Wheeeee, what a ride!

Wheeeee, what a ride!

This is why we use hedges – they kept us from stopping out of our long positions during the dip and, since our long positions pay off in a flat or up market, anything not down is VERY profitable for our Long-Term positions, which outnumber our bearish Short-Term hedges by 10:1 in our Income Portfolio and Long-Term Portfolio.

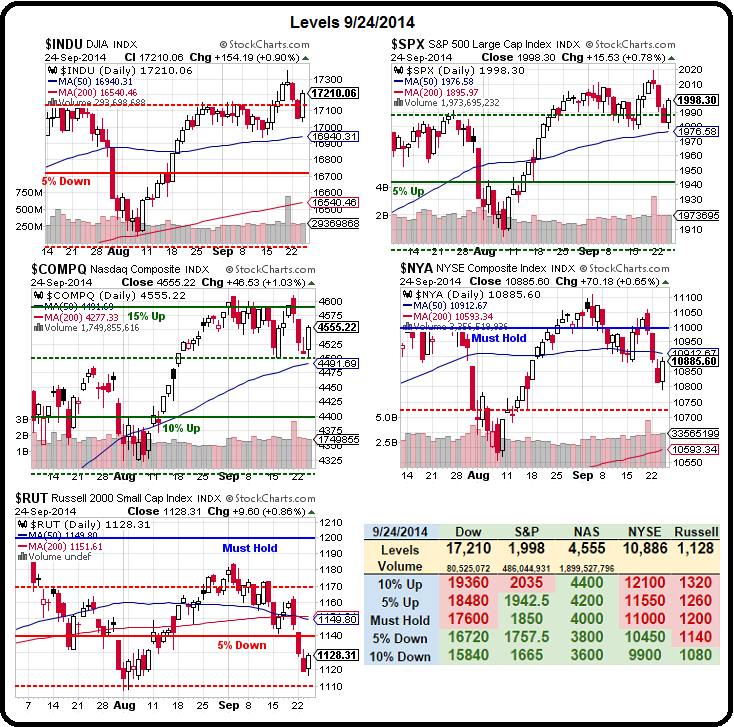

Markets do, indeed go up AND down on a pretty regular basis and we've made a lot of bottom calls this week, adding more long positions as we got a nice pullback. Now we have the bounces we predicted and we'll just have to wait and see if our strong bounce lines hold up for the week. Yesterday morning, before the Market, our 5% Rule™ predicted we'd see:

- Dow 17,100 (weak) and 17,150 (strong) – Now 17,210

- S&P 1,990 (weak) and 1,995 (strong) – Now 1,998

- Nasdaq 4,525 (weak) and 4,550 (strong) – Now 4,555

- NYSE 10,875 (weak) and 10,950 (strong) – Now 10,885

- Russell 1,125 (weak) and 1,135 (strong) – Now 1,128

So we have 3 greens and two in-betweens and that's certainly enough to get us to stop being bearish but not quite enough to turn us bullish yet. If we are holding the Strong Bounce lines on the Dow, S&P and Nasdaq, however, we could go long on the Russell, with the /TF Futures at 1,123.5 this morning or use TNA (the ultra-long Russell ETF), which closed at $68.36 yesterday and the weekly $67 calls are $1.45, with very little premium.

So we have 3 greens and two in-betweens and that's certainly enough to get us to stop being bearish but not quite enough to turn us bullish yet. If we are holding the Strong Bounce lines on the Dow, S&P and Nasdaq, however, we could go long on the Russell, with the /TF Futures at 1,123.5 this morning or use TNA (the ultra-long Russell ETF), which closed at $68.36 yesterday and the weekly $67 calls are $1.45, with very little premium.

As you can see from Dave Fry's Russell chart, that 1,125 line has been good support and a very clear signal to get out if it fails. So far, it's bee a texbook bounce with 1% gains offsetting 2.5% drops and the next significant point of resistance is a 50% retrace, so we're looking to get just 0.25% higher today to continue the bullish momentum. So far, our Futures are flat, despite Europe gaining 0.5% on more stimulus talk from Draghi (see my Tweet).

