"We should all fear Oilmageddon!"

"We should all fear Oilmageddon!"

That's the word from CitiBank, which is SUPPOSED to be the voice of reason in these markets. When Banksters tell us to get out of something – it's usually time to get in and, this morning, I put out a Trade Alert to our Members (and tweeted here) to take a long on Oil Futures (/CL) at the $30 line (with tight stops below) as well as lines on various indexes I detailed in the Alert.

Of course, we warned you last week that the market would likely turn back down and I detailed our hedges on the Ultra-Short S&P ETF (SDS) at $22.50 and mentioned we were long on Gold (/YG Futures) at $1,155 and Silver (/SI Futures) at $14.90 and Natural Gas (/NGK6 May Futures) at $2.15 on Thursday. This morning they are at:

- SDS $23.70 – up 5.3%

- Gold $1,180 – up $8,000 per contract

- Silver $15 – up $1,250 per contract

- Natural Gas $2.27 – up $1,200 per contract

Our one loser (so far) was Copper (/HG Futures), which dropped from $2.12 to $2.075 for a loss of $1,125 per contract. Of course stopping out your losers is important with Futures and we'd be happy to get back in either over $2.10 or off the $2.05 line (with tight stops below).

In Friday morning's post we detailed two major hedges for the S&P (SDS) and the Nasdaq (SQQQ) using the Ultra-Shorts and, of course, those are both paying off like gangbusters as Friday was already a bad day and the markets are following through this morning. We also detailed a trade idea for Barrick Gold (ABX) to leverage the run in gold – also doing fantastically, thank you! We're hoping for a bounce but really we're using our bullish future bets, pre-market to lock in the tremendous gains of our index hedges at what we THINK might be the bottom again at 1,850 on the S&P.

Nattering Naybob had a very good summary of the weeks events, reminding our Members yesterday afternoon of my Wednesday warning that we were simply in a "dead cat bounce" and likely to fall even further this morning, saying:

Nattering Naybob had a very good summary of the weeks events, reminding our Members yesterday afternoon of my Wednesday warning that we were simply in a "dead cat bounce" and likely to fall even further this morning, saying:

Some are connecting the dots so the 1859 to 1940 SP500 rally, could be the dead cat bounce we alluded to as the overall trend reasserts itself. I said ES could test 1930 and to wake me up when it got there, where it was rejected in a big way. I have a funny feeling this Super Bowl, Monday and week could all be ugly.

And ugly it is this morning but I'll be on Money Talk on BNN Wednesday night, explaining to Canada why the collapse of oil does NOT mean the Global Economy is collapsing and I'll write it down here so you can get ahead of the game and, as Buffett advises: "Be greedy while others are fearful."

The big problem is that most "analysts" don't know anything more than they knew in college – especially the ones who wrote books and who, even if they now know better, almost never contradict what they have published – no matter how much evidence to the contrary has piled up against them. Those who aren't slaves to the status quo are often paid by the-powers-that-be to steer the beautiful sheeple in and out of positions as needs dictate, and even the honest media loves a conflict – and they'll present both sides of an argument as valid – even when one side is clearly idiotic.

So, getting back to oil – most people think oil pricing is a function of supply and demand and long-term it is, but short-term it's a function of sentiment and manipulation. We take full advantage of that at PSW and I could give you a dozen examples from every one of our 10 years in circulation but suffice it to say it's not that hard to spot those patterns. One great pattern we observe is the fake, Fake, FAKE!!! trading of oil contracts over at the NYMEX.

