Dove, dove, dove.

Dove, dove, dove.

Dove, dove, dove – now that Fisher is gone, that's all we have at the Fed these days. This week we hear from Mester, Williams, Bullard, Evans and Lockhart – all doves on the Fed and, of course Super Mario speaks at 10am (EST) to get our markets off to a good start for the week with his own special brand of doveishness.

While our Fed, the ECB and the BOJ are doing all they can to talk the markets higher, China is warning its investors that the run that has pushed their market 75% in less than a year is unsustainable. A spokesman for the China Securities Regulatory Commission said on Friday:

“Investors should be cautious about market risks. We shouldn’t be thinking if we don’t buy now, we will miss it.”

A previous warning from the CSRC was ignored. The Shanghai Composite jumped 2.8% to surpass 3,000 on Dec 8th, the first trading day after the securities body on Dec 5th cautioned investors about growing market risks. The valuations of some listed companies are “relatively high,” the CSRC spokesman said in Friday’s statement. “There are about 700 companies in the Shanghai and Shenzhen stock exchanges with a price-earnings ratio of above 100,” the spokesman said.

Stocks continue to rise in China on speculation that the Government will do whatever it takes to sustain a 7% growth rate, which means lots of FREE MONEY will have to be printed. I think that's a fabulous idea – all Governments should print unlimited supplies of free money until all of our economies are growning at 7% and then everything will be AWESOME and nothing can possibly go wrong with that plan, can it?

Stocks continue to rise in China on speculation that the Government will do whatever it takes to sustain a 7% growth rate, which means lots of FREE MONEY will have to be printed. I think that's a fabulous idea – all Governments should print unlimited supplies of free money until all of our economies are growning at 7% and then everything will be AWESOME and nothing can possibly go wrong with that plan, can it?

I certainly hope not, because that's the plan we're pursuing at the moment! Meanwhile, Japan is starting to look like Zimbabwe and the 22% drop in the Euro in 2014 sent 124.4Bn Euros ($150Bn) out of the Union in the kind of negative cash-flows you expect to see in countries that are on the verge of collapse. That money has flown into US equities, giving us our own market bubble and also into China and even Japan because there simply aren't enough safe places to put $150Bn a quarter these days.

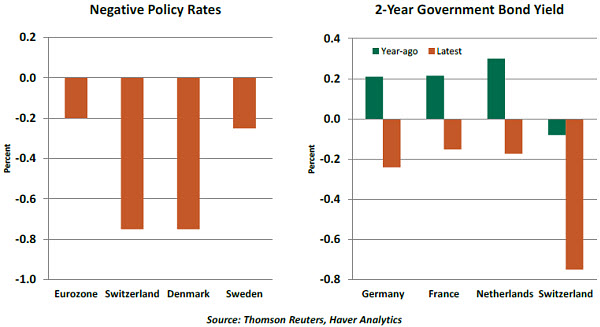

The inflows are also keeping our rates down despite the Fed's clear indication of their intention to hike as $374.3Bn of Treasury bonds (half) were bought by foriegn investors last year. Hey, 2% is a lot better than -0.25% that they are getting in Europe! “There are more and more Euros being printed, but these are hot-potato Euros,” said Roger Hallman of JPM.

The inflows are also keeping our rates down despite the Fed's clear indication of their intention to hike as $374.3Bn of Treasury bonds (half) were bought by foriegn investors last year. Hey, 2% is a lot better than -0.25% that they are getting in Europe! “There are more and more Euros being printed, but these are hot-potato Euros,” said Roger Hallman of JPM.

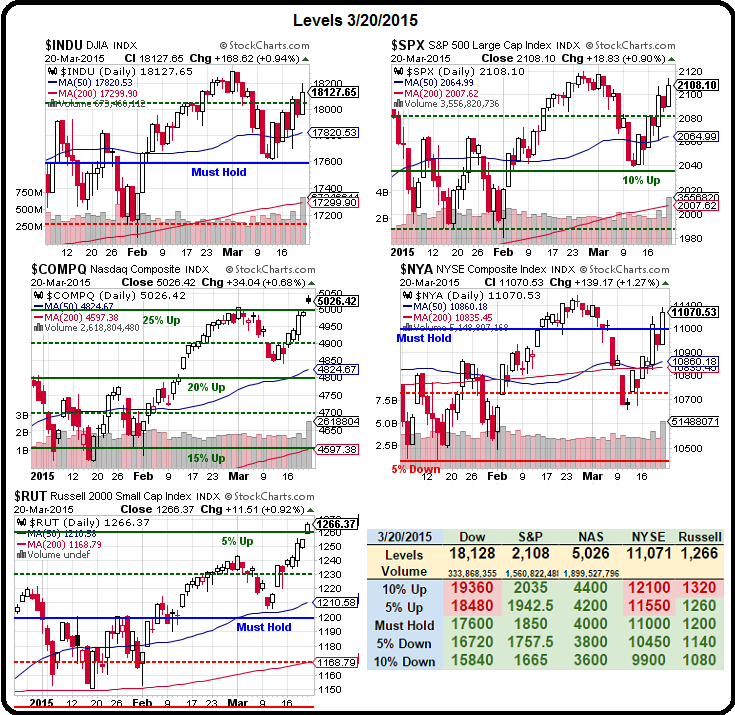

Here's a few charts we should contemplate to start our week off:

In the last 5 years, the US has gone $10Tn further into debt, now over $60Tn of total debt. That's 10% of our GDP in debt, each year:

Unemployment is down mainly because 6M people dropped out of the Labor Force entirely:

Twice as many men have no jobs as wehn I graduated college:

Household incomes are "improving," but only if you ignore the longer-term trend:

– 39 percent of American workers make less than $20,000 a year.

– 52 percent of American workers make less than $30,000 a year.

– 63 percent of American workers make less than $40,000 a year.

– 72 percent of American workers make less than $50,000 a year.

There is inflation – but only if you eat:

That's why, despite all this FREE MONEY being tossed around, the economy is fairly stagnant – the Velocity of Money is still at all-time lows, lows that were once thought impossible by economists and it's going down, not up – there's your deflation.

The only way to fix the Velocity of Money, to get people to spend again, is to give them better jobs and better wages so that they can get out and contribute to the economy. Letting a bunch of rich people hoard all the cash simply isn't working.