Wheeee, what a ride!

Wheeee, what a ride!

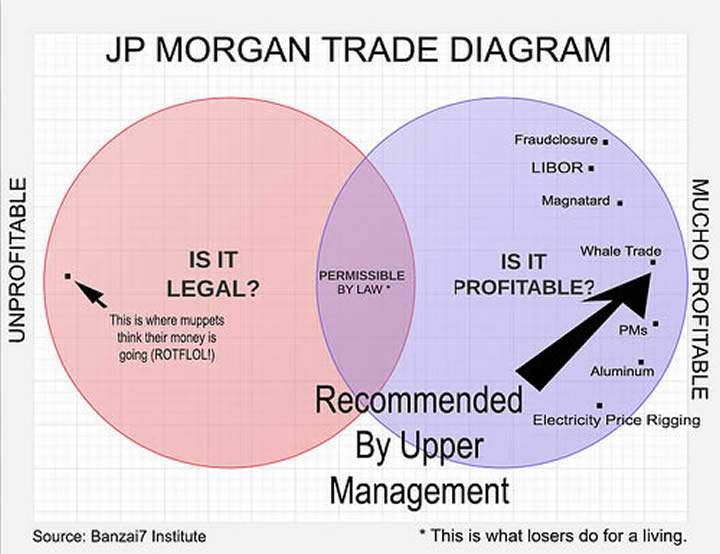

Already this morning, EU markets have taken back almost all of yesterday's 1.5% drop as a rash of M&A announcements spur bargain-hunters in various sectors. M&A announcements are a particularly desperate form of market manipulation on the part of the Banksters as these deals take months to put together and their announcements are usually timed with great care.

In this case, a group of deals have been rushed forward to give the sheeple the impression that the markets are undervalued but it's just the announcements of pending deals that have been accelerated to give you the impression that we're at some sort of bottom so, like the poor Chinese Retailers who ran back into the markets the past two weeks, you can take more shares off the hands of Banksters who failed to sell ahead of the drop and need another crack at it.

The banks don't even care if they are screwing their own clients – they have hundreds of Billions at play in the markets and if rushing a deal gives them a 1% bounce for a couple of Billion, what do they care about the effect on their $100M fee (negligible anyway). They certainly don't care what they are doing to the retail buyers – check out this typical story of how they are financially raping the farmers in China:

The banks don't even care if they are screwing their own clients – they have hundreds of Billions at play in the markets and if rushing a deal gives them a 1% bounce for a couple of Billion, what do they care about the effect on their $100M fee (negligible anyway). They certainly don't care what they are doing to the retail buyers – check out this typical story of how they are financially raping the farmers in China:

Oops, sorry, you can't check it out, it's been redacted on Bloomberg already (I was surprised they showed it in the first place). This morning a video report on China followed a farmer who had about $200,000 in his account and was playing the market and, due to relentless Government promotions and the urging of his broker, he accepted a $1M margin account and continued buying stocks to record levels. The bubble burst and he lost not only his whole $200,000 but now owes $200,000 to the broker.

He then takes a day's trip to Beijing to complain to the Government, in the naive belief that they will fix things for him because it was the Government's propaganda that got him to invest in the first place. Of course, no one will even see him about his problem and he is forced to take the long ride home, where the futility of the situation hits him and he breaks down and cries, realizing he has lost everything and enslaved his entire family to debt for the rest of their lives.

To give you an idea of how prevalent the destruction is, here's a video from CNBC on July 10th, celebrating all the clever farmers jumping into the stock market. The Bloomberg video, on the other hand, did not please China and one phone call edits what you can and can't see in America – that's just the way it is, bend over and take it!

To give you an idea of how prevalent the destruction is, here's a video from CNBC on July 10th, celebrating all the clever farmers jumping into the stock market. The Bloomberg video, on the other hand, did not please China and one phone call edits what you can and can't see in America – that's just the way it is, bend over and take it!