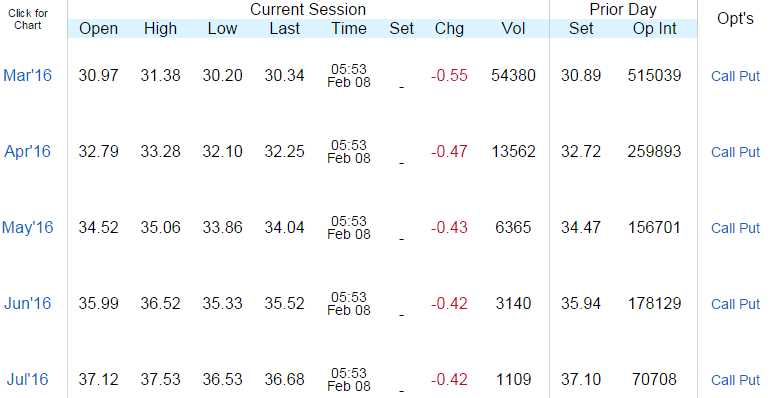

As you can see from the 5-month strip at the NYMEX, there are 515,000 open contracts for March delivery and that's very high, which puts downward pressure on the price because the contracts close on the 22nd (10 trading days, we're closed next Monday) and, not only are the storage facilities at Cushing, OK (the point of delivery) full to the brim with unwanted oil, but Cushing can only handle about 40M actual barrels of oil per month so there is NO WAY ON EARTH that 515,000 contracts, representing 515 MILLION barrels of oil, can possibly be delivered.

Of course the traders know this and they pull this scam off every month in order to create a false sense of demand for oil and, every month, they whittle their fake orders down to 15-25M actual barrels worth of contacts (15-25,000) and the rests are fake, Fake, FAKE!!! – ALL of the time.

Yes, trading on the NYMEX is a complete and utter fraud BUT knowing it's a fraud helps up make a lot of money so, other than my occasional rants like this one – we could care less – certainly the regulators don't seem to… This month, over 3M contracts will change hands at the NYMEX, representing 600M barrels of oil – all so just 20M can actually be delivered to the US consumers. The rest of the nonsense (99%) is just a game to move the prices around with the US consumers picking up the tab for all the fees that monthly churning generates.

As you can see, there are 515,000 contracts worth of open orders for March delivery and, since only 25M barrels are likely to be delivered, they have 10 days to cancel or roll 490M barrels worth of crude orders to longer months. Since most of those contracts are trading at a loss and since hope springs eternal and since humans and their corporate masters have a huge aversion to taking losses – we can expect those contracts to be rolled to longer months – only perpetuating the problem.

In addition, we know that "THEY" have trouble rolling more than 40,000 contracts in a single day – usually that causes downward price pressure and they have 10 days to roll 490,000 contracts – so oil will remain under pressure until 2/22, when we should get a nice pop into the end of that week. Meanwhile, rumors are accelerating regarding a possible OPEC production cutback and that's keeping oil off the $25 line – for now. As I said – we're playing for a bounce off $30 (with tight stops below) because we expect more rumors to lift oil into Wednesday's inventory report.

There are over 1 BILLION barrels worth of FAKE!!! orders for oil deliver at the NYMEX in the front 4 months – soon to be the front 3 months in 10 trading days. The US currently imports just 5.7M barrels per day or 171M barrels per month (but not all to Cushing, of course) so the deliveries FALSELY scheduled for Cushing alone, in March, represent a 3-month supply for the entire US!

There's problem number one – energy trading is a complete and utter scam (as if Enron didn't make that plainly obvious 15 years ago) and don't even get me started about the ICE (see: Goldman's Global Oil Scam Passes the 50 Madoff Mark). Oil is not racing back to $50 because $50 is not the mid-point on oil – it's a top and oil should NEVER have been anywhere close to $100 per barrel and that bubble has long since burst.

Again we have to think about the rigid and limited mind-set of the average analyst, who think that low oil prices mean a bad economy because, clearly, demand must be off. That was a very solid assumption since the birth of the internal combustion engine but now that we have electric cars and solar and wind power – it's no longer such a direct correlation. While we do have an oversupply of oil, to be sure – it's wrong to blame it on a slow economy.

