We had our best day of the year yesterday!

We had our best day of the year yesterday!

How did you do? Hopefully very well if you are one of our Members or have been following us on Twitter, where I began warning people one week ago that this was about to happen. And I don't mean in that ridiculously vauge Jim Cramer weather-vane way that's subject to interpretation. Not at Philstockworld! On Wednesday March 18th, at 7:52 am, I tweeted:

It doesn't get much more specific than that, does it? That was our post BEFORE the Fed announcement on Wednesday and, in the morning post, we discussed the decaying macros – as I have been doing with our Members for most of this month. That morning, we also called a bottom on oil at $44 and I put up the following trade idea for our Members in our Live Chat Room (which you can join by subscribing here):

We topped out at $110 in Jan but already we can sell the April $110s for $10.50 so let's sell 3 of those in the STP for $3,150. We already sold 3 March $105s for $5.40 (now $4.50) and they are going to be cutting it close but, worst case, we'll just roll them to April $110s. We also already sold March $120s for $13 on the spike to $110 and those look good at $2.50 with 3 days to go.

Of course I also like the long on /CL off the $44 line – as I said earlier, I expect us to test $45 into the inventories but at least $44.50 should be hit.

As you can see from the SCO chart, we caught the dead top on that one and those April $110 calls are already down to $1.90 for an 82% gain in a week (up $2,580) while oil Futures hit $52 this morning for a gain of $8,000 per contract. We also did our Live Trading Webinar for our Members (replay available here) the day before and our trade ideas from that were reposted in Member Chat at 10:14 that day as well:

Webinar/Micro – I didn't write them down but I like UCO July $5/9 bull call spread at $1.35, selling the Jan $5 puts for $1 for net 0.35 on the $4 spread.

USO has less decay so safer to sell puts on though there is some decay over time. Jan $13 puts can be sold for $1.25 to pay for the UCO play or you can establish a similar spread in July with the $14/18 bull call spread at $1.85, which would be net 0.60 if played with the short puts.

As you can see, we REALLY liked oil when it was bottoming last week. In fact, when asked on Monday for a trade idea for a group of High Net-Worth Investors in Canada, when I was taping and interview for BNN's Money Talk, I chose the above UCO trade – as it still hadn't moved yet. Well, it moved yesteday (and more so today), closing at $1.25 – up 257% in a week already! The USO Jan $13 puts dropped to 0.85, so using that variation, the net 0.10 spread closed at $1.15 for a 1,050% gain and using the USO puts with the July $14/18 spread (now $2.50) closed the day at net $1.65, up $1.05 or +175% in a week.

We liked those oil trades so much that I gave them away as our first free trade idea of the quarter in the next day's post so don't tell me you can't afford a Membership when those samples alone paid for a year's subscription several times over!

I said right in last Thursday morning's post (but did you listen?):

I know a lot of newsletters CLAIM to have great performance but how many of them tell you SPECIFICALLY what trades they like BEFORE they happen so you can see for yourself how well they perform? We talked about going long in /CLK5 in yesterday's morning post, which was in our subscriber's mailboxes at 8:26 am. We also REMINDED people that we had already gone long on USO and UCO in Tuesday's FREE Live Trading Webinar (replay available here).

Remember, I can only tell you what is going to happen in the markets and how to profit from it – the rest is up to you! I also said that morning:

Remember, I can only tell you what is going to happen in the markets and how to profit from it – the rest is up to you! I also said that morning:

