I was almost going to just put up my Jan 13th post again.

I was almost going to just put up my Jan 13th post again.

That one was titled "Weak Bounce Wednesday" and we opened that day at S&P 1,923 after bouncing almost exactly as high as we had predicted in Monday's (Jan 11) "Meaningless Monday Market Movement." This is why "Groundhog Day" is one of my favorite movies of all time. In that movie, Bill Murray plays Phil (great name), a weatherman, who gets trapped living the same day over and over again – yet he's the only one who is aware of it – for everyone else, they've never seen that day before.

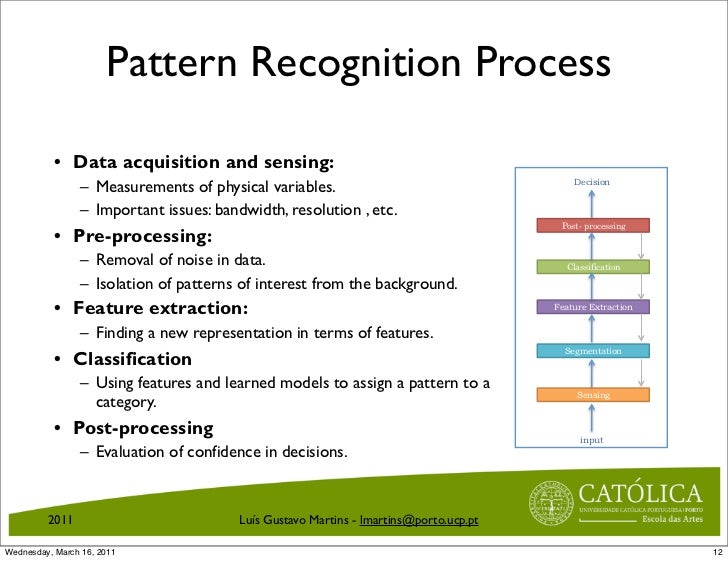

That sums up my job very nicely. All day long I talk to people and reporters who are constantly surprised by things I have seen happen over and over and over again. Each time, they have no idea what will happen next and, while there certainly are variations from time to time – I'm able to predict the outcomes with a pretty good degree of accuracy, not because I'm smart – but simply because I'm paying attention. And I'm not the only one – this is from Dave Fry this morning:

Like Bill Murray it feels like a bad Groundhog’s Day again as markets moved right back down in volatile, what I believe, is a descending spiral.

For bulls, just when you think markets are ready for a big time rally, (nearly 400 points higher just last Friday), bears moved back in taking charge once again. I further projected on just last week Thursday we could expect a countertrend rally in the S&P from 1902 to 1956. We hit 1940 on Friday and have fallen once again to close at 1904.

Paying attention to repeating patterns does more than make our Members look smart – it makes them lots of MONEY because we're able to place our bets accordingly.

Like yesterday – despite the falling futures in the morning I called for a long on Natural Gas May Futures (/NGK6), which opened at $2.13 and topped out at $2.19 for a $600 per contract gain. We also reiterated our Trade of the Year idea on UCO/USO, which hasn't gotten away yet but, so far, it was a perfect bottom call at the open.

This morning I sent out an alert to our Members (and Tweeted it out for good measure) calling for long Futures plays at 1,900 on the S&P (/ES), 16,100 on the Dow (/YM), 17,200 on the Nikkei (/NKD) and 0.975 on Gasoline (/RB). All made a few hundred Dollars before stopping out except Gasoline, which fell back to $97 for a quick stop out at the $97.50 line for a small loss. Our long on oil at $30 also died at $30.50 with "only" a $500 gain – still good enough to pay for the Egg McMuffins while we wait for the market to open.

We'll still like those lines long this morning as we expect oil to hold $30 and, more importantly, our bounce lines of 3 weeks ago haven't changed and neither have the macros we've been tracking so there's no reason for us to think we're breaking down here UNLESS Europe fails to pull it together at the -5% line, which is 9,400 on the DAX, down from 9,900 last week. That makes, according to our fabulous 5% Rule™, a weak bounce 9,480 and a strong bounce 9,560 on the DAX – those are the short-term lines we care about in Europe and nothing is safe if the DAX is under 9,500.

