And we're out!

And we're out!

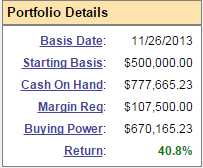

After making a ridiculous 40.8% in 15 months, we decided on Tuesday morning to get back to cash in our Long-Term Portfolio. We still have 13 positions left, mostly in the materials space but, as you can see, our cash now exceeds our portfolio's total value ($703,885.23) because the positions we did keep were our "losers" (so far) that are down, as a group, by $73,780.

There is almost not a single position we sold that I wouldn't be happy to buy back if they get cheap again but we didn't make 40% in just over a year by chasing winners. The way we built this portfolio was first creating a Buy List (Members, see our Virtual Portfolio Section for our last list) and then choosing a bargain every few weeks to add to our Long-Term Portfolio. As we move through Q1 earnings, we'll be making a new Buy List for 2015 and, now that we're back in cash, we'll begin making new picks for our Long-Term Portfolio.

While it is our INTENTION in the LTP to hold our positions over time, when we get a ridiculous run in the market like the one we've had for the past year, it is simply foolish not to take advantage of it. The stocks we bought were targeted to make 40% in two years, not 15 months and, when you are that far ahead of the curve - it's wise to turn those unrealized gains into realized ones before they disappear on you!

While it is our INTENTION in the LTP to hold our positions over time, when we get a ridiculous run in the market like the one we've had for the past year, it is simply foolish not to take advantage of it. The stocks we bought were targeted to make 40% in two years, not 15 months and, when you are that far ahead of the curve - it's wise to turn those unrealized gains into realized ones before they disappear on you!

In our last review (just 3 weeks ago) we were at $640,797 in the LTP so we gained 10% in 3 weeks on our positions - that's ridiculous. Never confuse being lucky with being good - gaining 10% in a month is lucky becuase, if we were that good, we'd be averaging 100% a year, right?