Courtesy of Sabrient Systems and Gradient Analytics

Yes, the market showed significant weakness last week for the first time in quite a while. In fact, the Dow Jones Industrial Average moved triple digits each day. But it was all quite predictable, as I suggested in last week’s article, and certainly nothing to worry about. Now the market appears to be poised for a modest technical rebound, and longer term, U.S. equities should be in good shape for a year-end rally. However, I still believe more downside is in order before any new highs are challenged. Moreover, market breadth is important for a sustained bull run, so the challenge for investors will be to put together broader bullish conviction, including the small caps.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

Last week’s weakness was expected for a variety of reasons, including the weak near-term technical picture and the fact that the week following a triple (or quadruple) witching options expiration day (like the prior Friday) is usually negative. So, there was nothing concerning at all about last week’s increased volatility and market turbulence. On the contrary, it was welcome cleansing action.

The U.S. economy has been showing steady strengthening while other developed markets are languishing. Q2 GDP grew at an impressive rate of +4.6% annual rate (after the Q1 contraction of -2.1%), and many economists are revising upward for Q3 to above +3%. Also, consumer spending grew by +2.5% annual rate, business investment +9.7%, and exports +11.5%, while consumer sentiment has improved. So, with quant easing programs in place around the world creating abundant global liquidity seeking safe and attractive return in the face of escalating turmoil, violence, and terrorism, there has been a flow of capital into U.S. stocks and bonds and a notable strengthening in the U.S. dollar (particularly against the yen and euro).

This has helped keep stock and bond prices high and inflation low, thus giving the Fed room to remain accommodative. And it intends to do so, even after accumulating $4.5 trillion in assets on its balance sheet. Despite a lower official unemployment rate, the Fed has stated that there are still too many people who are unemployed, underemployed, or no longer seeking work until the labor market improves. The 10-year U.S. Treasury bond yield closed Friday at 2.52%, which is down slightly from the prior week and continuing to trend downward after its mid-month spike. Thus, global liquidity and the relative safety of the U.S. continue to fuel strong demand. Indeed, low interest rates could be with us for a while, which is supportive of elevated multiples in equities.

One concern for stock investors is market breadth. If you examine the leadership this year in each of the major indexes, it is apparent that a relatively narrow group of the larger caps has led the charge. For example, in the Dow Jones Industrial Average, only five of the 30 stocks account for all of the index’s gains this year: Johnson & Johnson (JNJ), Disney (DIS), UnitedHealth Group (UNH), Merck (MRK), and Intel (INTC).

In fact, small caps are negative year-to-date ever since their negative divergence began in April. However, market breadth is important for a sustained bull run, so the challenge for investors during this seasonally weak period of the market will be to conjure up broader bullish conviction. And it’s not just small caps. Commodities, emerging markets, high-yield bonds have all been weak while the dollar strengthens. Some market observers are calling this risk-off behavior a harbinger of lower liquidity, higher interest rates, elevated volatility, and smaller total returns in equities.

The rotation out of traditional open-end mutual funds and into exchange-traded funds (ETFs) continues. ConvergEx observed that $26 billion has exited U.S. equity mutual funds this year, while $47 billion has flowed into ETFs. Most of that money has gone into funds that track the large cap S&P 500, while small caps, Europe, and Japan funds have all seen net outflows, which of course helps to explain the divergent performance of the major indexes.

The Energy sector has been a big laggard lately. Just take a look at the performance of the major sectors over the past three months, in the wake of Energy’s big surge in June. Since late June, the sector is down nearly -10% and has fallen below its important 200-day moving average, while Technology and Healthcare are nicely in the green (by about +5%). However, forward valuations remain very compelling, so Energy stocks should be poised for a rebound.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, spiked above 17 last week before closing Friday at 14.80, which is back below the important 15 level after trading above it during the week. As I observed last week, the 50- and 200-day SMAs are on a collision course, with the 50-day on the verge of crossing up through the 200-day. The 50-day already crossed up through the 100-day SMA at the beginning of September. Of note, VIX often hits a peak in October (as well as in January), but it has never hit a trough (low point) during October.

So, we don’t be surprised to see more volatility and market weakness over the coming weeks. And with the violent protests in Hong Kong (over China’s control) adding to the global turmoil, we likely will see more weakness this week, despite the promising technical picture and sector rankings described below.

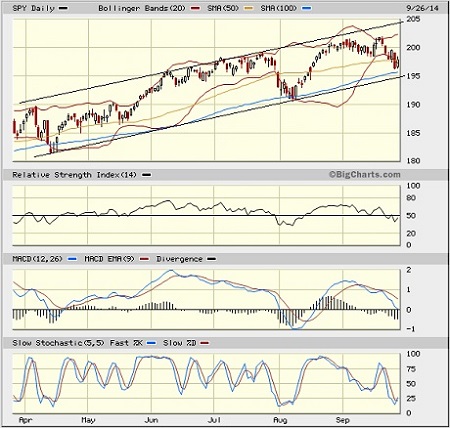

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed last Friday at 197.93. Friday’s recovery allowed it to close the week above its 50-day simple moving average. Next support levels are the 50-day SMA near 197, the bottom of the bullish rising channel around 195, the 100-day SMA near 194.5, and then the 200-day SMA all the way down around 188. There is also the August 7 closing low at 191 that might provide support, if called upon. The $200 price level will once again serve as tough overhead resistance until the bulls can put together greater conviction. Oscillators RSI, MACD, and Slow Stochastic are all at or near oversold territory, and thanks to Friday’s recovery, they are starting to point up bullishly. So, SPY could bounce further from here, or it could simply consolidate at this level and fall further. In any case, I don’t think these technical conditions are foretelling a major rally quite yet.

