Shanghai fell 6.4% last night.

Shanghai fell 6.4% last night.

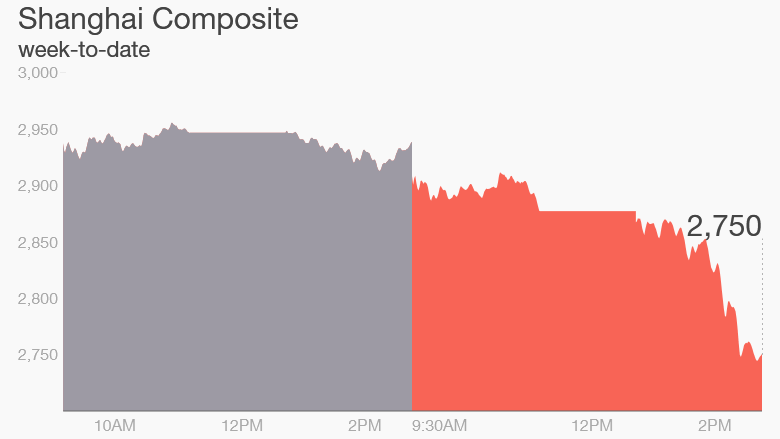

The worst part was the way they sold off into the close DESPITE ANOTHER $70 BILLION that China has pumped into the market through reverse-repo operations this week. The Shanghai is now down 900 points since Dec 22nd and that's just a touch shy of 25%, which is drastic by any account and now lower than the Aug 26th low of 2,927 (20% off) by a wide margin (5%) but still very much in-line with what our 5% Rule™ predicted for China's 2nd downturn. If we (and I think Wi is the Finance Minister) can turn China back around this week, back over 2,927 – all shall be, surprisingly, well.

All is well(ish) according to Siemens CEO, Joe Keaser, who told CNBC this morning that: "The real economy in China is a lot better than people are talking about right now. There is obviously some weakness in terms of real estate and the finance sector but as far as our business is concerned, we do see some decent growth in healthcare, which was very, very strong with double-digit growth in China."

We'll get a nice peek into the Chinese consumer market with Apple (AAPL) earnings this evening and we're playing AAPL to beat, but not too aggressively as we'll be much happier to get a discount if they disappoint. The big disappointment out of China this morning that sent their stocks plummeting was the realization that their Trade Data is fake, Fake, FAKE!!! and heavily exaggerated.

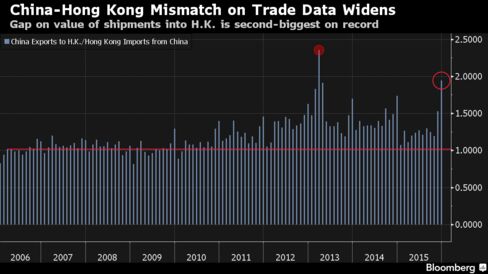

While this may shock retail investors – this is a story we've been covering at PSW since 2013 (and, more recently, see: October's "Monday Mandarin Meltdown – China’s Fake GDP Still Sucks!") so, we're not selling on this "news" just because the rest of the World is clueless as to what's really going on. Tuesday’s data from Hong Kong tallied imports in the territory from the mainland at HK$183.7 billion ($23.7 billion) in December while, on Jan 13th, the Beijing-based Customs General Administration announced December trade data showing shipments to Hong Kong had surged 10.8% to $46 billion – a 100% "exaggeration."

What people don't understand, as they finally realize China is much smaller, economically, than they have been imagining is that that is a GOOD thing – because it means their downturn won't actually hurt us very much! The only people losing money in China (and this will be confirmed by AAPL this evening) are the idiots who paid 100x earnings for fake, Fake, FAKE!!! Chinese unicorn stocks – which is pretty much all of them.

Buying stocks based on the assumption an economy – ANY economy – can grow 7% for a whole decade without severed negative repercussions is so idiotic that I have no pity on the people who didn't get out at 5,000 in June (when we began shorting). At the time I said:

The above chart illustrates the game that is being played in China to keep things LOOKING good, even while they are falling apart. Then we have to take into account that 90% of the public companies in China are some form of quasi-state controlled entities. While a lot of "investors" take solace in that, believing the Government will back up these companies if they begin to stumble – the consultant in me has to consider the internal bleeding of all these companies adding up to possibly Trillions of Dollars (certain Trillions of Yuan) in bailouts. How long can the PBOC really keep this up?

Since the answer is probably not "forever", we can expect, at some point, a bit of a correction. It's not likely the US, Europe and certainly not the rest of Asia will be able to avoid the fallout of a Chinese correction so we're going to be watching China very carefully this summer and reading between the lines of their policy announcements – especially when the Premier talks about "letting the markets work," which is code for no longer bailing out failing businesses.

It might not be too bad because most of the profits in China are paper profits anyway. People bought $1,000 worth of stock last year and now they think they have $10,000 but really it's $500. Of course, multiply that by half a Billion Chinese speculators and it does add up. Global Markets, led by China, just hit $75Tn – a new record. This is really amazing since Global GDP is still lower than it was in 2007 so that means that the ratio of stock valuations is now at an all-time high – isn't that special?

That was my morning post on May 22nd and, so far, everything is proceeding as I have foreseen. So, when I tell you China is not as bad as people are NOW making it out to be – take it from the only guy who called the top on the button 8 months ago. At the time, I thought China was 40% overvalued at Shanghai 5,000 and now we're under 3,000 and I think they are getting closer to fair value. Not that they won't panic lower but it's actually getting to the point where there may be a Chinese company we like other than China Mobile (CHL). And $50, by the way, is our buy line on CHL!

China, however, doesn't matter today. What matters today is AAPL's earnings this evening and then that doesn't matter because the Fed has a Policy Statement tomorrow at 2pm and THEN we'll see what levels the markets are at. Meanwhile, we're watching the same bounce lines that failed yesterday (see morning post), giving us a clear indication that the "rally" was failing at the time.