Oil spiked this morning.

Oil spiked this morning.

Back to $48.87 (/CL) in part due to the supposed OPEC deal to make a deal in December and in part because Hurricane Matthew is flirting with category 5 and heading towards the Gulf of Mexico, where it threatens a lot of production and will disrupt imports heading that way. At the moment – it's projected to turn north and graze Florida's East Coast, where it would instead become an insurance nightmare.

We took the opportunity to double down on our oil Futures shorts (see last week's Live Trading Webinar) and we'll keep an eye on the Oil ETF (USO) for an opportunity to add more Nov $12 puts at $1 if we get a good spike up. Nothing Fundamental has changed in the oil market – just a lot of sound and fury giving the bulls a bit of hope this morning.

We already took the money and ran on our other Futures Webinar play on Coffee (/KC), picking up $600 per contract on the quick spike higher and we're still long on the ETF (JO), which we picked last month at $20 (now $22.20) when I was on at the Nasdaq and I'll be back there this morning for another interview with another pick.

We already took the money and ran on our other Futures Webinar play on Coffee (/KC), picking up $600 per contract on the quick spike higher and we're still long on the ETF (JO), which we picked last month at $20 (now $22.20) when I was on at the Nasdaq and I'll be back there this morning for another interview with another pick.

Friday's rally was, as we expected way back last Monday, driven by Fed Speak and UNSUBSTANTIATED rumors that Deutsche Bank (DB) was settling with the DOJ for "just" $5Bn but German law is such that, if there were actually a settlement, they would have had to report it in 24 hours and they didn't so we'll have to see how much of Friday's 14% rally will unwind as we drift back to uncertainty and then we have to wonder how much of the Financial ETF (XLF)'s 1.5% rally will be given back and then we have to wonder how much of the S&P (SPY)'s 1% rally will be given back.

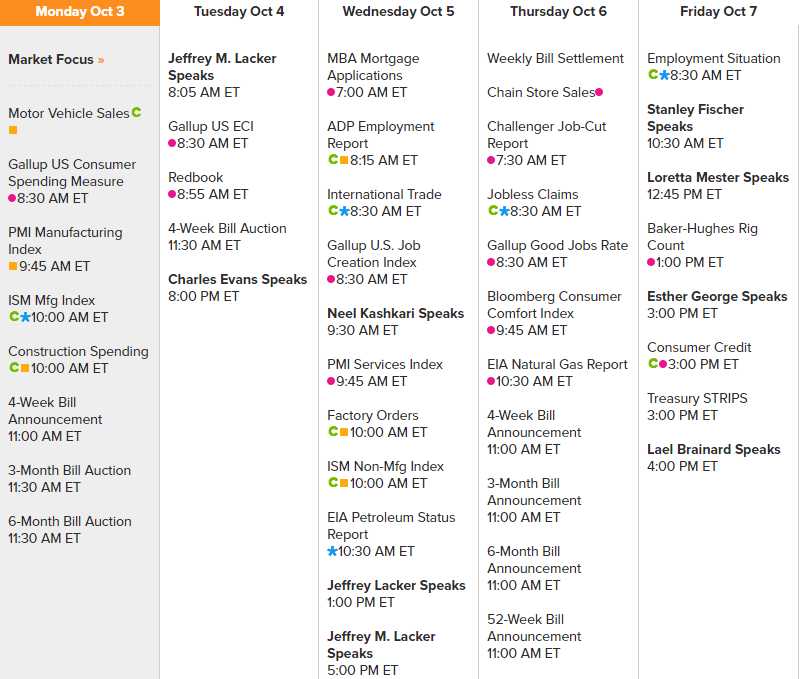

So that's on our plate for today and the Fed is still spinning plates this week with 9 speeches this week but 3 of them are super-hawk Jeff Lacker for some reason and he gets the first at-bat tomorrow (8am) and then 1pm and 5pm on Wednesday. Otherwise, we can expect the usual doveish chatter as we wait for Friday's Non-Farm Payroll Report:

China is closed for a holiday all week and Germany is closed today so it's a more than usually meaningless Monday (all Monday's should be market holidays) and DB is not trading so, in theory, nothing bad can happen, right? Looking at the chart of the Dax, which is drifting around 10,500, which is 4.5% below it's Must Hold line at 11,000, it's in a very tricky spot because it seemingly broke out of a wedge but did so in such a lame manner that you can't take it seriously.

This is the chart that says it all to me, asset prices have NEVER been higher in relation to our GDP and, generally, it's not asset prices that lead the GDP higher but vice-versa and we have quite the opposite at the moment, with GDP forecasts being endlessly revised lower, not higher.

This is the chart that says it all to me, asset prices have NEVER been higher in relation to our GDP and, generally, it's not asset prices that lead the GDP higher but vice-versa and we have quite the opposite at the moment, with GDP forecasts being endlessly revised lower, not higher.

