What a recovery!

What a recovery!

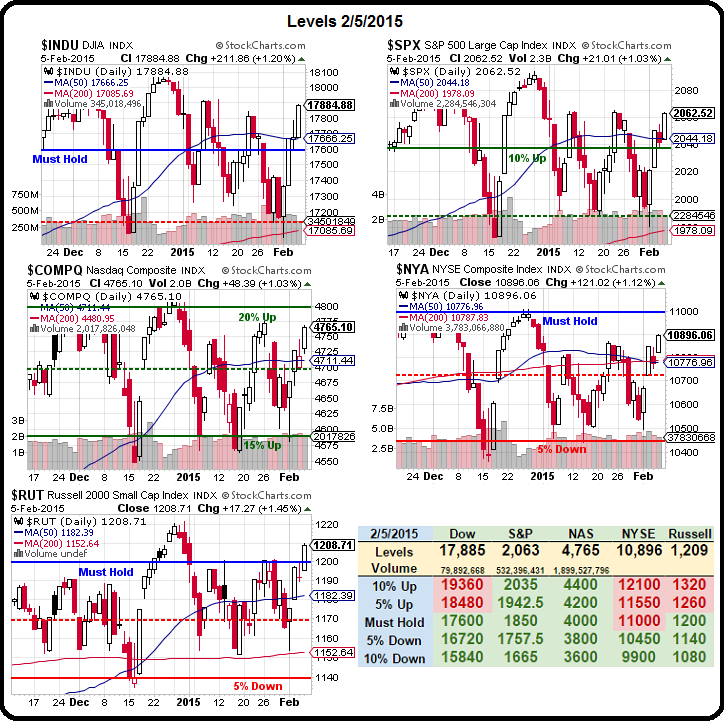

It's even better than the last two recoveries last month but not quite as good as the recovery we had in December. From a Big Chart perspective, using our 5% Rule™, we're still waiting for the NYSE to finally confirm a real rally by going over 11,000 – now just 104 points away!

Still, the rally was good enough that we gave up on our March TZA hedges in the Short-Term Portfolio, which has fallen back to up just 99.7% ($199,725) – down 4.8% since Tuesday's open in our smaller portfolio. Fortunately, however, our much larger and much more bullish Long-Term Portfolio gained $19,585 over the same period, netting us a $14,785 (2%) gain for the week on our primary paired portfolios.

Those of you who followed our call last Friday to go long on the oil Futures at $44.50 (/CL) should be happy to wake up this morning at $52.50 for an $8,000 per contract gain for the week (you're welcome). We took our money and ran on those trades and now we'll see if $50 holds next week and, if it does, we may want to take some more longs.

The long Natural Gas Trade Idea from the same post is still playable with Nat Gas Futures (/NG) at $2.59 this morning. Our target for that trade is $2.70 for $11,000 per 10 contracts in gains but the trade idea we put up Friday was for UNG, the ETF that tracks Natural Gas, for those of you who haven't graduated from our Futures Trading Webinars yet.

The long Natural Gas Trade Idea from the same post is still playable with Nat Gas Futures (/NG) at $2.59 this morning. Our target for that trade is $2.70 for $11,000 per 10 contracts in gains but the trade idea we put up Friday was for UNG, the ETF that tracks Natural Gas, for those of you who haven't graduated from our Futures Trading Webinars yet.

And, of course, for the options challenged (boy do you need our help!), there's nothing wrong with just going long on UNG ($13.25 this morning). For example: One of our Members, Rustle123, played the stock on IRBT yesterday morning, when I called for a long on the earnings sell-off in our Live Member Chat Room and, just 3 hours later, he had this to say:

Bought IRBT from 28.22 – 28.55 after your call Phil, sold at 29.45 for quick trade and hoping to buy back lower tomorrow. Almost paid for membership for the year on that trade today. Thank you, Phil.

The options play on IRBT did OK as well, it was:

Now you can sell the 2017 $23 puts for $4 and pick up the $25/35 bull call spread for $3.85 for a net 0.15 credit on the $10 spread and your worst case is owning IRBT at net $22.85.

That spread finished out at 0.50, up 0.65 for the day (433%) and off to a good start against the anticipated 6,766% potential gain on cash if IRBT should finish back over $35 in two years. The worst case is owning our Stock of the Century for net $22.85 (or $23.50 if you start today instead), which we still think is a pretty good price!

That spread finished out at 0.50, up 0.65 for the day (433%) and off to a good start against the anticipated 6,766% potential gain on cash if IRBT should finish back over $35 in two years. The worst case is owning our Stock of the Century for net $22.85 (or $23.50 if you start today instead), which we still think is a pretty good price!

Also in our early Thursday trading, we had this trade idea for TWTR for our Members ahead of earnings last night:

As to TWTR, I like them too and my kids live on it so there's the next generation all set. It's all about how well they monetize it but I certainly think they are worth a toss at $40.

Earnings are tonight and they might get away so maybe start with the 2017 $40/55 bull call spread at $5 and, if they go up – you are all set and, if they go down, then we can sell puts and roll the calls lower. 5 in the LTP on that one.

5 of those spreads cost $2,500 and will pay back $7,500 (200% profit) if TWTR is over $55 in Jan of 2017. We're going to be off to a great start as earnings went well and TWTR popped 10% last night and should open over $45. Very likely we could take a quick 30% profit right now on the spread but we have faith in the long-term target. Trades like that are the reason our Long-Term Portfolio is up 24% in a year!

8:30 Update: Nice beat on Non-Farm Payrolls, up 257,000 vs 234,000 expected with a total (after adjustments to Dec) of 3.1M jobs added in 2015 – the most since 1999 and that's a nice bullish number but also an anticipated number so we'll see if we can find some good shorting opportunities in the Futures in our Live Member Chat Room this morning.

8:30 Update: Nice beat on Non-Farm Payrolls, up 257,000 vs 234,000 expected with a total (after adjustments to Dec) of 3.1M jobs added in 2015 – the most since 1999 and that's a nice bullish number but also an anticipated number so we'll see if we can find some good shorting opportunities in the Futures in our Live Member Chat Room this morning.

As we know, good news can be bad news as it pushes the Fed to tap the brakes by raising rates sooner, rather than later. The one thing the Fed hates more than anything else is Wage Inflation – because that means their Bankster Buddies and their Top 1% clients may actually have to pay better salaries to their workers.

Wages did finally go up in December – up 12 cents to $24.75 (0.5%) and up 2.2% for the year – almost keeping up with inflation! That's too much for the Fed and our Corporate Masters, though and that means we're going to have nice shorts on our Index Futures at Dow (/YM) 17,850, S&P (/ES) 2,062.50, Nasdaq (/NQ) 4,262.50 and Russell (/TF) 1,207.50.

Wages did finally go up in December – up 12 cents to $24.75 (0.5%) and up 2.2% for the year – almost keeping up with inflation! That's too much for the Fed and our Corporate Masters, though and that means we're going to have nice shorts on our Index Futures at Dow (/YM) 17,850, S&P (/ES) 2,062.50, Nasdaq (/NQ) 4,262.50 and Russell (/TF) 1,207.50.

The key is to wait for at least two to cross below and short the laggard and then, if any of the 3 below go back over – kill the trade. That limits your losses but gives you tons of room for gains to the upside. This is going to be an exciting day so I'm off to our Chat Room.

Have a great weekend,

– Phil