This is just getting surreal.

This is just getting surreal.

I've been warning you for weeks that a big correction is coming in China and it's been amusing reading how wrong I was and how it's a new paradigm that I don't understand and China isn't like other markets etc., etc. In other words – pretty much the same stuff people say right before every bubble bursts but instead of dot.com or sub-prime, now people say "this time is different" for China.

I don't like telling people to go to cash – no one wants to subscribe to a stock market newsletter that tells you not to buy stocks but, when the situation in the market becomes this uncertain – I'd rather be safe than popular. The only reason the Shanghai stopped dropping today is because the bell rang to close the market. Also, you have to consider that a 10% drop is limit down for individual stocks so almost half the stocks stopped trading long before the close.

If you even hear the MSM mention the fact that a major Global market fell 6.5% in a day, you'll probably also hear the excuse that "brokers tightened margin requirements" but that's only partly true as what really happened today is Changjiang Securities Co. became the 3rd broker to raise margin requirements and it's much smaller than two majors who raised them last Thursday, which had no effect at all on the market.

If you even hear the MSM mention the fact that a major Global market fell 6.5% in a day, you'll probably also hear the excuse that "brokers tightened margin requirements" but that's only partly true as what really happened today is Changjiang Securities Co. became the 3rd broker to raise margin requirements and it's much smaller than two majors who raised them last Thursday, which had no effect at all on the market.

“With the total margin financing volume approaching two trillion yuan ($322 billion), institutional investors [are becoming] more cautious over any potential market bust,” said Li Lei, an analyst at Minzu Securities. “The growth rate of margin finance will slow down as brokers tighten rules, but the sheer volume will continue to climb to around three trillion yuan.”

Disclosures that Central Huijin Investment Ltd. was selling mainland shares of two of China’s largest state-owned commercial banks— Industrial & Commercial Bank of China Ltd. and China Construction Bank Corp.–came out earlier in the week, but analysts said that Chinese websites and blogs were talking about the sales. Huijin—a subsidiary of China Investment Corp., the nation’s sovereign-wealth fund—is selling small stakes but investors appeared to take the move as indicative of the government’s sentiment toward the market’s run-up.

Disclosures that Central Huijin Investment Ltd. was selling mainland shares of two of China’s largest state-owned commercial banks— Industrial & Commercial Bank of China Ltd. and China Construction Bank Corp.–came out earlier in the week, but analysts said that Chinese websites and blogs were talking about the sales. Huijin—a subsidiary of China Investment Corp., the nation’s sovereign-wealth fund—is selling small stakes but investors appeared to take the move as indicative of the government’s sentiment toward the market’s run-up.

Meanwhile, Japan is not helping matters because, as we expected (we're short EWJ), Retail Sales in Japan barely recovered from last month's 1.8% drop, up just 0.4% in April, which means still down 1.4% from February. Economorons, who are paid to know this stuff, had predicted a 1.1% gain using God knows what faulty data and models in their ivory towers.

This news means there is no demand for the Yen in Japan and that has weakened the Yen to a 12-year low at 124.25 to the Dollar. Gosh, I wonder why consumers are spending less just because their currency is worth 20% less than last year, which was 25% less than the year before that? Maybe I need to fly to Stockholm and explain things to these guys…

And what will Abe's solution be for this new downturn in Japan's economy? Why it's MORE FREE MONEY, silly – what else is there? As we discussed last week – Japan is closer to the end game than the other G8 countries (back to G7 now as no one wants to sit with Putin anymore) and that means it's either hyperinflate or default and Abe/Kuroda are trying as hard as they can to hyperinflate but, so far – all they've succeeded in doing is destroying their currency.

Why? Well, this comes around to why we end up talking about social and political things at PSW – because the money that they are dumping into the economy isn't going into the economy at all – it's simply going into the pockets of the Top 1% (people and corporations), who reap the rewards of low rates, globalized wage slavery, easy access to capital and, of course, bubblishious market prices.

Why? Well, this comes around to why we end up talking about social and political things at PSW – because the money that they are dumping into the economy isn't going into the economy at all – it's simply going into the pockets of the Top 1% (people and corporations), who reap the rewards of low rates, globalized wage slavery, easy access to capital and, of course, bubblishious market prices.

Social inequality is a real bitch when you're trying to find customers to sell unnecessary do-dads to and, of course, unnecessary do-dads are pretty much our entire economy! US consumers are not much better off than Japanese consumers – it's just that you don't know any of them – unless you read their name tags while they are serving you food or washing your car.

According to the Fed's just-released Report on the Economic Well-Being of US Households, 47% of the people surveyed would not be able to cover an emergency $400 expense without having to sell something they own or borrowing money. While that marks an improvement from 52 percent last year, the report states that it shows many Americans to be “ill-prepared for a financial disruption.”

The survey paints an image of fragile households, seemingly at odds with climbing consumer confidence and a healing economy. The findings demonstrate that the hangover from the financial crisis and downturn of 2007 to 2009 still weighs heavily on family balance sheets.

“We are failing as an economy if we have a huge swath of American households who can’t come up with $400,” said Josh Bivens, research and policy director at the Economic Policy Institute in Washington. “The really dire financial situations” of many survey respondents can be largely attributed to “the fact that we’re still far from fully recovered from the Great Recession.”

14% of all renters are still "underwater" on their mortgages, owing more than the home is worth. That means they are essentially trapped in their homes – unable to find more affordable housing or better jobs elsewhere. On the West Coast, the number is 17%, almost one in 5 homes… At the same time 81% of renters would prefer to own a home but 50% can't afford a down-payment and the other 31% don't qualify for a mortgage – that's not going to be easy to fix!

14% of all renters are still "underwater" on their mortgages, owing more than the home is worth. That means they are essentially trapped in their homes – unable to find more affordable housing or better jobs elsewhere. On the West Coast, the number is 17%, almost one in 5 homes… At the same time 81% of renters would prefer to own a home but 50% can't afford a down-payment and the other 31% don't qualify for a mortgage – that's not going to be easy to fix!

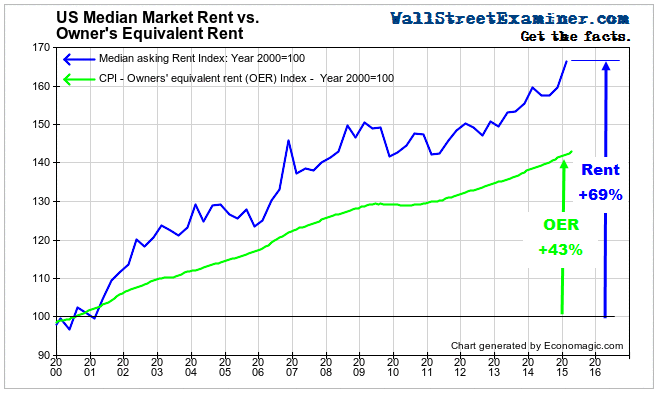

As you can see from the chart above (good explanation here) actual rents are increasing far faster than the OER number used to calculate the CPI. If the CPI took actual rental rates into account without all their modifiers – the CPI would have been up 0.8% in April, showing a 9.6% annualized inflation rate which, if you are a consumer, you already KNOW is more in-line with what you are seeing.

Of course, if the Government were to admit that inflation is already kicking into high gear, they'd have a hard time justifying more QE and ZIRP and the Top 1% like their free money and they aren't going to let it go without a fight. That's why you have to read radical bloggers like Lee Adler and David Stockman at Wall Street Examiner if you want to find out what's actually happening and take that fluff from the Corporate Media with a gigantic grain of salt.

Be careful out there!