Oh sorry, that's tomorrow's headline!

Oh sorry, that's tomorrow's headline!

Silly me, sometimes I get ahead of myself. As I've been saying all week(s), the market is overbought and the Fed is boxed in and even the bat-shit crazy Bank of Japan didn't lower rates this morning and the only reason they were able to hold if is because they have been assured that our Fed will be raising rates at 2pm, effectively devaluing the Yen against the Dollar anyway.

Still, not everyone is as certain as I am which is why I called for a short on the Nikkei Futures (/NKD) in our Live Member Chat Room this morning (7:02), saying:

We're back at 2,140, of course, along with 18,125, 4,825 and 1,230 – exactly where we were yesterday so it's just a reset by the TradeBots ahead of the Fed but now it's a lot more dangerous to short those futures, though still fun if you are careful enough to keep VERY TIGHT STOPS above those lines. /NKD blasted to 16,800 and now back to 16,700 as the Dollar pulls back, still a good short there.

As you can see, the Nikkei has already dropped 65 points and, at $5 per point, per contract that's a gain of $325 per contract for our Members and the Egg McMuffins are paid for already this morning (stop is now 16,650 to lock in $250)! The other levels are the same ones we've been watching all week and we're still looking for the S&P in particular to give us 2,120, on the way to 2,035.

Don't forget though, I'm an outlier in my prediction and our confidence in a rate hike today was shaken by yet another downward adjustment to our GDP outlook by the Atlanta Fed yesterday – from 3.5% to 2.9%, which is a 20% downgrade in GDP outlook since the beginning of the month – that's a very scary trend!

Don't forget though, I'm an outlier in my prediction and our confidence in a rate hike today was shaken by yet another downward adjustment to our GDP outlook by the Atlanta Fed yesterday – from 3.5% to 2.9%, which is a 20% downgrade in GDP outlook since the beginning of the month – that's a very scary trend!

So, if the Fed is divided (and it seems to be) this is certainly a data-point that can tip things back in the doves' favor but I still think the overriding logic is that this is the only window the Fed has, until March, to raise rates and you have to keep in mind that the Fed doesn't give a crap about anything but what's good for the Bankers and the bankers do not want the labor market to get too tight because it lowers profit margins and lessens the need for consumers to borrow money so better to keep them out of work while raising the rates on the money they need to borrow to live, right?

Larry Summers, for his part, is FREAKING OUT about the Fed possibly raising rates today and has already sent out 11 tweets on the subject this morning but I'd be very careful about backing Larry's views as he also begged the UK not to leave the EU. Not surprisingly, Summers is an adviser to several hedge funds as well as the Nasdaq and Citigroup (C), businesses who loves the free money the Fed showers down on the faithful. If the Fed raises rates and companies start cutting back – high-priced consultants like Summers are the first to go

Summers, and most of the "doves" are using the sort of logic that says "If you stop feeding the child chocolate, they will start crying again so never stop feeding the child chocolate until he's healthy and strong." See – you can think of many reasons why this is not a good idea and it's just a stupid to keep feeding money to an economy. It would be one thing if the money were being distributed fairly, but it's not, the rich are getting much, much richer and the poor are getting poorer.

Summers, and most of the "doves" are using the sort of logic that says "If you stop feeding the child chocolate, they will start crying again so never stop feeding the child chocolate until he's healthy and strong." See – you can think of many reasons why this is not a good idea and it's just a stupid to keep feeding money to an economy. It would be one thing if the money were being distributed fairly, but it's not, the rich are getting much, much richer and the poor are getting poorer.