Asset prices have grown 28% faster than GDP in this cycle vs 25% just before the bubble burst in 2008 and less than 20% when the Dot-Com Bubble burst.

This time is a bit different as the Fed and other Central Banksters have pumped in Trillions of Dollars of bailout money but, as I often point out, that money has not been used to do anything constructive in the economy – mainly it's been used to shore up balance sheets and buy back stocks – things that do nothing to improve the future prospects of companies and certainly things that do nothing to grow the economy so, essentially, money flushed down the toilet – unless you are on of the Top 1% owners of this scam.

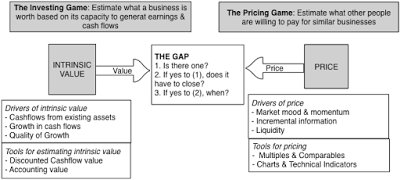

As noted by Value Walk, you can value an asset, based upon its fundamentals (cash flows, growth and risk) or price it, based upon what others are paying for similar assets, and the two can yield different numbers.

As noted by Value Walk, you can value an asset, based upon its fundamentals (cash flows, growth and risk) or price it, based upon what others are paying for similar assets, and the two can yield different numbers.

Clearly our market indexes and many of the stocks that make them up are PRICED at astronomical levels and, as long as there are greater fools to come along – all shall be well in investing land but we are still seeing a lot of evidence of much higher volumes on down market days than on rebounding up market days and that indicates the "smart money" is still heading for the exits.

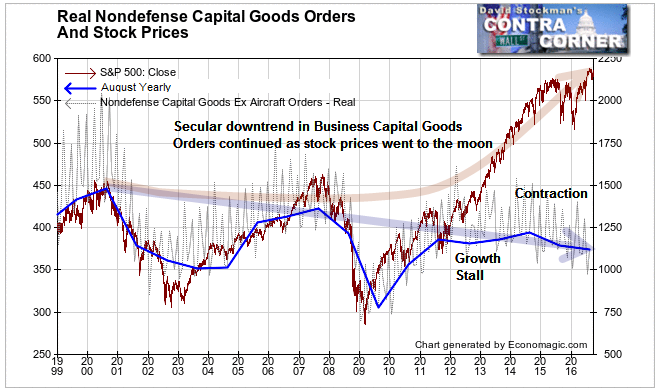

David Stockman points out that private spending on capital goods is a measure of business confidence in the economy. If business people believe the economy will grow, they invest more in plant and equipment. If they are not optimistic, they pull in their horns.

David Stockman points out that private spending on capital goods is a measure of business confidence in the economy. If business people believe the economy will grow, they invest more in plant and equipment. If they are not optimistic, they pull in their horns.

Apparently business people have been growing less confident in the growth potential of the US economy for the past 16 years. That belief, and the reduction in investment that follows from that belief, runs the risk of being a self fulfilling prophecy. This isn’t just a long term phenomenon. Business investment in capital goods has been flat since 2011, and has been declining for the past 2 years. According to Lee Adler:

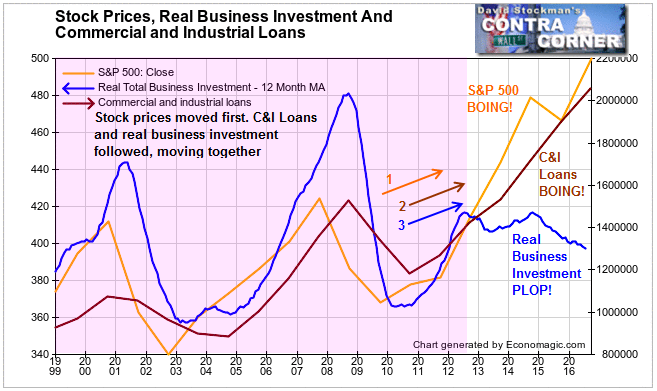

Driven by ZIRP and massive amounts of excess cash in the system, corporations are borrowing to buy back their own stocks. CEOs, CFOs, and their fellow executives conspire to issue massive stock option grants to themselves. Then the have their companies borrow the funds for free to buy the stock issued under those option grants. They shrink the shares outstanding and drive their stock prices higher in the process. As they raid their companies, everybody’s happy because their stock prices go higher. Corporate boards and regulatory bodies do nothing to stop the looting because the scam looks like a win win for everybody.

But it’s not. It’s just another massive bubble, a financial engineering bubble. It is a bubble driven by the cold calculations of the criminal masterminds in the C-suites of America’s corporations. It is a bubble enabled and funded by the mass insanity of central bankers and clueless investors around the world. And it is a bubble egged on by the cheerleaders on Wall Street and their financial media handmaidens.

Yeah, that about sums it up…