One Billion Barrels of oil on the wall.

One Billion Barrels of oil on the wall.

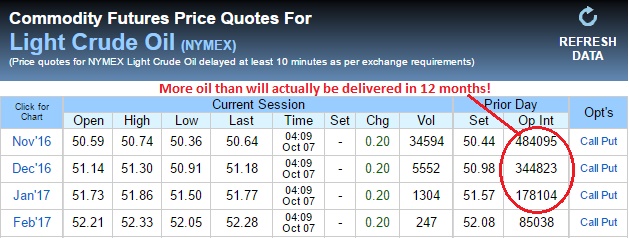

One Billion Barrels of oil – fulfill one contract for 1,000 barrels… 999,999,000 barrels of oil on the wall! 999,999,000 barrels of oil on the wall… Well, you get the idea. One BILLION is a lot of oil to have put out orders for – especially for a country that imports only 7M barrels a day. That would be a 142-day supply of oil if it were delivered. It would be even stranger if that oil were actually delivered to Cushing, Oklahoma, a facility that can only handle about 50M barrels of oil PER MONTH and just so happens to be full at the moment – so maybe 20M max.

The rest of the contracts, the other 940,000,000 are fake, Fake, FAKE orders that will all be either cancelled or rolled over to another month (causing more fake demand) by expiration day on the 20th, just 10 trading days from today. This is how the criminal US Energy Cartel keeps the price of oil up – even when there is no actual demand. It happens all the time, we point it out all the time – yet there are never any investigations as to why there are orders for 480M barrels of oil to be delivered to Cushing, OK, in November when it's not even remotely possible for 90% of those barrels to be delivered.

All these trading costs are passed down to you, the consumer. You pay them at the pump every time you fill up as the price of gasoline is set by the oil and gas trading that goes on at the NYMEX. “We get multiple complaints about spoofing every week,” said Aitan Goelman, director of enforcement for the U.S. Commodity Futures Trading Commission, CME’s main regulator. “It’s not a vanishingly small or infrequent practice.”

All these trading costs are passed down to you, the consumer. You pay them at the pump every time you fill up as the price of gasoline is set by the oil and gas trading that goes on at the NYMEX. “We get multiple complaints about spoofing every week,” said Aitan Goelman, director of enforcement for the U.S. Commodity Futures Trading Commission, CME’s main regulator. “It’s not a vanishingly small or infrequent practice.”

The CFTC said in a 2014 report that 10 spoofing probes had been initiated from July 2012 to July 2013 at Nymex and Comex, two of the derivatives markets owned by CME Group Inc. The regulator recommended the exchanges “continue to develop strategies” to detect the banned behavior. Clearly it's not working (if they did anything at all). The problem is, if the CME ever required the orders on their exchange to be genuine – then trading volume would drop about 95% – that's not good for profits, is it?

So the CTFC asks the Capitalists to make sure their most active customers have a legitimate interest in buying oil and the CTFC says "Of course they do – we asked them, and they said so." Case closed – job well done by those regulators that are stifling business, according to Trump. Clearly less regulation will fix this problem! Is it better to have no regulation than lax regulation? Maybe Trump is right – why pretend it's legitimate when it clearly is not?

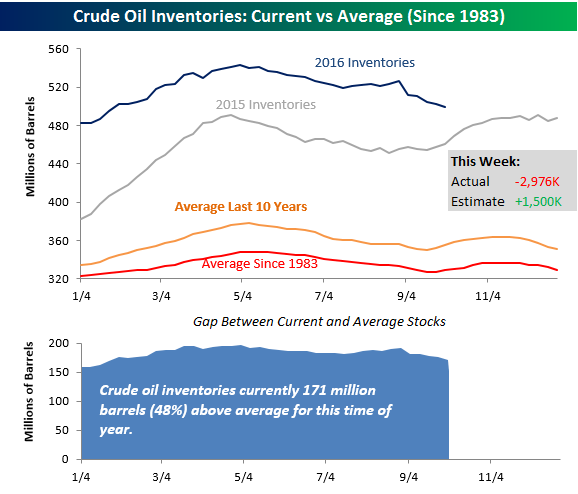

Back when the Democrats had control of the Senate, there was a study that determined that as much of 60% of the price of oil was driven by often-manipulated speculation and had nothing to do with the Fundamentals. We are short on oil because of those Fundamentals and this morning, once again, there's a great opportunity to short Oil Future (/CL) at $50.50 or the oil ETF (USO) at $11.50 (we already have the Nov $13 puts, now $1.55 in two of our Member Portfolios).

