Here we go again.

Here we go again.

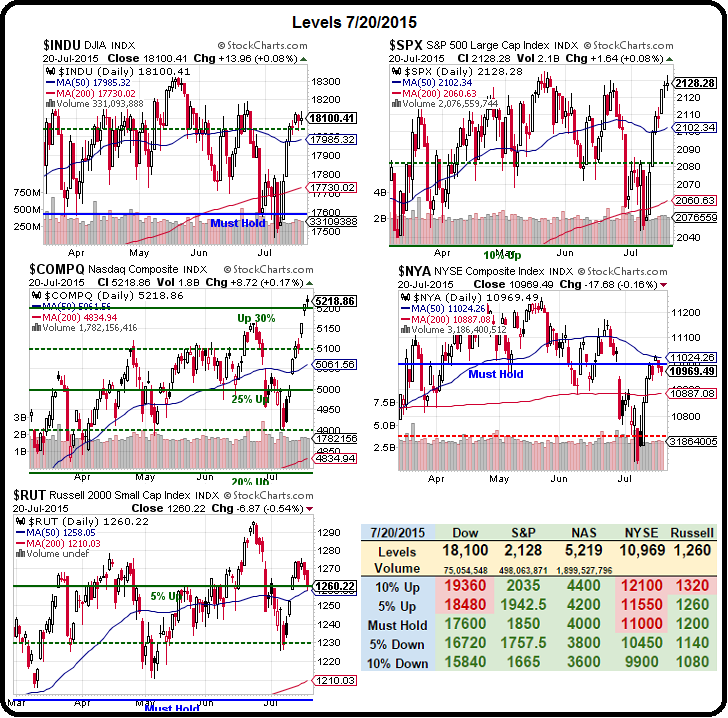

The S&P is testing that magical 2,130 line and let's pretend the last one didn't happen at the end of June, even though it was the same time of month at the same spot under the same conditions because THAT time we dropped 80 points (3.75%) over the next 30 days but THIS TIME is going to be different, right?

Everything, is of course, AWESOME! China – what? Greece – where? Australia – who? Japan – are they still on this planet, I thought they left? There is nothing to worry about when you don't worry about anything – just ask everyone whose ever been slaughtered anywhere, any time in history…

You see kids, Greece, China, Japan, Australia, the rest of the World… they don't matter because they are far away unless, of course, we plan to sell them stuff – then they are wonderful places where all our hopes and dreams will come true but, when their economies slow down, it doesn't affect us because – hey, look at that!

This morning, you can buy 6 barrels of oil for a BitCoin. What is a BitCoin, you may ask? Well, a BitCoin is a virtual currency that didn't exist in 2008 and on May 22nd, 2010, 10,000 of them were traded for a pizza and now that pizza maker can trade his 10,000 BitCoins for $3M in cold, hard, cash at a BitCoin ATM.

This morning, you can buy 6 barrels of oil for a BitCoin. What is a BitCoin, you may ask? Well, a BitCoin is a virtual currency that didn't exist in 2008 and on May 22nd, 2010, 10,000 of them were traded for a pizza and now that pizza maker can trade his 10,000 BitCoins for $3M in cold, hard, cash at a BitCoin ATM.

BitCoins are only one of hundreds of CryptoCurrencies that have popped up in the last few years and PSW now has a digital currency section to keep up and we've been buying GreenCoins, which we think may be the next big thing, but not ready for prime-time just yet. Over $4Bn has been put into BitCoins already and that's enough to buy 80M barrels of oil – imagine how much money is being diverted just to this new segment!

Perhaps that is why gold is losing it's luster. Bitcoins surged to match an ounce of gold last year but, since then, BitCoins have lost ground faster and now buy just about 10 grams (1/3 ounce). BitCoin's cache is similar to gold's – it's limited in quantity (21M possible coins), which already puts it miles above the Fiat Currencies we get shoved down our throats, and it's easy to transact – easier than gold, in fact, which has to be converted into Dollars to buy a pizza, though gold now has ATMs too…

Perhaps that is why gold is losing it's luster. Bitcoins surged to match an ounce of gold last year but, since then, BitCoins have lost ground faster and now buy just about 10 grams (1/3 ounce). BitCoin's cache is similar to gold's – it's limited in quantity (21M possible coins), which already puts it miles above the Fiat Currencies we get shoved down our throats, and it's easy to transact – easier than gold, in fact, which has to be converted into Dollars to buy a pizza, though gold now has ATMs too…

Nonetheless, we put our foot down on gold at $1,100 and the ETF (GLD) is at $105.70 and, if you want to make money betting gold will hold $1,100, then the GLD Aug $103.50 calls are $3.60 and the $105.50 calls are $2.35 and that's net $1.25 on the $2 spread that's already 100% in the money. As long as gold stays over $1,100 for 31 days – you can make 0.75 (60%).

