And the struggle continues.

And the struggle continues.

As you can see from Dave Fry's SPY chart, this is the worst kind of "rally" where we get big volume sell-offs followed by low-volume, bot-driven pump jobs aimed to sucker the retailers into buying the dips so the guys driving the tradebots can dump more shares on them. Wash, rinse and repeat until the big boys are all cashed out (we already are!) and then they pull the rug out and crash the market.

The crashing part will be easy – all they have to do is not prop it up but, for good measure, "THEY" can always send their minions out to TV stations with a few well-placed downgrades to really send things into a tailspin. Suddenly, Russia bombing Turkey Syria, China's collapsing economy, Europe's slow economy, the refugee crisis, Fed raising rates, terrible US Jobs and Manufacturing numbers, Brazil or Venezuela's collapsing economies, Greece (again) or even our Debt Ceiling (again) will suddenly matter and the markets will quickly drop 10%.

I was on Benzinga's Pre-Market Show yesterday morning talking about my value reasons for being short up here (S&P 2,000):

It's not that we're all bearish – we have a lot of material stocks and our portfolios are at record highs this week so THANK YOU manipulators – it's just that we think the stocks we already cashed out of have further to fall before they are "correctly priced" – like the many material stocks we stuck with when we cashed out the rest. Having a materials-heavy portfolio this past week turned out to be the perfect way to play this bounce.

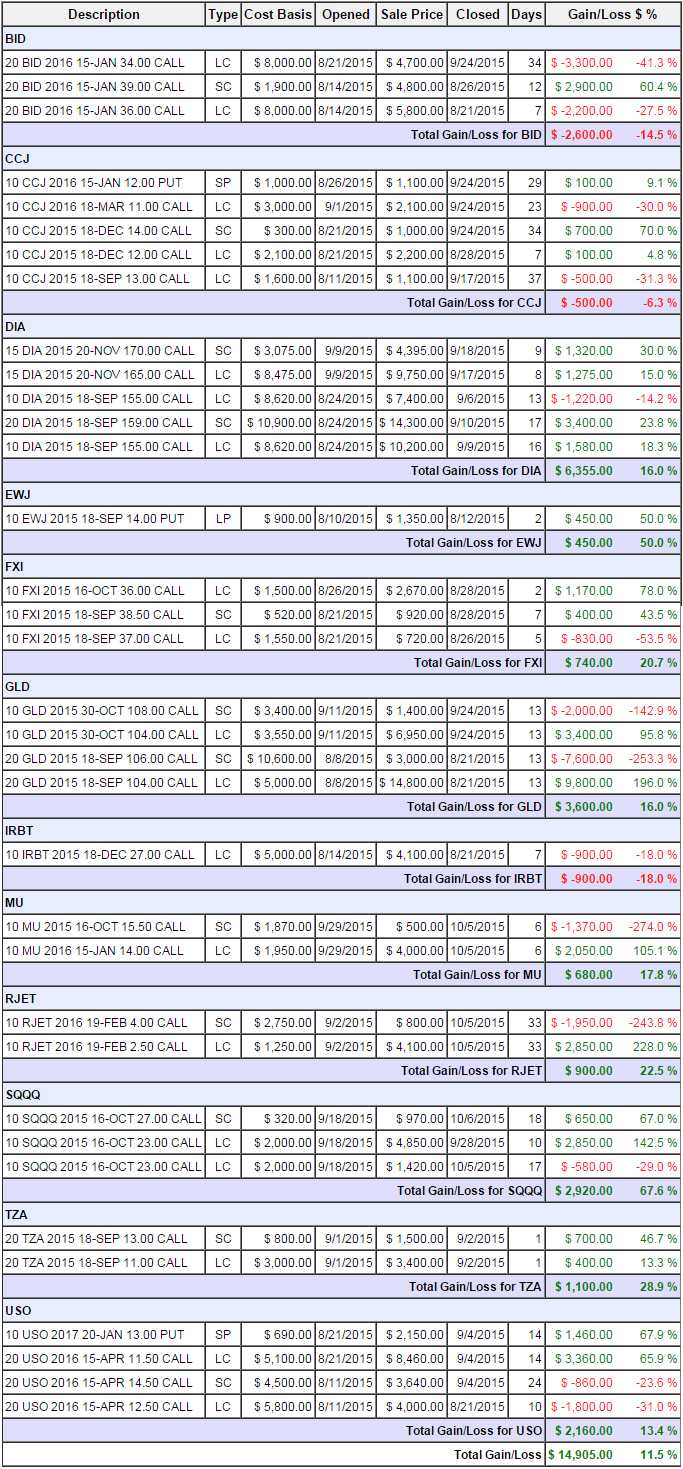

In fact, today is the end of month 2 for our Option Opportunities Portfolio over at Seeking Alpha, where our goal is to make $5,000 a month (5%) in a $100,000 portfolio and I'm very happy to say that our closed positions are, in fact, up $14,905 (14.9%) after 60 days:

As you can see, we only had to close 12 positions, averaging better than $1,000 per position with an average hold time of just over 2 weeks but, as we do that, we've been putting some of our profits back into longer-term positions that are much more relaxing to manage but still give us those great monthly returns. If you are interested in this kind of trading, you can check out our open positions by signing up here and, if you don't like our strategy after looking – SA has a generous satisfaction guarantee.

One of our long positions, Lumber Liquidators (LL) is going to be having a good day as they settled up with the justice department over their importation of wood that violated EPA standards by paying a $10M fine. "Ow, my wrist" said a LL spokesman!

This fine is NOT related to their flooring issues but it let's investors know that fears of fines that break the company are almost certainly unfounded (which was our investing premise back on 9/25). The stock should be up 10% this morning so even if you didn't use our option play – which is on the way to a 100% gain – it's still a pretty good return for 2 weeks, right?

This is what we mean by "Option Opportunities" – we seek our mispriced stocks and then use options to make hedged and leveraged bets to take advantage of the situation. You can always just play the stock – but it's way more fun with options! Our OOP Members also have access to our Live Weekly Webinars (Tuesday's 1pm, EST) and you can view a replay of this week's here, where we had a wide-reaching conversation about the current market situation and our featured trade idea was for NLY – which then did this:

We're value investors and that means we know how to find opportunities in any kind of market – even the ones we'd rather not play in like this one. Still, my overriding concern about the S&P's ability to take out the 2,000 line is keeping us "Cashy and Cautious" in our 4 Member Portfolios, as we wait to see how the situation resolves itself.

We're value investors and that means we know how to find opportunities in any kind of market – even the ones we'd rather not play in like this one. Still, my overriding concern about the S&P's ability to take out the 2,000 line is keeping us "Cashy and Cautious" in our 4 Member Portfolios, as we wait to see how the situation resolves itself.

As I noted at Benzinga yesterday, I think we fail here and leg back down to 1,850 but that is good and health and we'll be happy to do a bit more buying down there (we already have an offer on AAPL at around $100, but using short put options to drop our net entry to $75).

As we come into earnings season, there are going to be tons of fun short-term trades we can take. Just yesterday we did a hedged short on Netflix (NFLX) for our OOP and our short play on oil using the Ultra-ETF (SCO) is going well as yesterday's inventories were a bust. There's always something to trade – that's why we have no fear keeping our portfolios 90% in cash – if we can make 15% in 2 months using just 10% of our cash – why risk exposing ourselves to the downside?