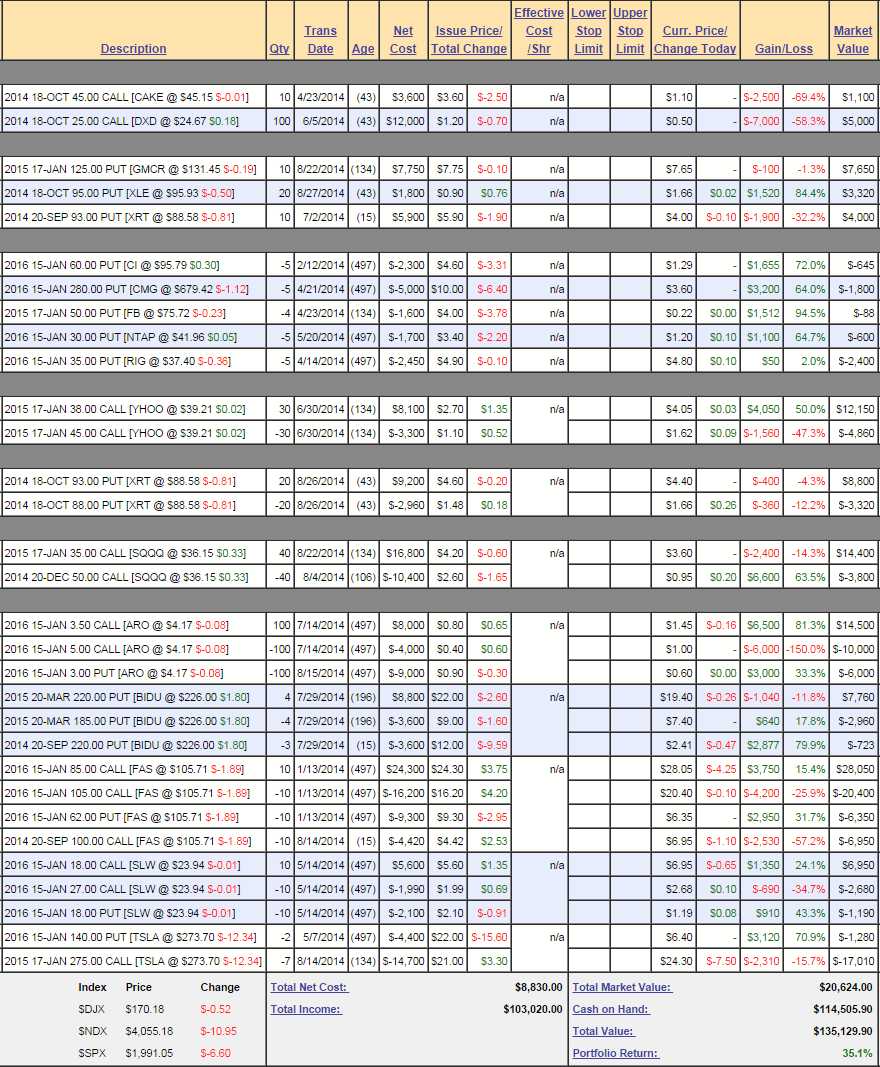

What we're stressing this year, above all else is our "BE THE HOUSE - Not the Gambler" strategy, in which we try to be the sellers, not buyers of options premium. Another very key strategy we're practicing is BALANCE - our Income Portfolio is a very conservative retirement portfolio, aimed at generating a 10% annual income with as little risk as possible while our much more aggressive Long-Term and Short-Term Portfolios balance each other - aiming for 20% annual gains.

Both sets are very much on track for their goals and, at this point, we're more concerned with protecting the profits we have than taking new risks but that doesn't stop us from adding prudent positions, especially as long as the market continues to make new weekly highs. In fact, we just added an IRBT position to the LTP on Friday (not yet reflected in this update)!

Short-Term Portfolio Update (STP): Back to $135,000 (up 35% for the year), that's a good sign as we were down to $125,000 earlier in the week so we gain $10K on a little dip means we're doing our job protecting the LTP. You never really know if your mix is right until it's tested under pressure.

- CAKE - Well, I hate naked long calls but we bought back the short calls from this spread and this is what we're left with. I'm not sure we'll get the pop we need if the indexes are dragging us down but there's also no particular reason to pull this trade so let's see what happens next week. Our premise here is lower food costs = more profits.

- DXD - One of our anchor hedges, just out of the money at $24.54 with 42 days left.