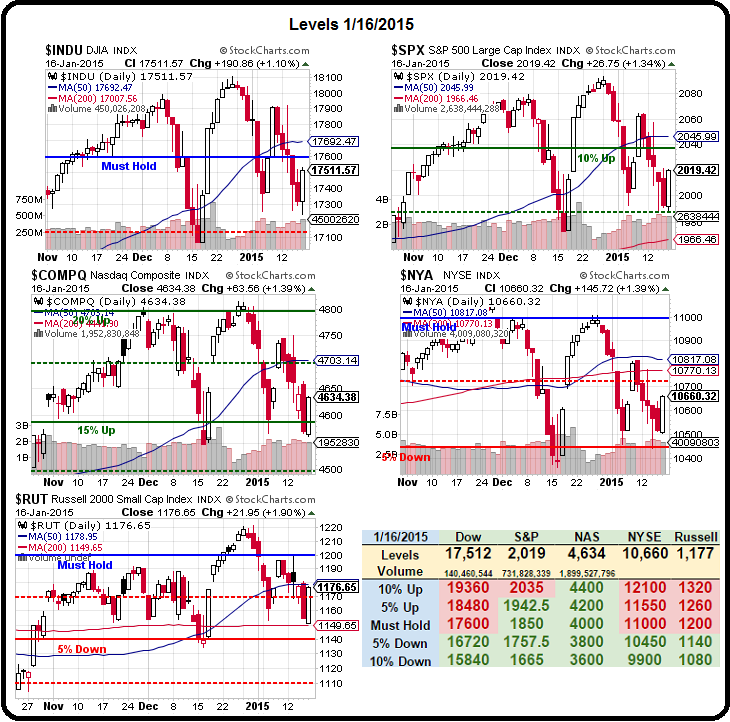

2,027 is our goal today for the S&P.

2,027 is our goal today for the S&P.

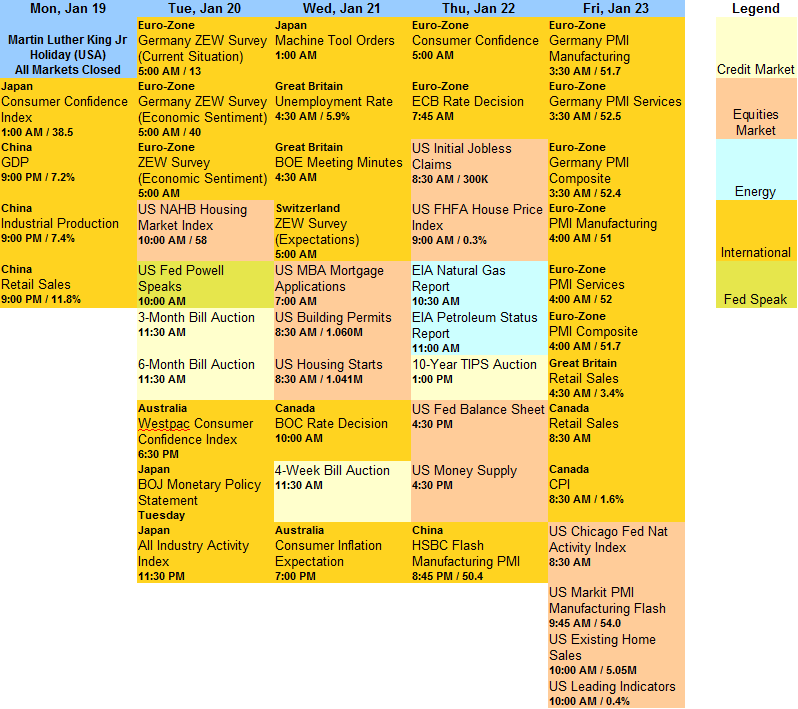

After that, we'll turn our attention to 2,040 tomorrow (the 10% line on our Big Chart) and we need 22 Nasdaq points to make that strong bounce line and then we'll look for 4,700 to come back on MORE FREE MONEY from the ECB on Thusday.

