The low-volume rally comes to an end – now what?

The low-volume rally comes to an end – now what?

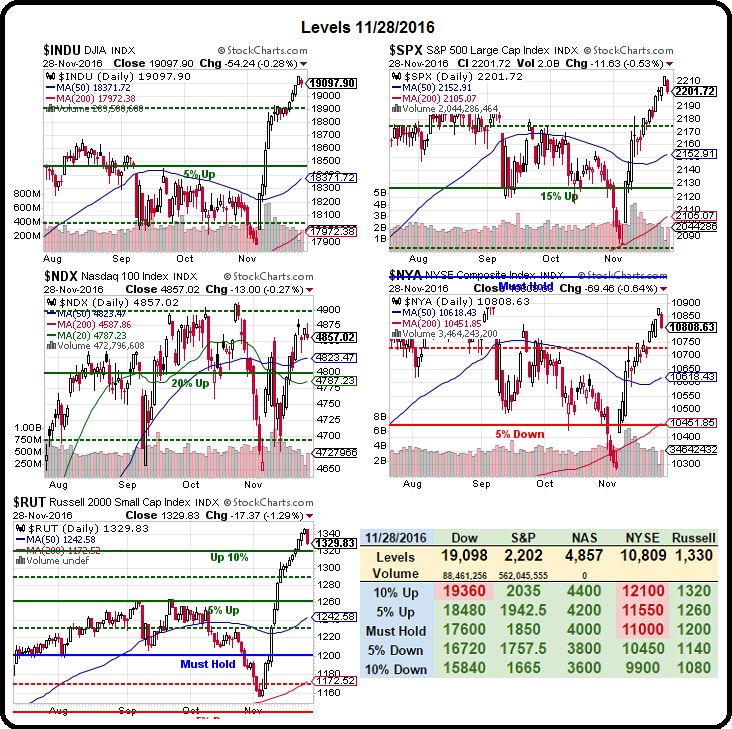

As you can see from this chart of On-Balance Volume, there's been a HELL of a divergence between it and the S&P and, in the end, OBV usually wins out. OBV is a momentum indicator that uses volume flows to predict price and it's generally very accurate – except when certain key stocks are being propped up in order to create the illusion that there is index strength when, in fact, the people manipulating the market are dumping everything else they hold into the greedy hands of the retail suckers. Then it looks like this.

Maybe this time is different, right? Like last fall, when OBV tanked in November and the market didn't collapse in November or December – it collapsed in January, falling from 2,100 to 1,800. That's only 14% and we're up 7% since Trump was elected so a net loss of just 7% from where you were before the election is no reason not to BUYBUYBUY expensive stocks now, is it? At least that's what the stock pushers are telling us on TV and they are on TV – so they couldn't be lying to us, could they?

Remember the great bull markets of the 50s and 60s or the late 90s? What did they have in common? Rising wages! Rising wages are the foundation for sustained economic growth and we're simply not there yet and you KNOW what happens when wages stagnate and prices rise, don't you? Assuming you are not having this article read to you, you were on the planet 8 short years ago when we last suffered the consequences of things rising to the point at which people could no longer afford them.

Remember the great bull markets of the 50s and 60s or the late 90s? What did they have in common? Rising wages! Rising wages are the foundation for sustained economic growth and we're simply not there yet and you KNOW what happens when wages stagnate and prices rise, don't you? Assuming you are not having this article read to you, you were on the planet 8 short years ago when we last suffered the consequences of things rising to the point at which people could no longer afford them.

And by people, of course, I don't mean you – you are in the investor class and you have something 80% of the people in this country do not have, which is MONEY! You have money in your checking account and money in your savings account – in fact, you have SO MUCH MONEY that you are able to plan for your future – very much unlike 240M of your fellow countrymen.

Keep this chart in mind when you are investing in companies that make $10 burritos or plan to have half the population pay them $10/month to watch videos – most people don't have another $10 to spend on anything, most people are in debt with negative net worth! These sky-high market valuations are based on expectations of future sales that have no basis in reality.

