ROFL!

ROFL!

Greek Prime Minister Tsipras claims that the creditors have rejected his deal while they are claiming he has walked back on proposals that were put forward on Monday. That's the latest news as the meeting in Brussels fell apart into lunch (but will resume later). Apparently, the Commission stressed Athens still had to show willingness to carry out "prior actions," spending cuts that had already been agreed to before they'd be getting close to a deal and Greece is now complaining (though I'd say realizing) that EU President Junker is an unfair arbiter in talks with Germany and the IMF.

Greek stocks are plunging again, led lower by the banks as Greece is on day to day life support and this is all it takes to get us back in panic mode and S&P just released a warning that isn't helping to calm things down:

Greek stocks are plunging again, led lower by the banks as Greece is on day to day life support and this is all it takes to get us back in panic mode and S&P just released a warning that isn't helping to calm things down:

In our baseline scenario, we continue to think that Greece will remain a eurozone member. But the limited progress in talks to date between Greece and its creditors suggests that a Greek exit is possible. We consider that Greece's exit–coupled with the loss of emergency European Central Bank (ECB) financing–would bankrupt Greece's financial system. This could in turn send negative ripples across Southeastern Europe's Greek-owned banks.

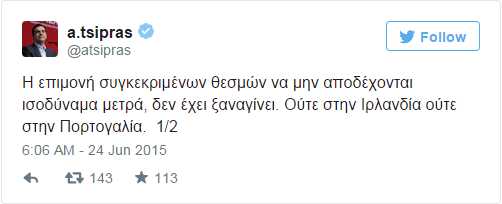

Amazingly (and dangerously) this is diplomacy by Twitter as Tsiparis tweeted out a message this morning saying that the IMF's rejection of the Greek proposal indicated that they were insincere about wanting a deal or slaves to "special interests" in Greece (ie., the Top 1% that don't want to be burdened by Greece's proposed bailout measures (see yesterday's post to understand why we shorted overnight in aniticipation of this happening).

Amazingly (and dangerously) this is diplomacy by Twitter as Tsiparis tweeted out a message this morning saying that the IMF's rejection of the Greek proposal indicated that they were insincere about wanting a deal or slaves to "special interests" in Greece (ie., the Top 1% that don't want to be burdened by Greece's proposed bailout measures (see yesterday's post to understand why we shorted overnight in aniticipation of this happening).

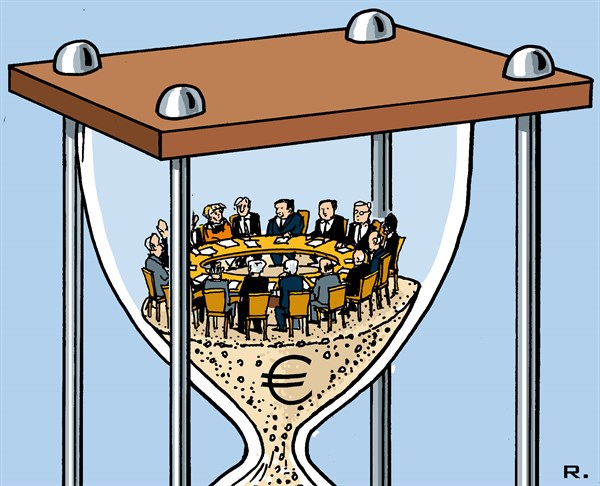

This is only day one of the two day "emergency summit" that is supposed to fix Greece so it ain't over 'till it's over, as the great Yogi would say. Of course fat ladies are singing in opera houses all over Europe as this nonsense has been going on for 4 months (plus 6 years) so the chance of suddenly smoothing everything out by lunch wasn't very likely anyway.

Keep in mind that Draghi is there, Lagarde is there, Merkel is there – surely these people have other things to do than worry about Greece night and day for months on end? Of course they are all angry and frustrated and so is Tspiras, who goes home to angry protestors who can't stand the austerity that's already killing the country and give him a World of crap over any additional concessions the Troika wrangle out of him.

Keep in mind that Draghi is there, Lagarde is there, Merkel is there – surely these people have other things to do than worry about Greece night and day for months on end? Of course they are all angry and frustrated and so is Tspiras, who goes home to angry protestors who can't stand the austerity that's already killing the country and give him a World of crap over any additional concessions the Troika wrangle out of him.

Not only that but, even if Tspiras agrees to Troika's new terms, HE has to go sell it to his Parliament, who have to live with the pissed off people every day (it's a small country) and are already seeing the destruction caused by those "prior actions" that have already been put in place on the Greek economy.

For the leftist government in Athens, the urgent goal is to unlock frozen payments from a Eurozone fund and from the IMF worth 7.2Bn Euros, or $8.1Bn, before June 30th, when the European portion of the country’s current bailout package expires and a giant loan payment falls due. For powerful creditors like Germany and the International Monetary Fund, a deal must force Greece to make far-reaching changes to its mostly-dead economy so the country can return to growth and pay back its debt.

