Chinese imports fell 20.4% in September.

That's in Dollar terms, you'll hear it's "just" 17.7% in declining Yuan but that's the same BS people fall for when looking at Japan numbers, where the 16% decline in the Yen makes all their numbers seem not quite as awful as they actually are. Nonetheless, next week China will release their Q3 GDP numbers which will tell you their economy is magically growing 7% – despite the fact that they are buying 20% less stuff (and exports were down 3.7% too!). In fact, had it not been for surging oil imports as China topped off their reserves – the numbers would have been a lot worse!

Other than the occasional bursts of IPhone shipments, it's been all downhill for China this decade. This is all happening DESPITE the fact that China’s policymakers have increased infrastructure investment and loosened monetary settings in a bid to cushion the slowdown. The latest steps include new approvals to build rail networks, the expansion of a plan allowing lenders to borrow from the PBOC using loans as collateral, a tax cut for vehicle purchases and a reduction in the minimum down payment for first-time home buyers.

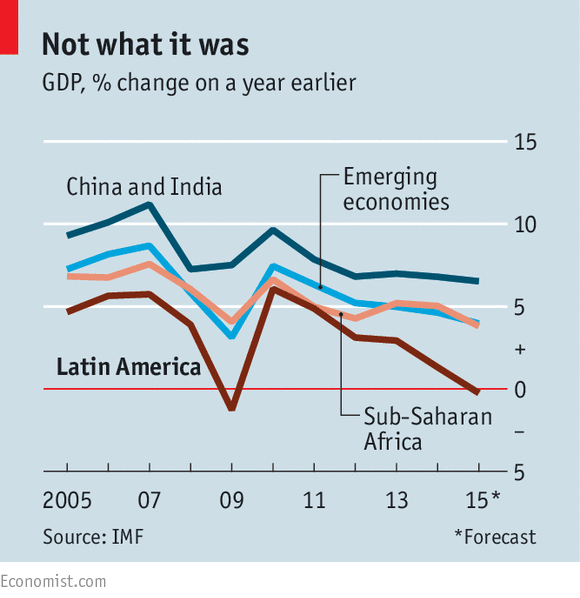

"We anticipate further headwinds in the coming months," saidTao Dong, chief regional economist for Asia excluding Japan at Credit Suisse Group AG in Hong Kong. "Our model suggests that global industrial production will lose further momentum. Not only China but emerging market countries are also struggling with domestic demand."

The IMF said the “cross-border repercussions” of slowing Chinese growth “appear greater than previously envisaged.” Gee – ya think? As we've been warning you (have I mentioned how much I like CASH!!! lately?) China's economic slowdown is quickly spreading to all of the Emerging Markets and even Europe is not immune. This morning, Germany's ZEW Sentiment Index fell 84.3%, from 12.1 to 1.9 – miles below the 6 that was forecast by leading economorons.

The IMF said the “cross-border repercussions” of slowing Chinese growth “appear greater than previously envisaged.” Gee – ya think? As we've been warning you (have I mentioned how much I like CASH!!! lately?) China's economic slowdown is quickly spreading to all of the Emerging Markets and even Europe is not immune. This morning, Germany's ZEW Sentiment Index fell 84.3%, from 12.1 to 1.9 – miles below the 6 that was forecast by leading economorons.

"The emissions scandal at Volkswagen and sluggish growth in emerging markets are dampening the economic outlook for Germany," ZEW President Clemens Fuest said in a statement.

Gee, ya think? Why is everything always a surprise to these people? It's like they don't read the papers – like they just look at the charts and plot lines in complete disregard of what is actually happening in the economy. Oh, wait – that is exactly what they do – it's called TA and it's also what 90% of so-called market "analysts" do and that's why THEY SUCK TOO!

Paying attention to what is actually going on in the World led us to press our FXI shorts yesterday and those should look good this morning. My comment to our Members in our Live Chat Room (10:46) was:

Speaking of the long haul, FXI is testing $39 but we can still get 0.70 for our 10 Oct $39 puts in the OOP so let's take our 0.24 loss and run on those and move out to the Nov $40 ($2.20)/38 ($1.20) bear put spread at $1 so our net will be $1.24 overall – essentially the same bet but a month later.

If FXI is below $38 into our November expiration, that $1 spread will be $2 (up 100%) but we're in for net $1.24 after taking a loss from our too early call and we'll only make 0.76 (61%) which is still $760 profit on a $1,240 investment in just over 30 days – not terrible. OOP stands for our Option Opportunities Portfolio and we find opportunities for trades like that several times each week (see the weekend review).

I know I sound like a broken record warning about China, Japan, Emerging Markets, the Euro-Zone, Income Inequality (see chart below), etc. but every day I have hundreds of Members asking me what's good to buy and, as I learned back in 2008 – unless you keep pointing out the reasons NOT to buy, most traders have a default setting of BUY – and that can get people in big trouble in a market crisis.

Looking ahead to Q4:

- In North America, Canadian Energy Companies are cutting thousands of jobs and slashing benefits on the jobs that remain – merry Christmas!

- The IEA projects the oil glut will continue through 2016 as demand falls faster than supply.

- 1/2 of the World's Wealth is now in the hands of 0.7% of it's people. 84.6% of the World's Wealth is held by a total of 383M people (5.3%). The bottom 71% share 3% of what's left.

- Related to the above, the Velocity of Money and the Labor Force Participation Rate are both at new lows, indicating severe economic stagnation in the US.

- UK inflation went negative in September, the worst showing since 1960 despite record amounts of stimulus. Again, no one is buying anything – at any price!

- The EU, having "won" with Greece, is now forcing Spain to cut spending drastically ahead of upcoming elections. What could go wrong?

- There was literally NO interest in bonds floated by the China Construction Bank in Europe, with just 1% of the $158M issue sold to European Investors – that's a huge flashing danger sign if ever I saw one…

- There are projections for $800Bn of net outflows from Emerging Market Equities this year and next.

- India service inflation is running 5-7% and it's about 2/3 of India's economy, which means inflation is accounting for India's GDP growth – not expansion.

- Credit-default swaps in Indonesia point to a potential crisis and the Government is on credit watch and already near a junk rating.

- Singapore's economy is turning down and their Central Bank is considering another round of stimulus (should we consider that a positive?).

These are a few things we're concerned about heading into Earnings Season. MAYBE we can ease our way out of it – but is this really an environment where you want to be buying stocks near their all-time highs? All-time highs are for when things are great now and the outlook is great looking forward and there's not an economic cloud in the sky. THIS IS NOT ONE OF THOSE TIMES, is it?

We are 90% in cash and our remaining positions are very well-hedged. That is how we are heading into earnings season and it doesn't mean we're not trading – we're simply looking for select opportunities as they develop and we're favoring the kind of trades that we can either get quickly in and out of or in companies that are such a bargain, that we don't mind riding out a 20% market correction with. That's how we're sleeping well at night – Cashy and Cautious – so far, we sure haven't missed anything, other than some heartache.

Be careful out there.