.jpg) It's actually only been 56 days but close enough.

It's actually only been 56 days but close enough.

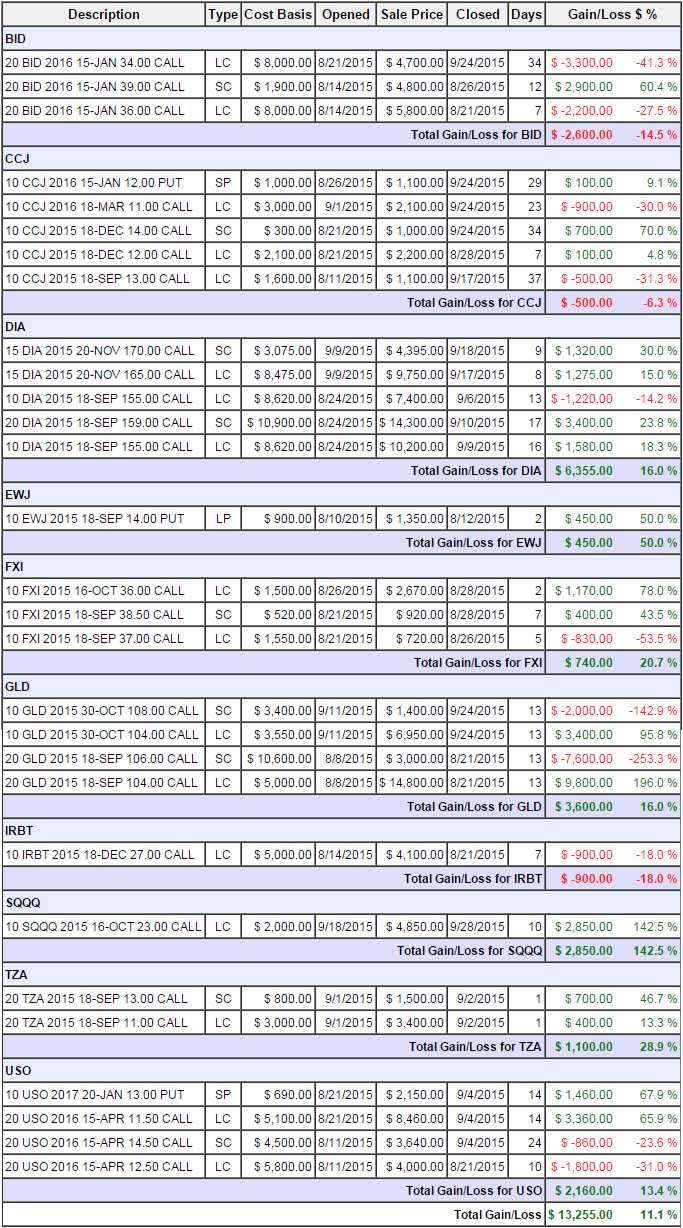

So far, we've only had to close 10 positions (average of about one per week) for a $13,255 gain, which is 13.25% of the portfolio's $100,000 base. Our original goal was to try to make $5,000 a month, so we're well on track so far. It's been a choppy, nasty market and we've spent the last two weeks protecting our long positions more so than trying to add new ones.

The goal of our Options Opportunity Portfolio, is to take advantage of short-term OPPORTUNITIES in the market using options for both hedging and leverage. Overall our goal remains closing about $5,000 a month in profits, some of which we roll over into longer-term positions that will being paying us steady incomes as they mature.

The only new positions we added this week were Micron (MU), which had a wonderful day on Friday after earnings and finished at $15.91, well over the $15.50 target we need to make 72% on that trade. To protect our very quick gains, we also added a Jan $25/30 bull call spread on the ultra-short Nasdaq ETF (SQQQ) at $1,600, which pays $5,000 should the Nasdaq slips - so that's $3,400 of downside added against our open positions. Once you have profits, you also have a responsibility to protect them!

Before we Review our open positions, here's a quick look at the ones we've closed:

Our biggest loser, BID, is still a working, open position. We have 20 of the April $32s still open at $4.30 and we're down $2,600 so that's $1.30 per contract which means we neet to be $5.60 above our $32 strike by April option expirations (15th). The purpose of these reviews (and it's a habit you should have for all your positions) is to decide whether we are on or off track on our open items and to make adjustments were we're not on track.