Of course, the economy is mostly dead after 5 years of accepting similar IMF austerity packages that have knocked the GDP of Greece down by 25% and plunged them further into debt (ECB and IMF have lent Greece 240Bn Euros in 5 years!) – so you have to forgive Tspiras for not trusting the IMF (his principle debtor) when they say that more austerity is the answer or Junker when he tells Greece that the IMF deal is the best he can do.

Of course, the economy is mostly dead after 5 years of accepting similar IMF austerity packages that have knocked the GDP of Greece down by 25% and plunged them further into debt (ECB and IMF have lent Greece 240Bn Euros in 5 years!) – so you have to forgive Tspiras for not trusting the IMF (his principle debtor) when they say that more austerity is the answer or Junker when he tells Greece that the IMF deal is the best he can do.

As you can see from the chart on the right, only 11% of the money lent to Greece over the past 5 years has actually gone to Greece. The rest has gone paying interest on debt and paying fees to Banksters to recapitalize existing rates. Geece's actual deficit only grew $15.3Bn ($3Bn/yr) – the rest is the result of being in a debt trap they can't escape from (without leaving the EU) and the EU's solution is, of course, MORE DEBT (and more austerity).

Keep in mind the "solutions" being pushed by the Troika are, at this point, ridiculous – like raising hotel taxes from 6.5% to 13% and raising restaurant taxes from 13% to 23%. Aside from the fact that locals will simply stop eating out, tourists will stop coming and Tourism is Greece's primary revenue generator. Take that away and what's left? Nothing but bones for the creditors to pick over and they WANT Greece to liquidate their islands and sell their ports and utilities. Make no mistake about it, this is an invasion of Greece by foreign banks, who are taking over the country without firing a shot.

In our FREE Live Trading Webinar yesterday (replay available HERE), we took a conviction short on Russell Futures (/TF) at 1,290 with a plan to double down at 1,292, which we hit after the close. As you can see from the chart, we caught a nice move down from our 1,291 average entry and we've got a stop now at 1,289 for a $300 per contract win (at least $600 from our double sets) – not bad for an evening's work! We also shorted /NKD at 20,900 (also mentioned in yesterday's morning post) and our stop on that one is now 20,800 for a $500 per contract winner on those.

Today we're hoping for a nice pullback in Gasoline (/RBQ5) to give us another entry below $2.05 as we want to be long on gasoline into the coming holiday weekend. Gasoline contracts roll over tomorrow so, hopefully, a bit of selling pressure will take them down as low as $2.03 ($2.075 on this /RBN5 chart) where we can begin going long again with some conviction.

Meanwhile, if you want some really crazy stuff, look no further than China, where yet another 500Bn Yuan ($80.5Bn) was thrown on the fire this morning (must be Wednesday) – this time directed into 193 aviation projects that some would say are meant to mask the fact that China has build over 100 airports that have less than 100 flights a day between them – TOTAL!

That popped the mainland markets up 3% into the close but they were down half a point so finished up 2.5% for the day. The reason the airports are empty is because they are servicing empty cities like Tianjin, which is a 45-minute high-speed train ride from Shanghai, in theory, because they haven't finished the train station yet…

Tianjin’s government this month sold 13.2 billion Yuan ($2.1 billion) in bonds at zero premium to Central Government Debt, joining other provinces in taking advantage of a debt swap program designed by Beijing to keep infrastructure projects afloat. The funding fix sustains a cycle China can’t afford to break as 90% of the buildings in this picture are EMPTY!

Tianjin’s government this month sold 13.2 billion Yuan ($2.1 billion) in bonds at zero premium to Central Government Debt, joining other provinces in taking advantage of a debt swap program designed by Beijing to keep infrastructure projects afloat. The funding fix sustains a cycle China can’t afford to break as 90% of the buildings in this picture are EMPTY!

“Yujiapu (the financial district) must keep building so that banks can create fictional collaterals with which to increase lines of credit to LGFV debtors,” said Victor Shih, a professor at the University of California at San Diego who studies China’s politics and finance. “China can prevent the bankruptcy of local LGFVs and developers by ordering banks to roll over loans. However, it would take a Stalinist relocation of businesses to Yujiapu to fully occupy the office towers there.”

It's a madhouse I tell you – A MADHOUSE!!!

Anyway, speaking of madhouses in a collapsing economy, our Q1 GDP has been revised to -0.2% with Corporate Profits down $111Bn (5%) so enjoy the record highs while our economy continues it's slow collapse. Don't worry, I'm sure we can borrow more and more money to paper over our debts and prop up the Banksters who will, in turn, help the Corporations they control buy back stocks to create the illusion of earnings despite the fact that they are not actually selling anything.

Anyway, speaking of madhouses in a collapsing economy, our Q1 GDP has been revised to -0.2% with Corporate Profits down $111Bn (5%) so enjoy the record highs while our economy continues it's slow collapse. Don't worry, I'm sure we can borrow more and more money to paper over our debts and prop up the Banksters who will, in turn, help the Corporations they control buy back stocks to create the illusion of earnings despite the fact that they are not actually selling anything.

After all, what can possibly go wrong?