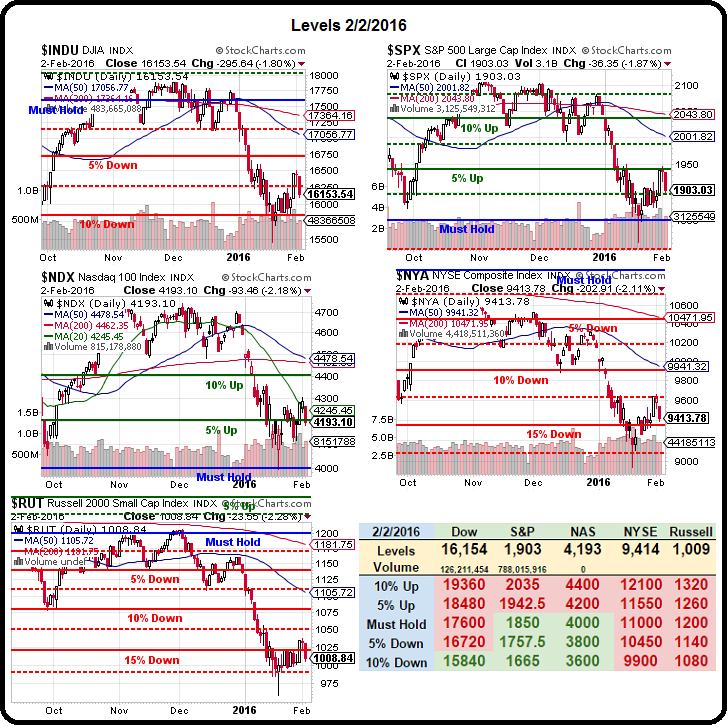

Locally, our bounce lines for the indexes are:

Locally, our bounce lines for the indexes are:

Dow 15,840 is the -10% line on our Big Chart, down from the Must Hold Line at 17,600. That makes the weak bounce 16,200, about where we finished the day yesterday while a strong bounce would be 16,550.

- S&P 1,850 from 2,100 was a 250-point drop and that makes for 50-point bounce lines to 1,900 (weak) and 1,950 (strong). We were rejected soundly on Monday at 1,950 and that was a bad sign – right back to test the weak bounce which, for the moment, held up.

- Nasdaq, as I mentioned in the other post, is all about AAPL and AAPL is still on the outs at $94.50 but it's a BUYBUYBUY there, so we HAVE to love the Nasdaq to hold up at 4,200, even though it's the +5% Line on our Big Chart and well above our other indexes. We did actually spike down to the 4,000 line on the 20th but let's call 4,100 the real floor and that is 600 down from 4,700 so 120-point bounces to 4,200 (weak, rounding down) and 4,350 (strong, rounding up) are what we'll looking for and 4,200 needs to hold so we can have faith in the others.

- NYSE tumbled from 10,450 (our -5% line) to 9,350 (-15%) since Christmas and that's 1,100 points so we'll be looking for 9,550 (weak) and 9,750 (strong).

- Russell 1,200 was our Must Hold line and we haven't held that since Thanksgiving – which is one of the reasons we've been so bearish since then. 1,000 is, however, 16% below that and 1,020 is the -15% line while 960 is -20%. We've come nowhere near 960 (and, hopefully, we won't) so we'll work with that 1,020 line and that's not even weak – that's just better than hopeless! For a weak bounce, we'll need to recover 1,050 and then 1,100 and no, the math doesn't work on those but the Russell is a crazy-assed index (technical term) which is prone to wider swings but does obey those round-numbered lines.

We will need to take and hold at least 3 of those 5 strong bounce lines into the weekend or we'll have to up our downside hedges significantly! Our bullish premise is based on the fact that oil is bottoming and that the oil sector has been a huge drag on the markets. Ex-oil and oil services and the banks that lend them money – things are looking pretty good. While China is slowing down, it's not stopping and the glut of materials will work themselves out – eventually. Investors who were so badly burned in 2008 are being overly cautious in 2016 and we see many, many fine companies to invest in at these levels (see our Watch List).

We will revisit our Watch List in today's Live Trading Webinar (1pm, EST) and also go over some Futures Trading Strategies and hopefully we'll be well above those entry levels I posted above.

Be careful out there!