And we're OUT!

And we're OUT!

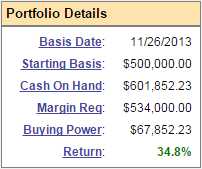

That's right, we took advantage of yesterday's BS rally to cash out our Long-Term Portfolio at the exact high of 34.8%, up $173,815.03 in 16 months. We keep several virtual portfolios for our Members (and you can join us here) and the generally bullish LTP is paired with our Short-Term Portfolio, which acts as a hedge to the LTP positions but also makes short-term bets when the opportunities arise.

The STP has also performed much better than expected and is up 83.8% over the same time-frame at $183,820 off our $100,000 start for a combined gain of $257,635, which is 42% of our initial investment and that was our goaaaaaaaaaaaallllllllllllll for two years (see "How to Get Rich Slowly") and it's only March - of course we deserve a rest!

Cashing out our largest portfolio, in addition to protecting our profits, also helps us re-focus on what positions we REALLY want to play for the rest of 2015. We'll be making a new Buy List for our Members and we'll also be double-dipping on some of our winners (AAPL comes to mind) as soon as we see a good re-entry. One of the trades we did keep will be featured tonight on my TV appearance on Business News Network's Money Talk and we found 11 other trades we liked enough to keep in play (mostly ones that were underperforming) through the upcoming correction.

Cashing out our largest portfolio, in addition to protecting our profits, also helps us re-focus on what positions we REALLY want to play for the rest of 2015. We'll be making a new Buy List for our Members and we'll also be double-dipping on some of our winners (AAPL comes to mind) as soon as we see a good re-entry. One of the trades we did keep will be featured tonight on my TV appearance on Business News Network's Money Talk and we found 11 other trades we liked enough to keep in play (mostly ones that were underperforming) through the upcoming correction.

Also, it's not too late to participate in our "Secret Santa's Inflation Hedges for 2015" as inflation has not officially been recognized yet (so our picks are still cheap) but, as currencies race each other towards the event horizon, we have faith that our infation hedges will begin to pick up the slack. In any case, the way we designed our hedges, we don't need a big move in the market to make big gains on our spreads.