Now, if gold drops to $1,000, that's 10% down or $95ish on GLD. Let's say we REALLY want to own 1,000 shares of GLD at $95 ($95,000). We could sell 10 of the Jan $95 puts for $1.85 and collect $1,850 in exchange for our promise to buy GLD at $95, $10.70 (10%) below the current price. We can then use that $1,850 to buy 20 of the GLD Aug $103.50/105.50 bull call spreads ($2,500) and that's net $650 on $4,000 worth of spreads with a potential return on cash of $3,350 (515%) in 31 days.

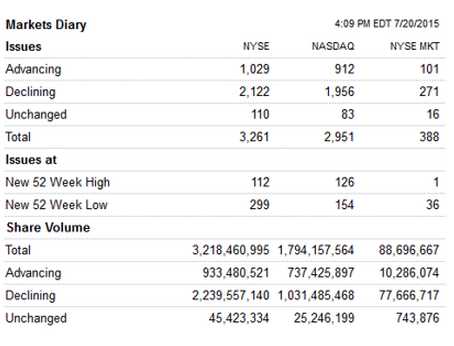

We also had a long trade idea for oil but we'll discuss that in today's Live Trading Webinar at 1pm (EST). As to the rest, we're leaning short on the indexes and just shorted the Futures this morning in our Live Member Chat Room as they looked both toppy and weak (18,000 on /YM, 2,120 on /ES, 4,675 on /NQ for example) – especially when you look at yesterday's shockingly bad advance/decline ratios with declining volume outpacing advancers by more than 2:1!

We also had a long trade idea for oil but we'll discuss that in today's Live Trading Webinar at 1pm (EST). As to the rest, we're leaning short on the indexes and just shorted the Futures this morning in our Live Member Chat Room as they looked both toppy and weak (18,000 on /YM, 2,120 on /ES, 4,675 on /NQ for example) – especially when you look at yesterday's shockingly bad advance/decline ratios with declining volume outpacing advancers by more than 2:1!

The indexes look flat because, as I said in yesterday's post, THEY ARE BEING MANIPULATED, with just a few headline stocks holding up the entire index so the Banksters who control them can sell off the bulk of their positions while forcing the bottom 99% (through 401Ks and IRAs that are forced to use index ETFs) to buy their crap which is attached to the rising indexes. Yes people, that is the way things work. The banks develop these ETF products so that they can CONTROL YOU and FORCE you to buy things like NFLX when you are really trying to buy AAPL in the QQQ because you're not allowed to invest in individual stocks in your retirement account.

That means any crap they stick in the index with AAPL will get bought. As noted by the WSJ this morning (via Deano), AAPL alone accounts for 12.5 points of the S&P 500s 72-point gain this year. That's 17%! AMZN was 7.5 points (10%), GOOG is in twice, DIS, FB, GILD, NFLX, JPM and PFE essentially made up the rest and EVERYTHING ELSE got dumped (relatively). Is that a healthy market when 15 stocks gain while 485 lay flat?

We're not going to worry about China or Australia (getting really bad now) or Japan or Greece or Brazil or Venezuela – we'll have plenty to worry about right here in the US come next week's Q2 GDP report which, if we're reading our data correctly, may give us a negative reading – again. Two negative quarters in a row is called a recession – or it used to be before they outlawed the term and replaced it with MORE FREE MONEY!!!

It's hard to say, because now we have a category called "Intellectual Property," which was only added to our GDP last year and already is adding 0.5% to our numbers. Since that number was -0.2% last quarter, we can figure that, without IP picking up the slack from fixed investment – we'd be in very sad shape.

So hopefully Minions will save the economy from Recession next week because nothing funnels money more efficiently to the Top 1% than a blockbuster movie where millions of people bring their cash to thousands of theaters who send most of it out of town to Hollywood where they hire Korean cartoonists to make the next blockbuster. Minions indeed!