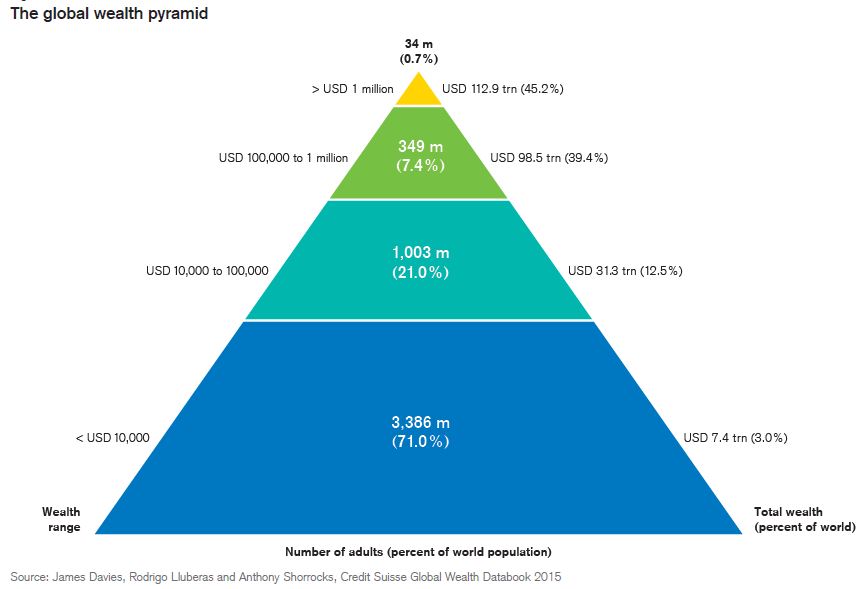

The rich are in fact, so rich, that they are running and even richer guy for President than they did last time. As you can see from the pyramid chart, 84.6% of the wealth is now held by 8.1% of the people with just 0.7% holding 45.2% of the wealth. CLEARLY their interests are not in line with the majority – especially when the bottom 71% have just 3% of the wealth.

When you live in a country where those people have easy access to firearms – that should worry you if you're one of the Top 1% holding 15x more wealth than the entire bottom 70% combined! Fortunately, however, we in the Top 1% control the media and thus, the narrative and we are putting more and more of our people in charge to make sure there will be no popular uprisings or any of this nonsense about a more equitable distribution of wealth – it's our pie and you'll all sit quietly if you want your crumbs!

When you live in a country where those people have easy access to firearms – that should worry you if you're one of the Top 1% holding 15x more wealth than the entire bottom 70% combined! Fortunately, however, we in the Top 1% control the media and thus, the narrative and we are putting more and more of our people in charge to make sure there will be no popular uprisings or any of this nonsense about a more equitable distribution of wealth – it's our pie and you'll all sit quietly if you want your crumbs!

The best part of this whole thing is how the MSM is able to fool the Bottom 90% into believing wealth distribution isn't a problem in this country. This chart illustrates the actual distribution of wealth in the US vs what people think it is – even the people on the short end of the stick, the 60% who have less than 5% of the wealth, believe they have 12.5% of the wealth – mainly because they simply can't even imagine how much richer the top 20% is than the bottom 60%.

Similarly, the Top 10% can't really understand just how rich the Top 1% actually is. I know a lot of you out there like to think you are in the Top 1% but the bar is a little higher than you might think, thanks in large part to a 127% increase in Top 1% income since QE began in 2009. If your income hasn't more than doubled in the last 7 years – you may not be in the Top 1%:

Of course, the good thing about being near the Top 1% is you can probably afford to move to a state where you will be accepted in the finest clubs, etc. Like all of you, I want to know what the Hell is going on in North Dakota, where you need to be making $502,000 a year to make the cut. West Virginia has the lowest bar ($243,000) and Connecticut is the highest ($678,000) so even within the Top 1% there's a lot of inequality.

QE has made this possible and we could stop it today, begin to normalize rates and it still won't matter because the rich are not giving back those gains. They are going to fight hard to keep every single Dollar and those Dollars add up to about $85 Trillion so when you see the Koch brothers spending $1Bn to buy GOP elections around the country – it's nothing compared to the interests they are protecting (over $100Bn between them). What's 1% every 4 years spent to insure your way of life continues?

QE has made this possible and we could stop it today, begin to normalize rates and it still won't matter because the rich are not giving back those gains. They are going to fight hard to keep every single Dollar and those Dollars add up to about $85 Trillion so when you see the Koch brothers spending $1Bn to buy GOP elections around the country – it's nothing compared to the interests they are protecting (over $100Bn between them). What's 1% every 4 years spent to insure your way of life continues?

And when you wonder why a 70 year-old Billionaire wants to bother being President and give up his own jet for the crowded Air Force One and live in the relative squalor of the White House for 4 years – consider that his "$10Bn" fortune would be taxed at 40% ($4Bn) when he dies and distributed back to the American people. Simply eliminating that one tax would directly benefit his children by $4Bn – isn't that worth living in an old, white, house for a few years?