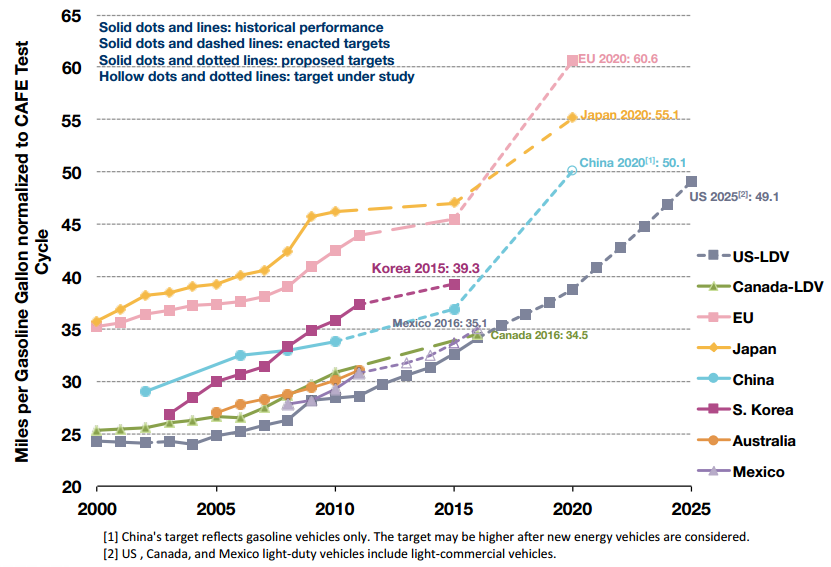

One solid example of this is auto demand. You are probably aware of the fact that auto sales hit records in 2015, with 50M cares delivered globally. While this is somewhat a bump in demand, it's mainly about replacement cars and what kind of cars are we replacing? The average age of the US fleet is 11.5 years and we can safely assume that most cars being replaced fall on the longer end of the scale. Well, the average car in 2005 got just 22 miles per gallon and we're replacing them with cars that get 35 miles per gallon (new car fleet average) thanks to Obama's CAFE standard rules. And it's not just the US – the whole World is getting more efficient:

A car being driven 15,000 miles a year (average) that used to use 750 gallons at 20 miles per gallon is replaced by a car driven the same 15,000 miles a year that now gets 35 miles per gallon and used 428 gallons. That's 42% LESS fuel than the previous car! An oil barrel is 42 gallons and it's not all refined to gasoline but let's just say that each new car sold requires 10 less barrels per year than it's predecessor. At 50M cars a year that's 500M less barrels per year required for our auto fleet – a 1.5Mb/day demand cut that becomes 3Mb/day in year 2 and 4.5Mb/day in year 3 and THAT is where our demand is going and it's NOT coming back!

In fact, we also are getting more efficient trucks and more efficient planes and more efficient machines in our factories and a lot of equipment is using wave, wind and solar energy for power and not using any oil at all to run. So our economy could be off to the races and oil consumption would still be going downhill and, ironically, the better our economy does the faster the old gas-guzzling machines get replaced and the faster the demand for oil declines but that's a GOOD THING, not a reason to panic.

In fact, we also are getting more efficient trucks and more efficient planes and more efficient machines in our factories and a lot of equipment is using wave, wind and solar energy for power and not using any oil at all to run. So our economy could be off to the races and oil consumption would still be going downhill and, ironically, the better our economy does the faster the old gas-guzzling machines get replaced and the faster the demand for oil declines but that's a GOOD THING, not a reason to panic.

Yes, there will be disruptions as we move into a post-oil economy – especially for economies that depend on oil. Saudi Arabia alone has enough oil in the ground to supply the World for 40 years and, sadly, it's not likely they'll even use half of it before oil is a fuel of the past and THAT is why no one wants to cut production – despite this persistent glut that is without end – because they know they are playing a game of musical chairs with oil barrels and they are all going to be stuck with a worthless fuel of the past with a rapidly declining inventory value.

This is also bad news for companies like Exxon (XOM), Chevron (CVX) which are, unfortunately, Dow Components. It's bad news for the energy sector and the banks that lent them money so there WILL be disruption – but it's the good and healthy kind as our society moves on from using oil and it's NOT a sign of a slowing global economy – that's why we flipped long this morning!