I love the smell of Napalm in the morning!

I love the smell of Napalm in the morning!

That's the classic line from Apocalypse now that I'm often reminded of during Member Chat, when people start to get nervous about a market sell-off. Rober Duval says "It smells like victory" and laments that "Some day this war's going to end." and THAT is how a prepared trader should feel about a market pullback.

Rather than victory, it smells like OPPORTUNITY – even if you are not on the right side of the trade. It's an opportunity to stress-test your positions and check your portfolio balance because, if you can survive this – you can probably survive anything.

At PSW, we keep 5 virtual portfolios for our Members. A $25,000 Portfolio (for small trades), a Butterfly Portfolio (for well-hedged trades) and a usually bearish Short-Term Portfolio (aggressive trades) which acts as a hedge for our 2 larger, portfolios, the Long Term Portfolio (aggressive and low touch) and the Income Portfolio (conservative and low-touch).

At PSW, we keep 5 virtual portfolios for our Members. A $25,000 Portfolio (for small trades), a Butterfly Portfolio (for well-hedged trades) and a usually bearish Short-Term Portfolio (aggressive trades) which acts as a hedge for our 2 larger, portfolios, the Long Term Portfolio (aggressive and low touch) and the Income Portfolio (conservative and low-touch).

From a balance perspective, we're primarily concerned with the sum of our Long-Term and Short-Term Portfolios and, currently, that's $175,178 (up 75.2% for the year) and $561,856 (up 12.4% for the year) for a combined $737,034 – up 22.8% from where we began the year ($600,000) despite the sharp pullback in the market. That's BALANCED!

Another key to our success is that we are using just $438,750 of our $1,200,000 in ordinary (non-portfolio margin) buying power (36.5%) between the two – THAT leaves us in fantastic shaped to pounce when the market throws a sale like this one. In the Income Portfolio, we're using just 1/10th of our buying power – we've been waiting for an opportunity like this all year!

Another key to our success is that we are using just $438,750 of our $1,200,000 in ordinary (non-portfolio margin) buying power (36.5%) between the two – THAT leaves us in fantastic shaped to pounce when the market throws a sale like this one. In the Income Portfolio, we're using just 1/10th of our buying power – we've been waiting for an opportunity like this all year!

We just had an extensive conversation in our Live Member Chat Room about portfolio allocations and scaling into positions, so I won't re-hash the strategy here but I will say that, if you are not weathering the market storm well enough to be in a buying mood – you're doing it wrong!

Specifically, in our Short-Term Portfolio, we've been using DXD (ultra-short Dow) and SQQQ (ultra-short Nasdaq) hedges on the way down. The nice thing about a trade like our 30 SQQ Nov $35/40 bull call spreads that we bought for $2.58 is that we can already sell the $35 calls for $5.50, which is more than the spread would net if we finish above $40 in 40 days (now $40.66).

The net of the spread is currently just $1.90, so we're actually showing a loss even though the spread is in the money. That's because the short $40 calls now have a large premium ($3.60) while the long $35 calls are losing theirs (as they go deeper in the money). If we leave them alone (and this is an excellent hedge if you need a new one) those 30 spreads still have $9,300 more to gain.

Balancing our portfolios isn't just about slapping down hedges – you have to UNDERSTAND how the hedges work! You have to be smarter than the running balances your broker shows you – they don't reflect an accurate picture of how your option trades are doing and UNDERSTANDING this, when most retail traders playing with options are clueless, gives us a tremendous trading advantage.

When the S&P fell below 900, what did Warren Buffett do? He sold $5,000,000,000.00 worth of S&P $900 puts to SUCKERS who bet it would go lower. Both Buffett and I knew that it was already ridiculously low and unlikely to go lower (see 2010's "The Worst-Case Scenario: Getting Real With Global GDP!") and, even if it did (it hit 666 on the spike low) – it wasn't likely to stay there.

You see how this market can whip you around (see my take on "Flip Floppin' Thursday", for example) so, unless you are a day trader, you need to take positions you have CONVICTION in, not just whatever some idiot on TV told you to BUYBUYBUY or SELLSELLSELL last night.