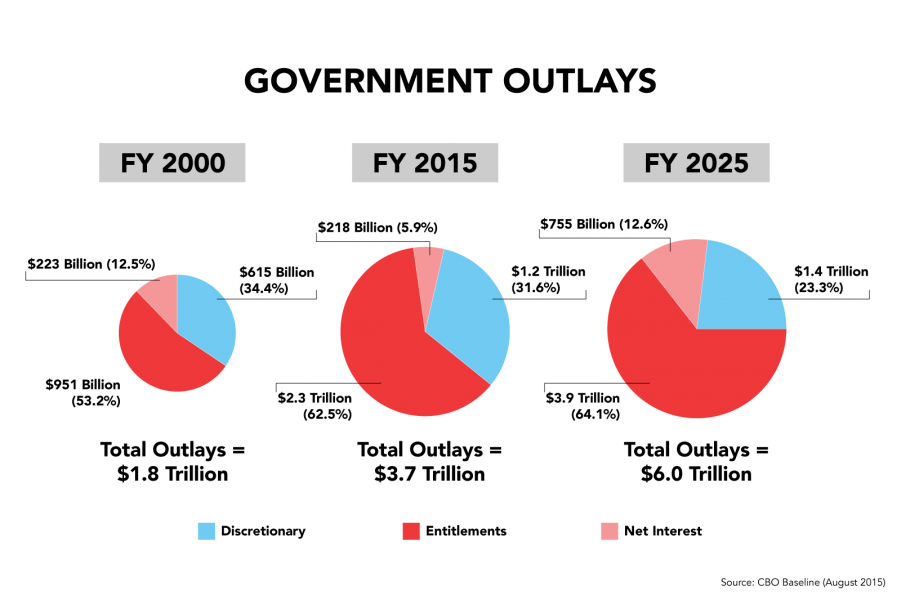

Yes, the consumer economy is getting better but only because we've forced increases in minimum wage and provide $2.3Tn worth of "entitlements" to our people. That's Medicare, Medicaid, Social Security, Food Stamps, Unemployment, etc. and it's "only" 12% of our GDP and it's NOT charity – those people paid into the system and it's SUPPOSED to pay them back so they are ENTITLED to the money – it shouldn't be an option as to whether or not we pay them back when they need it.

Yes, the consumer economy is getting better but only because we've forced increases in minimum wage and provide $2.3Tn worth of "entitlements" to our people. That's Medicare, Medicaid, Social Security, Food Stamps, Unemployment, etc. and it's "only" 12% of our GDP and it's NOT charity – those people paid into the system and it's SUPPOSED to pay them back so they are ENTITLED to the money – it shouldn't be an option as to whether or not we pay them back when they need it.

Entitlements is one of those Orwellian words used to force your thinking a certain way to cloud an otherwise obvious issue. Had Social Security and Medicare payments been managed properly and simply gotten the normal bank interest the accounts should have gotten over all these decades, there would be a massive surplus in the system. But that's not what happened, the Government broke into the "lock box" and borrowed the money at unfavorable rates and never managed the flow of funds coming in realistically and now the system is "in trouble" but it's the kind of in trouble a bank robber gets into when they get caught – only this bank robber is blaming the depositors!

That's right, the bank managers looted the bank, spent the money giving themselves huge tax breaks and now, when the books don't balance, rather than put the money back – they are calling the depositors leeches simply because they'd like to have their money back. Isn't that special?

Anyway, this isn't about entitlement spending or how totally screwed the country is over the next decade (should be obvious from that chart) or the childish evasion of responsibility by one of our major political parties that will make the situation much worse and doom half the people of this country to lives of abject poverty. No, this is about whether or not the economy – the one that is in so much trouble over the next 10 years – can sustain these all-time high market valuations. No, it can't.

Anyway, this isn't about entitlement spending or how totally screwed the country is over the next decade (should be obvious from that chart) or the childish evasion of responsibility by one of our major political parties that will make the situation much worse and doom half the people of this country to lives of abject poverty. No, this is about whether or not the economy – the one that is in so much trouble over the next 10 years – can sustain these all-time high market valuations. No, it can't.

And THAT is why we're short the market here. That's why we're short the S&P Futures (/ES) below the 2,200 line (with tight stops above) and Dow (/YM) 19,100, Nasdaq (/NQ) 4,875, Russell (/TF) 1,330 and even the Nikkei (/NKD) at 18,500 – because that same economy also can't sustain an ever-rising Dollar.

When things are unrealistic, we bet against them. Even Alice left Wonderland at some point. John Maynard Keynes famously said "the markets can remain irrational longer than you or I can remain solvent" and he should know, because he went bankrupt several times investing. However, he did not mean the markets can remain irrational forever – forever is a long time and despite many people's perception, money is a finite commodity, which "flows" from one place to another and the only way to create more real money is by paying it out as wages – not tax breaks!