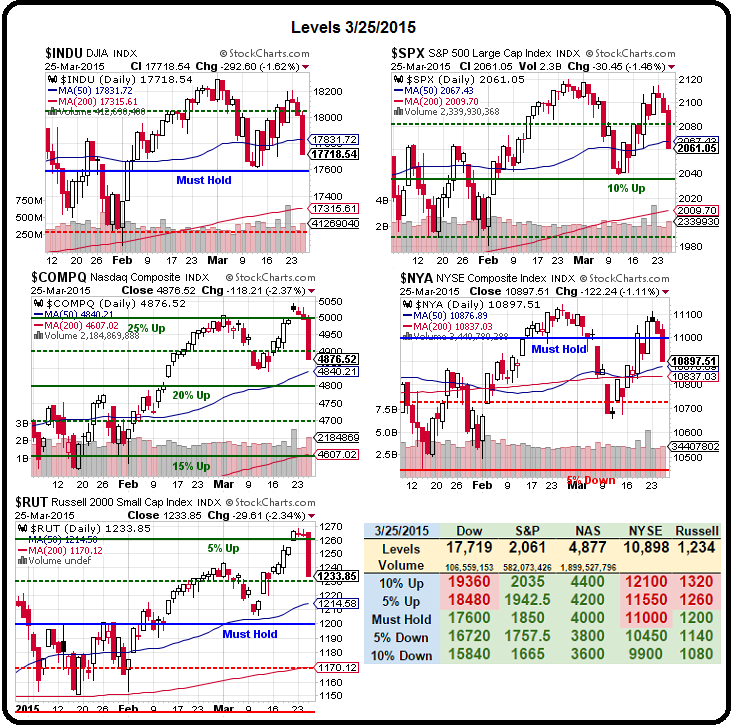

Meanwhile, we'll see how all this nonsense around the Fed plays out but it looks to me like we're forming a dreaded "Golden Arches Pattern" on our indexes, and that will bring us back to the late January lows in the next 30 days so please – be careful out there.

And what does a Golden Arches pattern look like? That you can see clearly on our big chart, now that it's had a week to form:

We spend last Thursday getting more aggressively long on oil and more aggressively short on the market in our Live Member Chat Room and Friday I sarcastically titled the morning post: "5,000-Point Friday – This Nasdaq Bubble Will NEVER Burst!" and pointed out that "Despite our success, I'm not happy with this rally but I wasn't happy in 1999 or 2007 either and that made me miss out on some nice gains so we're keeping our LTP open (though, as you can see, over 50% in cash) so we don't "miss out" on the madness." I also closed with the following point:

That's why we are cautious despite the exhuberance that is being shown by the equity markets. We'll do fine with our conservative portfolio and our various hedges but the real money – as you can see, is made when the market sells off and you are fortunate enough to have CASH!!! on the sidelines.

By Tuesday morning, things had gotten ridiculous enough (because our Long-Term Portfolio had gained 5% ($35,000) in a few days. That I decided it was time to take the money and run and we cashed out all our non-energy/material plays (where we still think there's a playable bottom) saying:

By Tuesday morning, things had gotten ridiculous enough (because our Long-Term Portfolio had gained 5% ($35,000) in a few days. That I decided it was time to take the money and run and we cashed out all our non-energy/material plays (where we still think there's a playable bottom) saying:

As of yesterday's close, our Long-Term Portfolio was up 33.3% and, unfortunately, I have to pull the plug on it and go to cash. I cannot in good conscience endorse holding onto these huge gains in equities that we've been blessed to achieve. There will be exeptions and I will publish a list for our Members first thing this morning but, on the whole, I can't see a better way to lock in our $166,000 in gains ($666K for the portfolio, which is a warning in itself!) than to just go to cash and start fresh from there.

As you can see from Dave Fry's SPY chart, we caught the exact tippy-top of the morning spike and made some very good and very timely exits right before the bottom dropped out. As noted above, our Short-Term Portfolio was left VERY bearish and that has popped $30,000 (30%) while the market has dropped already. We have already hit our primary goal at 2,035 (the 10% line on our Big Chart) on the S&P Futures (/ES) and we flipped long there in our Live Member Chat as well as long on /TF (Russell Futures) at 1,220 and short on oil at $52 (/CL) to lock in our bonus gains for the morning and take advantage of the bounce (probably weak).

Remember – I can only tell you what is going to happen and how to profit from it – the rest is up to you! ![]()