You see how this market can whip you around (see my take on "Flip Floppin' Thursday", for example) so, unless you are a day trader, you need to take positions you have CONVICTION in, not just whatever some idiot on TV told you to BUYBUYBUY or SELLSELLSELL last night.

Use Rational Valuations to determine what things are worth – don't just follow a trend. As I noted above, if the Nasdaq stays where it is and SQQQ stays above $40, then that SQQQ spread goes from $1.90 to $5 (up 163%) in 39 days. Isn't that a great hedge? Essentially, you will get paid 163% back on your money UNLESS the Nasdaq recovers.

So, if you have a tech-heavy portfolio and want to stop the bleeding – this is ideal because, either your tech stocks make a comeback, our you get compensated for a move lower, flat, or even if it's not high enough to drop SQQQ back below $36.90. That's all hedging is – it's really not that complicated. This is what we teach you to do at Philstockworld.

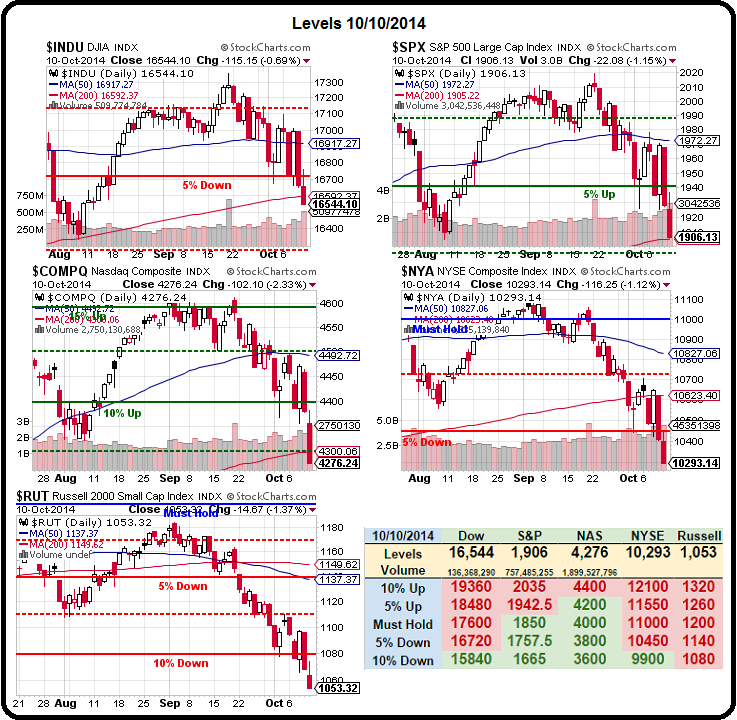

If you want more bang for your hedging buck, without getting into the fancier strategies we teach our Members, then we just have to find your panic-point and try to cover that. Let's say, like us, your long-term positions were up 20% and now they are up just 12.4% after the Dow has dropped 850 points (5%). We KNOW how much our current STP hedges will make ($9,300 on that one SQQQ spread alone) so figure we are already hedged for another 650-point drop 50 16,000.

Below 16,000 is a 5% drop from here and DXD is a 2x ultra-short of the Dow at $26. So, if the Dow drops 5-10%, then DXD will go up 10-20%, between $28.50 and $31. Currently, the Nov $26 calls are 0.95 and the Nov $29 calls are 0.33 so it's net 0.62 on the $3 spread that has 383% of upside potential if DXD simply goes into November expiration (39 days) above $29, a bit more than 10% higher than here.

That means, if your portfolio dropped $25,000 and you want to avoid another $25,000 loss, you can invest $5,000 in a hedge like that and that will pay you back $24,000 at $29 (+$19,000). If the Dow goes back up, you lose the hedge but get back some or all of the $25,000 you lost on the dip, if the Dow goes flat, you lose the hedge but there's no more damage and now, hopefully, it's time for the Santa Claus Rally. Of course we would adjust along the way – these are just the basics.

Having a plan is step one towards not panicking in the market. What's yours?