Wheeeee – what a ride!

It's been so long since we had even a minor correction that people are acting like this little pullback is the end of the World. If you'll notice, on our Multi-Chart, only the Russell has crossed their -5% line and, globally, only the Hang Seng has even tested it's 10% line – and they've already weak bounced 2%. When did we forget that markets do not go straight up forever? Has the constant Fed meddling left us with nothing but skittish investors, who cut and run at the first inkling of pain?

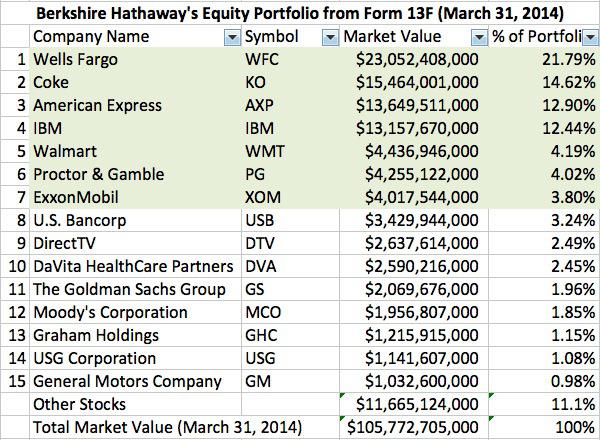

Warren Buffet has owned KO for 40 years – including the crash of 2009, when it went down $7Bn, for him along with the rest of the market. When the stocks got lower – he bought more – because he KNOWS what the stocks are worth, even when the Retail and even "Professional" investors did not.

Warren Buffet has owned KO for 40 years – including the crash of 2009, when it went down $7Bn, for him along with the rest of the market. When the stocks got lower – he bought more – because he KNOWS what the stocks are worth, even when the Retail and even "Professional" investors did not.

WFC is 22% of Berkshire's stock holdings but it was only 14% when the stock dropped from $35 in 2008 to $9 in 2009, wiping out $9.1Bn on Berkshire's balance sheet on 350M shares. What did Buffett do? He bought 175M more shares for $10 and those 525M shares are now worth $26Bn at $51. Buffett didn't panic because he KNEW what WFC was worth and he also knows that investors are, for the most part, fairly irrational people.

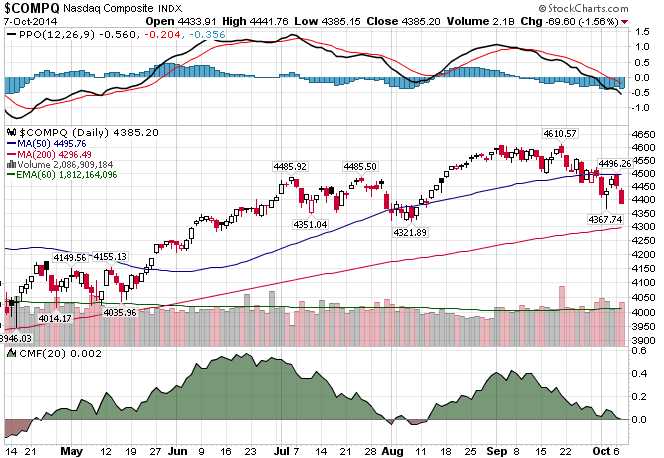

I have been complaining all year about how irrational prices were and we essentially sat out the top of the rally and stayed mainly in CASH!!! in our Member Portfolio HOPING for a correction (a bigger on than this, frankly) that would give us some nice entry set-ups for 2015. We don't think the market will collapse, but it would be nice to come back down to our 200 dmas to test the bottoms on some real volume.

As we're down about 5% (average) in our indexes and as we have the Fed Minutes this afternoon, I'm looking for a weak bounce, acccording to our 5% Rule™, of 1% – anything less than that today will be a very bearish sign! We're very interested in the -5% line on the Nasdaq at 4,367, which was the low we spiked to last week – below that and we're almost certain to test the 200 dma at 4,300 – another 2% down from here.

As we're down about 5% (average) in our indexes and as we have the Fed Minutes this afternoon, I'm looking for a weak bounce, acccording to our 5% Rule™, of 1% – anything less than that today will be a very bearish sign! We're very interested in the -5% line on the Nasdaq at 4,367, which was the low we spiked to last week – below that and we're almost certain to test the 200 dma at 4,300 – another 2% down from here.

FXI is at goaaaaaaaaaalllll! at $38.30, our play on that one was from the main post on 8/18 and we were a little early when I said:

We shorted India last week (EPI) and now FXI has got my mouth watering as a potentially good short. I'd feel better about taking up a short on FXI at $45, not $42 but the Jan $42/38 bear put spread is just $1.80 on the $4 spread and that makes it very interesting as it pays 122% on a less than 10% decline in the Chinese markets – a nice way to hedge your bullish China bets!

That's a very simple hedge and you can see how the Hang Seng fell apart in September and already we're up to $2.70 for a nice 50% gain – that's the way you hedge against a 5% market correction – you pick nice, simple trades like these that can make you 10x what the rest of your portfolio loses on the dip!

Our Short-Term Portfolio is full of hedges like that and, back on 9/23 I mentioned some of our protective plays in the morning post, saying:

That's our plan into the weekend. As I've mentioned before, we're also using DXD ($24 at the time), TZA ($14.68) and SQQQ ($35.26) to hedge our long portfolios – just in case things unravel over the weekend. We also discussed FXI ($40.30) puts earlier in the week as a play on China melting down so PLENTY of ways to profit from the downside.

If you buy just $2,500 worth of the of the TZA Oct $13/16 bull call spread at $1 (25 contracts), they will pay you back $7,500 if TZA goes up about 15% (just a 5% move up in the RUT) AND they don't lose all their money until TZA is down 10% (a 3% move up in the RUT).

TZA is already over $18, so we were a bit conservative and the spread is already $2.90 so no point keeping it open (and we went long /TF in the futures at the 1,070 line anyway, playing for the weak bounce to 1,080). There's 190% on that one, as promised. Our Short-Term Portfolio is stuffed with useful little spreads like that and yesterday alone it shot up from +58.4% to +71.9% at the close. That helped to offset losses on our Long-Term Portfolio, keeping them above the 20% line for the year. BALANCE is the key to long-term investing!!!

We'll go over some hedging strategies in today's Live Webinar at 1pm, it's Members only and you can sign up here and, fair warning, we are only a week ahead of a substantial price increase (up 100%). If you sign up for an annual Basic or Premium Membership, you will only be billed quarterly and you will lock in today's rates for the year – existing monthly or quarterly Members will only get a small, 15% bump.

We haven't raised our prices since 2008 and the market is up 200% – inflation is a harsh mistress!