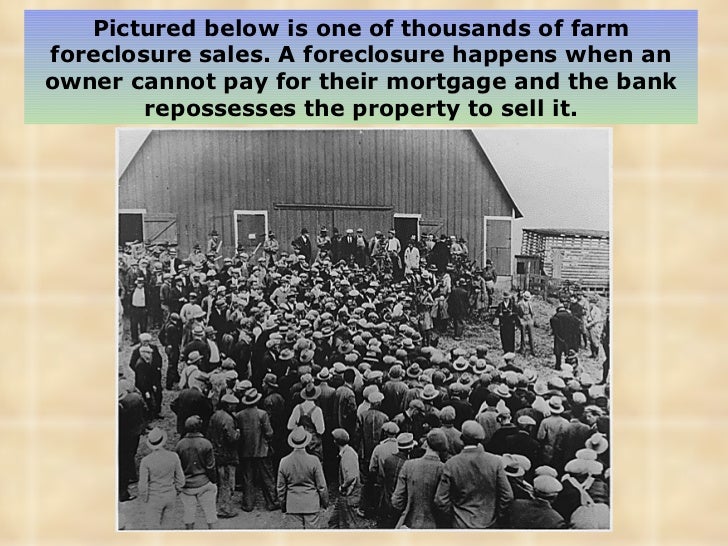

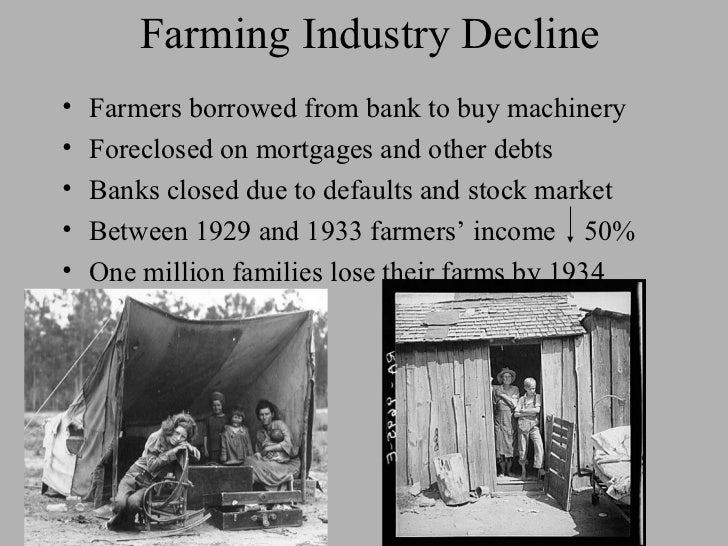

In the great depression, the Banksters took control of all the land that had been given to American farmers (40 acres and a mule to people willing to farm the land) by convincing them to buy expensive modern equipment on credit that did make their farms more productive but a single bad season left the farmers unable to make payments and suddenly their whole farms were being seized by the banks backed by the full force of the US law machine (see "Grapes of Wrath").

By turning the farmers into gamblers and convincing them to put their assets on the line and then pulling the rug out from under them, the Chinese Banksters have transferred hundreds of Billions of Dollars from the Bottom 99% to the Top 1% and, of course, the Banks will be bailed out of any losses the farmers don't pay and the State will turn around and tax the farmers again to pay for the bailouts and the wealth transfer continues.

But this isn't about that. This is about a video that was on Bloomberg this morning has now completely disappeared from existence and THAT is the state of Corporate Media in America these days. Everything you used to laugh about regarding Russia's Pravda and Izvestia is EXACTLY what is now happening to the US Media except, rather than Government control – it's controlled by Corporations, who determine what information you will be given each day.

But this isn't about that. This is about a video that was on Bloomberg this morning has now completely disappeared from existence and THAT is the state of Corporate Media in America these days. Everything you used to laugh about regarding Russia's Pravda and Izvestia is EXACTLY what is now happening to the US Media except, rather than Government control – it's controlled by Corporations, who determine what information you will be given each day.