Back when the Democrats had control of the Senate, there was a study that determined that as much of 60% of the price of oil was driven by often-manipulated speculation and had nothing to do with the Fundamentals. We are short on oil because of those Fundamentals and this morning, once again, there's a great opportunity to short Oil Future (/CL) at $50.50 or the oil ETF (USO) at $11.50 (we already have the Nov $13 puts, now $1.55 in two of our Member Portfolios).

Despite the fact that these guys are REALLY GOOD at faking demand for oil, canceling or rolling 40M barrels worth of contracts a day for the next 10 days is very likely to hit a snag along the way and we expect a nice sharp drop (5% would be $2.50) in oil along the way and, at $10 per penny, per contract – those little dips can get very profitable. Of course, it's a very dangerous trade and you can get burned for $1,000 per contract or more if it moves $1 against you – not for the feint of heart but this is one of the biggest build-ups of fake contracts we've seen since last October, when we made a similar play for similar reasons and caught a nice $20 drop (and yes, that's $20,000 per contract!).

Here's me on the radio – exactly 12 months ago, last October 7th, explaining why we felt it was going to be a great trade to short Oil against the manipulators. Oddly enough, one of the reasons oil was rallying last year was rumors of Russia working with OPEC to cut production – that didn't pan out but it worked for a while so why not do it again? This time, I believe OPEC will cut – I just don't think it's enough given the size of the glut.

That is a LOT of oil! Last year, we were "only" 100M barrels above the 10-year average in inventories at this time of year, this year, we've added another 40M barrels so an extra 1M barrels a week have been added to inventories since the glut of oil caused a 40% crash last year. Even if OPEC cut 1Mb/d tomorrow, we only get 15% of our oil from OPEC so 150,000 less barrels would just barely stop our build from growing but would do nothing to soak up the glut of oil that's already out there (171M too many barrels).

And it's not just the US, Europe is swimming in oil, as is China, who just topped off their Strategic Petroleum Reserve that was using 1.2Mb/day this year. So, without China's "demand", OPEC's proposed 750,000 barrel cut will 500,000 less than needed just to make up for China's shortfall going forward. Not to worry though bulls, China is going to have another 99Mb reserve built by 2020 – so we have that demand to look forward to!

Until then, expect a bit of a pullback as the reality of the glut hits the false expectations that production cuts will make a difference.

8:30 Update: Non-Farm Payrolls rose by 156,000 jobs and that was a pretty big miss from the 190,000 jobs expected by leading economorons. The additional jobs were so low it bumped unemployment back over 5% for the first time since March and hourly earnings are essentially flat – at 0.2%, continuing to lose ground after a promising start to the year.

8:30 Update: Non-Farm Payrolls rose by 156,000 jobs and that was a pretty big miss from the 190,000 jobs expected by leading economorons. The additional jobs were so low it bumped unemployment back over 5% for the first time since March and hourly earnings are essentially flat – at 0.2%, continuing to lose ground after a promising start to the year.

The initial move by the market was a quick pop but it's a shortable pop at Dow 18,200 (/YM), S&P 2,155 (/ES), Nasdaq 4,875 (/NQ), Russell 1,250 (/TF) and Nikkei 16,900 (/NKD) which are the same lines we've been shorting all week because this is the kind of bad news that really is bad news as our economy is stalling while the Fed has their foot firmly on the gas and they've already warned us they are going to have to hit the brakes because the road (and yields) are about to curve ahead.

We also expect a weak market day because there are 3 bearish Fed speakers this morning but we already talked about that on Monday so let's leave it at that and see how the day unwinds.

Have a great weekend,

– Phil