Waiting.

For what, I don't know. Who cares if the Fed raises rates by 0.25% or not? We all know it's coming and whether it comes tomorrow (it won't) or October (it will) has nothing to do with the health of the economy or earnings for the last 3.5 months of 2015.

We know the Fed can't lower rates below 0, so they have nowhere to go but up and it's just a matter of when, not if, rates are going to rise. No jobs will be gained or lost, no factories will be opened or closed, no ditches will be dug or filled in based on what the Fed does tomorrow. The Fed has not in any way, shape or form done anything to help the real economy in 7 years – why start now?

Yes, they've made interest cheap so you could refinance your house and buy a new car (ie. take on more debt for the Banksters who own the Fed) but they've also destroyed the value of savings and incentified our Corporate Masters to leverage, merge and lay off workers, which has the net effect of driving wages to record lows in relation to Corporate Revenues and Profits:

Do you see that red line on the top chart? That's ZERO – you can't go much lower than zero unless you figure out how to get the employees to pay you for the privilege of coming to work (I know, we shouldn't give them any ideas!). NO Corporate profits are shared anymore, workers are paid as little as possible and given no credit whatsoever for a company's success and, thanks to drastic cutbacks in pensions and benefits – they are discarded like a broken machine after a lifetime of service to the company.

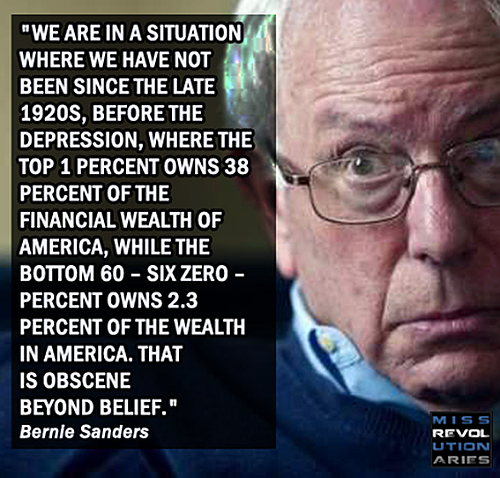

It's no wonder Bernie Sanders is striking a resonant chord among the voters. While most candidates have tin ears when it comes to the state of the real economy, Sanders knows how bad conditions are for the majority of the people in this country and he's willing to point the finger at the people who are grinding them down.

It's no wonder Bernie Sanders is striking a resonant chord among the voters. While most candidates have tin ears when it comes to the state of the real economy, Sanders knows how bad conditions are for the majority of the people in this country and he's willing to point the finger at the people who are grinding them down.

60% of the people in this country work their whole lives and have NOTHING to show for it – not a house, not one share of stock, not even money in the banks. They are born, they work, they consume and they die – and even that is expensive!

Yet there is an entire political party in this country that thinks they are not paying their fare share of taxes, that their kids shouldn't get a free lunch in school, that if they can't afford college it's their problem, that if they get sick – it's tough luck. There's even talk of a $15 Minimum Wage and that's being fought tooth and nail yet $15 an hour is $600 a week and $30,000 a year (if they dare to take a vacation) yet that's just $24,602.83 take-home, less than $500 a week.

If you can live on $500 a week, God bless you, you're a way smarter consumer than I am. I'm not sure one of my teenage daughters could get by on that – certainly not where we live. That's not even the Minimum Wage, that's the wage they are fighting against. If you have a wife and a kid (or should those things be denied to people?) how do you house, clothe and feed them while saving for college and retirement? And remember – $15/hr is DOUBLE what millions of people are actually making under the current rules.

If you have a Big Business, that generates a lot of revenue overseas, you don't have to worry about this. The nice thing about the Top 1% is there's 70M of them on this planet. So many, in fact, that Apple can sell them each a new phone every year and even some watches that require the phone to operate (why not?). Catering to the rich is the only growth segment left in this World because the rich are getting SO MUCH richer while the bottom 80% have almost no disposable income left – so all you can sell them are the things they absolutely need to survive.

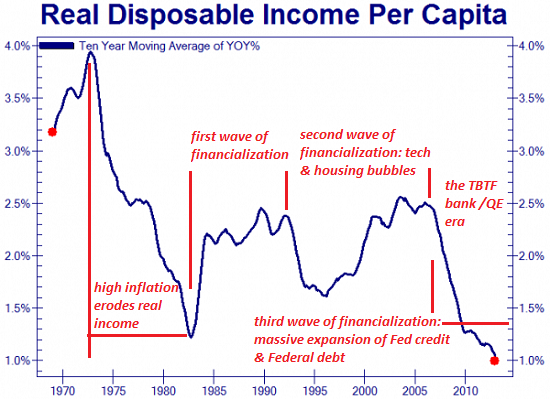

This chart isn't that interesting because it's obvious from the wages chart above that workers have no money but, if you have a busisness that depends on customers in the bottom 80% – you'd better be concerned with this trend! It's not just the workers that are suffering from runaway Capitalism in the US but small business owners as well – who can't rely on growing overseas profits to offset the fact that their customers simply can't afford to buy as much as they used to.