The Russell 2000 small cap index has been really ugly. Its 50-, 100-, and 200-day SMAs had all converged at the same spot, and then last week the 50-day crossed down bearishly through the 200-day, and price closed below all three on Friday. However, the good news is that the index is now severely oversold and the oscillators are all pointing bullishly upward, and the Bollinger Bands have suddenly spread wide. We should see at least a small bounce from here, but again, probably not the next big rally.

Latest sector rankings:

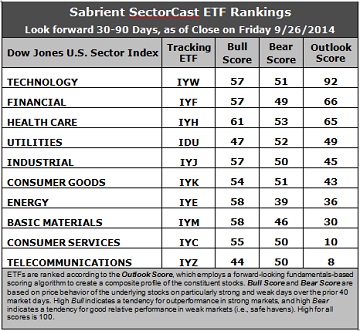

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Technology still holds the top spot with the same Outlook score of 92. The sector displays relatively solid scores across most factors in the model, including the best Wall Street analyst sentiment (net upward revisions to earnings estimates), the strongest return ratios, a good forward long-term growth rate, and the forward P/E has fallen a bit (which is good). Healthcare slips to the third slot as Financial moves up to take the second spot this week with a score of 66 as the sector displays further improvement in sell-side analyst sentiment (upward revisions), as well as the best (lowest) forward P/E and the strongest insider sentiment (open market buying). After Healthcare, there is a 16-point gap down to the middle group comprising Utilities, Industrial, and Consumer Goods/Staples.

2. Telecom stays in the cellar this week with an Outlook score of 8, as the sector displays the lowest scores on most factors in the model. Consumer Services/Discretionary stays in the bottom two with a score of 20, despite the highest long-term forward growth rate.

3. Looking at the Bull scores, Healthcare displays the strongest score of 61, while Telecom is the lowest at 44. The top-bottom spread is now 17 points, reflecting relatively low sector correlations on particularly strong market days. It is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold, rather than the all-boats-lifted-in-a-rising-tide mentality that dominated 2013.

4. Looking at the Bear scores, Utilities is seeing its score begin to rise again, as one would expect for this traditionally defensive sector. But it is Healthcare that displays the highest Bear score this week, although at 53 it is fairly low, indicating only mild investor interest when the market is weak. Still, on a relative basis, Healthcare stocks have been the preferred safe havens on weak market days. Energy continues to display the lowest score of 39. The top-bottom spread has fallen to 14 points, reflecting higher sector correlations on particularly weak market days. Again, it is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points.

5. Technology displays the best all-weather combination of Outlook/Bull/Bear scores, followed by Healthcare, while Telecom is clearly the worst. Looking at just the Bull/Bear combination, Healthcare is the clear leader, followed by Technology, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish). Telecom scores the worst, indicating general investor avoidance during extreme conditions.

6. Overall, this week’s fundamentals-based Outlook rankings look a bit biased to the bullish side of neutral. On the one hand, defensive and economically-sensitive sectors are mixed about in the rankings, and only three are scoring above 50. But on the other hand, Technology and Financial sit at the top, along with the all-weather Healthcare sector, and Industrial is hanging in there, too. Last week, I mentioned seeing a glimmer of bullish hope within the generally neutral-looking rankings, and this week the glimmer appears to have grown somewhat brighter.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or bearish), once again suggests holding Healthcare, Technology, and Financial (in that order) in the prevailing bullish climate. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint because SPY is above both its 50-day simple moving average and its 200-day SMA.)

Other highly-ranked ETFs from the Healthcare, Technology, and Financial sectors include Market Vectors Biotech ETF (BBH), iShares PHLX Semiconductor ETF (SOXX), and PowerShares KBW Regional Banking Portfolio (KBWR).

For an enhanced sector portfolio that enlists top-ranked stocks (instead of ETFs) from within Healthcare, Technology, and Financial, some long ideas include Medivation (MDVN), Celgene Corp (CELG), Skyworks Solutions (SWKS), NXP Semiconductors NV (NXPI), Regions Financial (RF), and Fifth Third Bancorp (FITB). All are highly ranked in the Sabrient Ratings Algorithm and also score within the top two quintiles (lowest accounting-related risk) of our Earnings Quality Rank (a.k.a., EQR), a pure accounting-based risk assessment signal based on the forensic accounting expertise of our subsidiary Gradient Analytics. We have found EQR quite valuable for helping to avoid performance-offsetting meltdowns in our model portfolios.

However, if you think the market has come too far and you prefer to maintain a neutral bias, the Sector Rotation model suggests holding the same three: Technology, Financial, and Healthcare (in that order). But if you have a bearish outlook on the market, the model suggests holding Technology, Healthcare, and Utilities (in that order).

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.