We tried going short earlier this morning but that's not working so far, and now we'll see if we can get any traction to the upside (if we do get over our levels, otherwise – still shorting). Overall, we don't have any fundamental reasons to get bullish, other than MORE FREE MONEY from the ex Managing Director of Goldman Sachs International, who Forbes ranks as the 9th most powerful person in the World.

We tried going short earlier this morning but that's not working so far, and now we'll see if we can get any traction to the upside (if we do get over our levels, otherwise – still shorting). Overall, we don't have any fundamental reasons to get bullish, other than MORE FREE MONEY from the ex Managing Director of Goldman Sachs International, who Forbes ranks as the 9th most powerful person in the World.

Of course, just ahead of Draghi on that list is Abdullah bin Abdul Aziz Al Saud, the king of Saudi Arabia who, as Liberty Blitzkreig points out, beheads people every day and no one seems to make a fuss about it.

While we're on the subject, I loved Info Terrorism's take on the Administration's efforts to sell the war, as well as their summary of why we're bombing Syria. We expected all this back on 9/11, when we went with RTN as our favorite war profiteer, and I loved Jon Stewart's take on our new mess (same as the old mess) yesterday:

So, you may wonder, why would we want to go against the wishes of two of the most powerful people and short oil ($93.40), gasoline ($2.75), the Dow (17,150) and the Nikkei (16,350)? Well, that's because, as powerful as these people may be – they are still fighting physics in trying to make the markets do things they simply shouldn't be doing.

Oil, for example, is in a glut, not a shortage and bombing a few oil fields that are controlled by ISIS won't impact the global supply, nor will anything OPEC does at their next conference, since they are now producing just 40% of the World's oil.

Oil, for example, is in a glut, not a shortage and bombing a few oil fields that are controlled by ISIS won't impact the global supply, nor will anything OPEC does at their next conference, since they are now producing just 40% of the World's oil.

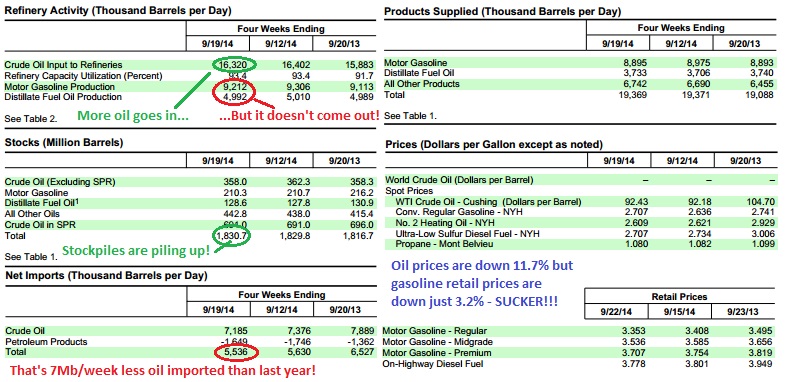

Those were the reasons that oil popped from $91.25 to $92.55 (this morning's high) but those same reasons didn't convince Brent traders to go higher and even this morning Brent is trading flat while US Oil is being manipulated higher. We'll see how long they can get away with it but I doubt the enthusiasm will last longer than the 10:30 Natural Gas Report. Here's a look at yesterday's Petroleum Status Report, where a 4.3Mb draw in crude was nothning more than a recording of oil that is piling up in the refineries:

It's a SCAM folks, they are importing 7 MILLION LESS barrels of oil per week than they did last year yet our stockpiles have grown by 14M barrels. They are not producing more product so, logically, that must mean demand has dropped. Yet prices are being pushed higher to punish the consumers with a war of convenience started by yet another version of Rent-A-Rebel, those groups that always seem to suddenly appear and cause trouble whenever oil traders, like the Koch Brothers, are facing a loss.

Rather than fight another $3Tn war, why don't we spend $3Tn on renewable energy projects in our own country and cut our need for foreign oil to zero? It's just 5.5Mb now so we only have to replace 25% of our consumption and we can cut 10% of auto fuel consumption by simply making sure people inflate their tires properly.

Getting people to conserve energy used to be something the Government did – that's why the Kochs and their Heritage Foundation want the Government "off your backs".