Our Bounce Lines from last were were (and still are):

- Dow 17,280 (weak) and 17,460 (strong)

- S&P 2,006 (weak) and 2,027 (strong)

- Nasdaq 4,608 (weak) and 4,656 (strong)

- NYSE 10,560 (weak) and 10,670 (strong)

- Russell 1,172.50 (weak) and 1,185 (strong)

China made their own weak bounce overnight and that's already enough to get our Futures back on track but, as you can see from the chart on the left – this morning's bounce to 3,173 erases only 50 points out of a 275-point drop, which just happens to be the very definition of a weak bounce per our 5% Rule™.

China made their own weak bounce overnight and that's already enough to get our Futures back on track but, as you can see from the chart on the left – this morning's bounce to 3,173 erases only 50 points out of a 275-point drop, which just happens to be the very definition of a weak bounce per our 5% Rule™.

So, to sum it up – we are likely to have strong bounces as traders are relieved to see China having weak bounces and, of course, in anticipation of MASSIVE stimulus coming from the ECB on Thursday – what could possibly go wrong? Well, for one thing, Draghi can disappoint us on Thursday (again), China could turn lower after the weak bounce and we can hear about more trading companies in trouble over their Swiss Franc gambles. How's that for starters?

China's GDP was less than exciting this morning at 7.4%, it was the slowest growth in 20 years and oil fall back to $47.50 (where we are long /CL) and Natural Gas fell back to $2.90 (where we are longh with tight stops on /NG) and gasoline is back to $1.34, but that one we stopped out of from our $1.30 long entry on /RB). The IMF says China will slow to 6.8% this year and that's a high estimate compared to UBS (6.5%) and Oxford Economics (6%) – as well as intelligent observation.

Back in the EU, few economists think ECB QE will do much good and here's a nice Financial Times video to give us a short recap on that issue. Russia is still collapsing, Greece just got downgraded again and, oh yes, did you hear the one about the 20-standard-deviation move in the Franc? That was so last Thursday though, how could that possibly affect the markets today, right?

Back in the EU, few economists think ECB QE will do much good and here's a nice Financial Times video to give us a short recap on that issue. Russia is still collapsing, Greece just got downgraded again and, oh yes, did you hear the one about the 20-standard-deviation move in the Franc? That was so last Thursday though, how could that possibly affect the markets today, right?

Gold (we're long) lept all the way to test $1,300 over the weekend and the Dollar remains high (92.95) while commodities remain out of favor due to the REALLY TERRIBLE Global Economy that stock traders seem fairly oblivious too (except on days in China where the market drops 8% in one session, of course). Still, we don't worry about stuff that happens in China, or Europe, or Canada, or Japam or Mexico – but terrorisim – FREAK OUT BABY!!!

This is the challenge Obama faces tonight as he gives his State of the Union address and attempts to get Americans to focus on fixable problems, like Poverty, The Budget, Jobs and Education and stop fixating on Terrorism (or anything on Fox "News"), which is being used to justify our $745,000,000,000 Defense Budget – even though we aren't actually at war with ANYONE.

This is the challenge Obama faces tonight as he gives his State of the Union address and attempts to get Americans to focus on fixable problems, like Poverty, The Budget, Jobs and Education and stop fixating on Terrorism (or anything on Fox "News"), which is being used to justify our $745,000,000,000 Defense Budget – even though we aren't actually at war with ANYONE.

Human rights are not only violated by terrorism, repression or assassination, but also by unfair economic structures that creates huge inequalities. – Pope Francis

You are literally 100 times more likely to drown in your bathtub than die from terrorism in the US but the GOP/Fox want you to focus on the bogey-man and not on the people who are really destroying your lifestyle – the top 1%!

You are literally 100 times more likely to drown in your bathtub than die from terrorism in the US but the GOP/Fox want you to focus on the bogey-man and not on the people who are really destroying your lifestyle – the top 1%!

As you can see from the chart above, you are 100% likely to be affected by your declining share of Global Wealth if you are not in the top 1%. You have, in fact, lost 10% of your wealth to the top 1% in the past 5 years and you'll lose another 10% in the next 5 years if this trend continues. This is what Obama will speak about tonight – he wants to stop this, and the Republicans want to stop him!

It's going to be a very exciting week and it's not about where our indexes bounce up to but whether or not those lines hold. We went into the weekend still a bit bearish and it's going to take a lot more than a token effort by Draghi to get us to change our minds.

Be careful out there!