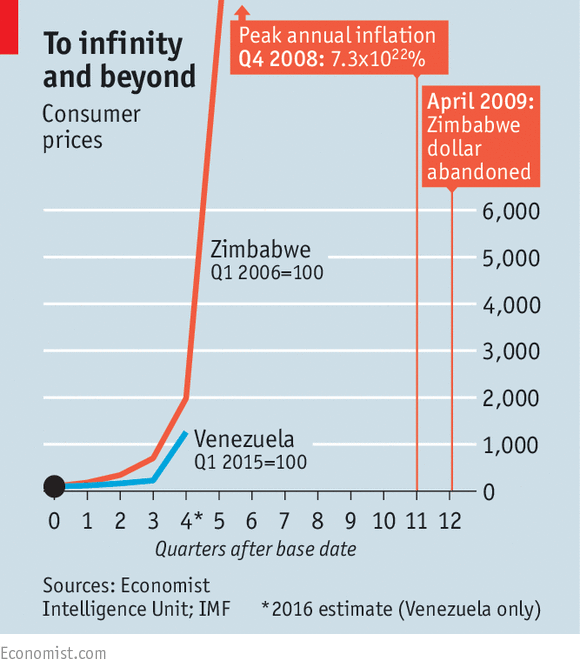

Venezuela is a country where they pretended it was OK to print money to solve their problems for too long and now they have to weigh their currency to buy things because you need too much of it to count. Inflation in Venezuela is hitting 720% this year, less than two years after President Maduro attempted to make up for shortfalls in oil revenues by ordering banks to print more cash. ATMs need to be refilled constantly because they can't hold enough local currency to meet the basic demands of day-to-day living.

Venezuela is a country where they pretended it was OK to print money to solve their problems for too long and now they have to weigh their currency to buy things because you need too much of it to count. Inflation in Venezuela is hitting 720% this year, less than two years after President Maduro attempted to make up for shortfalls in oil revenues by ordering banks to print more cash. ATMs need to be refilled constantly because they can't hold enough local currency to meet the basic demands of day-to-day living.

That's how quickly things get out of control when your Government tries to pretend a crisis isn't a crisis and our market is rallying because we elected a Government that is going to solve our financial problems by giving massive tax breaks to Billionaires? Really? Now, many of those Billionaires are our beloved Corporate Citizens, who will be granted even more rights by the Trump Supreme Court and yes, they will do very well in the looting of America. Just beware of companies that service the bottom 80% – because that's where all the money is being taken from!

Speaking of inflation – our 3Q GDP Report came in strong at 3.2% up 10% from the prior 2.9% estimate driven by a 5% increase in the relative price of the Dollars that the GDP is measured in. Current Dollar GDP jumped 4.6% ($207Bn) and gave us the bulk of the change but that's too nuanced for the MSM to explain so expect a lot of happy talk about GDP today. Still it's a good report though I will raise my usual objection to calling a $12.6Bn rise in inventories a "good" thing.

Speaking of inflation – our 3Q GDP Report came in strong at 3.2% up 10% from the prior 2.9% estimate driven by a 5% increase in the relative price of the Dollars that the GDP is measured in. Current Dollar GDP jumped 4.6% ($207Bn) and gave us the bulk of the change but that's too nuanced for the MSM to explain so expect a lot of happy talk about GDP today. Still it's a good report though I will raise my usual objection to calling a $12.6Bn rise in inventories a "good" thing.

On the whole, it's a good GDP report but we just elected a guy who vows to reverse all of the changes Obama made to create this "terrible" economy. Will he replace it with an even better one? Maybe – certainly that's what the markets are expecting with a 7% rally since election day and 2,220 is 20% above the 1,850 low the S&P put in for the year at the Must Hold line on our Big Chart.

Is our GDP 20% higher than it was in February? No, that would be 21.5% GDP growth and we're growing at 3.2%, which is less than 21.5% so a 20% jump in market prices may be getting a bit ahead of the 5-year trend, right? So don't be surprised if the market does not react well to this "terrific" GDP number. It's simply not enough to justify the 20% move and our 5% Rule™ tells us to expect a weak retrace of 4%, back to 2,150 (+$2,500 per contract on short 2,200 Futures on /ES) and possibly 8% – all the way back to 2,070 and THEN we may find a level where we could begin to consolidate – if we assume wise President Trump will be able to build on the policies that have led us to 3.2% GDP growth in the final quarter of Obama's Presidency.

Good night and good luck with that!