This chart isn't that interesting because it's obvious from the wages chart above that workers have no money but, if you have a busisness that depends on customers in the bottom 80% – you'd better be concerned with this trend! It's not just the workers that are suffering from runaway Capitalism in the US but small business owners as well – who can't rely on growing overseas profits to offset the fact that their customers simply can't afford to buy as much as they used to.

Where is a real recovery supposed to come from on this chart? Certainly not from cutting Social Programs and cutting Jobs Programs and cutting Benefits to pay for another round of tax cuts against those record Corporate Profits. That's just common sense, something there's not much of in this country since it was cut out of the school budget under Bush II.

It's not just our country, of course. The whole World is run by these multinational Corporations. Wal-Mart (WMT), for example, has 300 stores in China and 85,000 Chinese employees and about the same in Chile, Canada, the UK and Brazil while Mexico has 1,500 stores with 170,000 employees. In the US they have 8,400 stores and 2M employees. In each country, the pay the minimum legally allowed and, of course, they pay the least taxes allowed as well.

It's not just our country, of course. The whole World is run by these multinational Corporations. Wal-Mart (WMT), for example, has 300 stores in China and 85,000 Chinese employees and about the same in Chile, Canada, the UK and Brazil while Mexico has 1,500 stores with 170,000 employees. In the US they have 8,400 stores and 2M employees. In each country, the pay the minimum legally allowed and, of course, they pay the least taxes allowed as well.

It's not just WMT, of course, many other stores, fast food, endless service jobs – all pay below poverty wages and funnel money out of the local communities and into the hands of far-away owners who create enormous pools of wealth for the very few people lucky enough to own these companies.

Sure, as investors, we can say "well, if you can't beat them, join them" but how is that good for this or any other country in the long run? Perhaps, as Bernie Sanders contends, we CAN beat them. Teddy Roosevelt and his "Trust Busters" broke up the big corporations over 100 years ago and the Unions beat them back after World War II 60 years ago – maybe we're about due for another round...

Meanwhile, back in the markets: Japan had their debt rating downgraded by S&P this morning and that's one of the major dominoes yet to fall in the Global economy. I have long warned that if people begin to understand how server Japan's 250% debt to GDP ratio really is, confidence in the entire global financial system could begin to unwind. In fact, the main reason we were worried about China was that it would have a spillover effect that would push Japan's economy over the tipping point.

China is still doing their part by faking the closes, as illustrated by today's 5% jam-up into the close. We can't really point fingers as yesterday's US "rally" was nothing but low-volume BS and the only people being fooled by this are the hapless retail investors, who have been brainwashed into buying every dip and are now ready to be the ultimate bag-holders when the Top 1% have finished unloading their shares on them. As noted by Dave Fry:

China is still doing their part by faking the closes, as illustrated by today's 5% jam-up into the close. We can't really point fingers as yesterday's US "rally" was nothing but low-volume BS and the only people being fooled by this are the hapless retail investors, who have been brainwashed into buying every dip and are now ready to be the ultimate bag-holders when the Top 1% have finished unloading their shares on them. As noted by Dave Fry:

Of course in this environment you either surrender to the dictates of the tape or you probably won’t make any decent returns. Clearly we’ve entered an Orwellian period the past 7 years.

The Fed has given bulls everything they want with low-zero interest rates. This has permitted massive stock buybacks and M&A given cheap financing to do so. But the stock market is not the economy. For a rally to continue from here it won’t be supported by fundamental economic data or even good earnings for that matter.

Tuesday given the worse than weak economic data (Retail Sales, Empire State Mfg Survey, Industrial Production & Business Inventories) the “bad news is good” pimps rushed to seize the tape believing the Fed won’t be raising interest rates any time soon—perhaps not in my lifetime.

Is this time different historically? It could be since I’m not aware of any historical period where there’s been 7 consecutive years of nearly uninterrupted returns. Even the dotcom period lasted just 6 years by my reckoning. And of course we’ve not seen this type of central bank manipulation ever.

As Dave notes, it's almost impossible to play the market in the midst of Global manipulation by our Central Banksters so we're sitting on the sidelines, mainly in cash, but we did up our index hedges into yesterday's silly rally. I expect the Fed to state tomorrow that they will raise rates in October, which is a wishy-washy way to kick the can down the road. I don't see how that will take us to new highs though – so I'm leaning short.