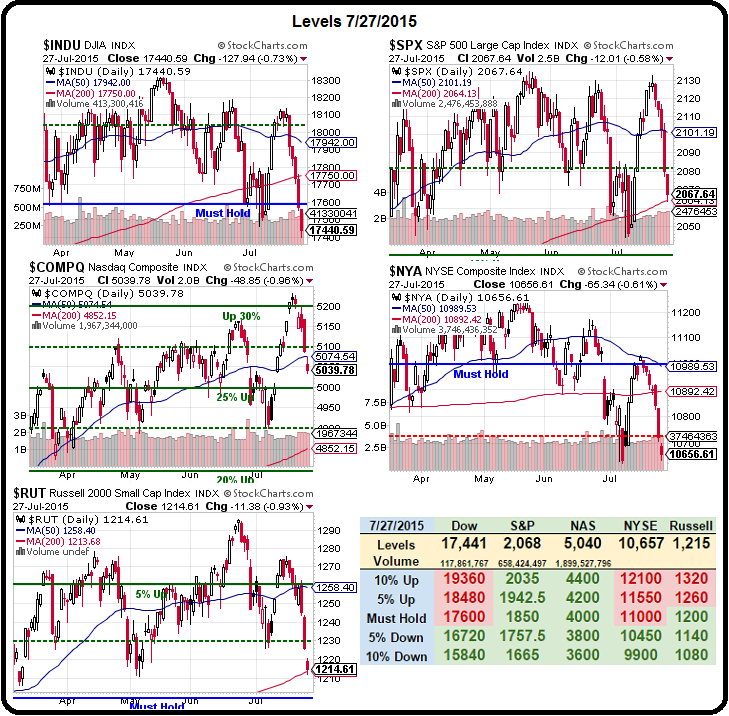

Speaking of information, yesterday we stopped out of our Futures trades early in the morning at Dow (/YM) 17,400, S&P (/ES) 2,065, Nasdaq (/NQ) 4,525 and Russell (/TF) 1,215 and we re-entered our Futures shorts when they broke down at 10:30 and this morning we got all the way back to Dow (/YM) 17,500, S&P (/ES) 2,075, Nasdaq (/NQ) 4,550 and Russell (/TF) 1,220 for another great entry on our Futures short.

We'll be doing a Live Futures Trading Webinar at 1pm (Join us here, replay will also be available if you can't make it live) following up on our weekend article, "Using Stock Futures to Hedge Against Market Corrections" – something very, very relevant to the current markets!

As you can see on our Big Chart above, we've had quite the little breakdown in our indexes – especially in the Dow, NYSE and Russell, who all failed at lower highs and are now making lower lows. That is NOT a good sign! After falling to the 4% line, which is the weak bounce off the 5% drop we predicted, we expect a bounce to the 3% line (ie, a 1% bounce) where the real test will be. These are the bounces we'll be watching today:

As you can see on our Big Chart above, we've had quite the little breakdown in our indexes – especially in the Dow, NYSE and Russell, who all failed at lower highs and are now making lower lows. That is NOT a good sign! After falling to the 4% line, which is the weak bounce off the 5% drop we predicted, we expect a bounce to the 3% line (ie, a 1% bounce) where the real test will be. These are the bounces we'll be watching today:

- Dow 18,200 to 17,300 is 5% and 900 points. Weak bounce is 17,500, strong bounce is 17,700.

- S&P 2,135 to 2,020 is 5% and 115 points. Weak bounce is 2,045 and strong bounce is 2,060 (supported by 200 dma at 2,064 so far)

- Nasdaq 5,200 to 4,950 is 5% and 250 points. Weak bounce is 5,000 and strong bounce is 5,050.

- NYSE 11,300 to 10,650 is 650 points. Weak bounce is 10,800 and strong bounce is 11,000.

- Russell 1,300 to 1,235 is 65 points. Weak bounce is 1,250 and strong bounce is 1,265.

We are not expecting any impressive moves despite Europe's euphoria. It's just a trick to send more lambs into the slaughter and this market is far from bottoming. If those bounce lines are hit, we can make some technically bullish bets but we're still very bearish in our short-term portfolio and not likely to regret it – though we are doing a bit of bottom-fishing for the LTP, just in case.