Do you want to be a Millionaire?

Do you want to be a Millionaire?

Sure you do, why not. $1,000,000 is a nice amount of money – even at 5% interest in retirement, it's enough to drop $50,000 into your bank account each year to supplement whatever else you may have coming in. So let's agree that it's nice to have a Million Dollars.

Now I'll say something you may not agree with – if you are not on a path to have $1M in the bank by the time you retire – it's probably your own fault.

Yes, I'm sorry but it's true. It's really not as hard as you think to save $1M and I'm going to teach you how and, as long as you are under 50, I can show you how to get on the path to turning $50,000 into $1M in 25 years. If you are under 40 – it's going to be a piece of cake to save $1M by the time you are 65 – as long as you can follow our plan.

First I need to convince you of the value of SAVING YOUR MONEY – this is not something most people are good at – especially young people. Unless you accept the VALUE of saving your money, you will not be able to make the wise choices you need to make to get on the path to saving $1M.

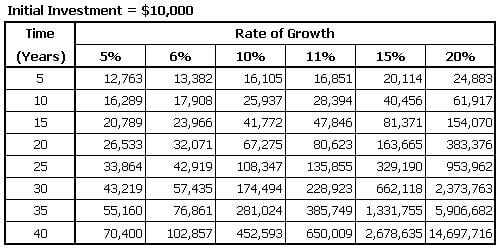

This is a compound rate table. It's a mathematical fact. If you start with just $10,000, even at 10%, you will have more than $450,000 in 40 years. I'm 51 now and I can tell you that 30 years ago, I could have bought a cheaper car after college and saved $10,000. I could have gone to 20 less concerts and saved $2,000 and 20 less fancy dinner dates for $2,000 and taken one less ski trip for $2,000 – you get the idea. I was young and I was successful but I didn't know at the time that EACH $10,000 I spent in my 30s would cost me $450,000 in my 70s.

That was my excuse then, what's your excuse now? Now I'm 51 and when I'm 91 I'm sure I'll appreciate having an extra $450,000. I'll appreciate it so much, in fact, that I'm motivated to put away $50,000, so I'll have $2.25M. The point is, you need to accept the reality of these numbers and understand that EACH $5 cup of coffee you buy at Starbucks is costing your future self $225. Flying first class for $1,500 instead of coach for $300 is costing your future self $54,000 – are you really that rich?

That was my excuse then, what's your excuse now? Now I'm 51 and when I'm 91 I'm sure I'll appreciate having an extra $450,000. I'll appreciate it so much, in fact, that I'm motivated to put away $50,000, so I'll have $2.25M. The point is, you need to accept the reality of these numbers and understand that EACH $5 cup of coffee you buy at Starbucks is costing your future self $225. Flying first class for $1,500 instead of coach for $300 is costing your future self $54,000 – are you really that rich?

Now, keep in mind that we're using the conservative 10% rate. At Philstockworld, we have 4 virtual portfolios for our Members that are averaging over 20% this year. At 20%, each dollar you save compounds into $237 in just 30 years. While we can't ALWAYS have huge winning years, we only need to AVERAGE better than 10% returns and we will be in fantastic shape – if we begin by deciding to save our money.

Using our "Be the House – Not the Gambler" strategy, which we have discussed in our previous videos like "How To Buy a Stock for a 15-20% Discount" and "The Secret to Consistent 20-40% Annual Returns" we can put ourselves on a path to growing our savings at rates we desire to build a great retirement account. This is what we teach our Members every day at Philstockworld.

But it all has to start with you. YOU need to decide to forgo that $5 cup of coffee, that $500 day at the ballgame, that $1,000 weekend trip because you fell stressed – think how much less stressed you will feel in 40 years when that $1,000 is an extra $45,000! Then there are the big decisions you make along the way to retirement: Do you need that new car? Do you NEED that big wedding? Do you need a house that big?

But it all has to start with you. YOU need to decide to forgo that $5 cup of coffee, that $500 day at the ballgame, that $1,000 weekend trip because you fell stressed – think how much less stressed you will feel in 40 years when that $1,000 is an extra $45,000! Then there are the big decisions you make along the way to retirement: Do you need that new car? Do you NEED that big wedding? Do you need a house that big?

It's ironic that people don't realize that NOT spending $500 a month on their house and instead SAVING that money each month at a compounded 10% a year for the same 30 years ($180,000) nets you back $1.1M. Not only that, but NOT spending $500 a month on your mortgage for the same 30 years, even at 5%, SAVES YOU $172,000 in payments. That's how much you save with each $100,000 you choose NOT to borrow for a mortgage!

Growing your wealth isn't just about making money in the markets. In 2015, Philstockworld will focus on wealth-building techniques which, combined with our winning investing strategies, can help put you on the path to a life of financial independence – LEARN MORE HERE.