$19,700!

$19,700!

That's how much our Short-Term Portfolio gained on Friday during the market drop. During the session, we cashed out some of our winning hedges and added a few more conservative positions into the weekend - just in case China comes through with stimulus and pops the market.

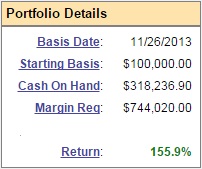

That brought our cash position up from $255,000, at noted in the morning post, to $318,000. In other words, we cashed out $62,975 worth of winning positions - WHILE THEY WERE WINNING - this is something I work very hard to teach our Members, the forgotten skill of taking profits off the table!

As we calculated in Member Chat, we still had $45,000 of in-the-money protection after we cashed out the naked portions of our SDS, SQQQ and TZA hedges at 11:15. Then, later in the day, we didn't like the way the market looked so we added bull call spreads on SDS and SQQQ after noting that the S&P and the Nasdaq still had a lot further to fall if this is a proper correction.

What's the most important take-away here? WE CHANGED OUR MIND! We followed our Rule #1 and ALWAYS sold into the initial excitement because we got a good drop in the morning and we didn't want it to reverse on us. Then, once the bounces were weak and we began breaking down again - we simply bought another SDS position and more SQQQs.

What's the most important take-away here? WE CHANGED OUR MIND! We followed our Rule #1 and ALWAYS sold into the initial excitement because we got a good drop in the morning and we didn't want it to reverse on us. Then, once the bounces were weak and we began breaking down again - we simply bought another SDS position and more SQQQs.

A lot of traders are "embarrassed" to make a decision and then, even if they feel it was a mistake, to go back and re-buy the position - especially when they have to call a broker and "admit" they changed their mind. That's a huge problem because even the best traders are wrong 40% of the time and sticking to wrong decisions does not make you a better trader (trust me, I've tried!).