Well, now what?

Well, now what?

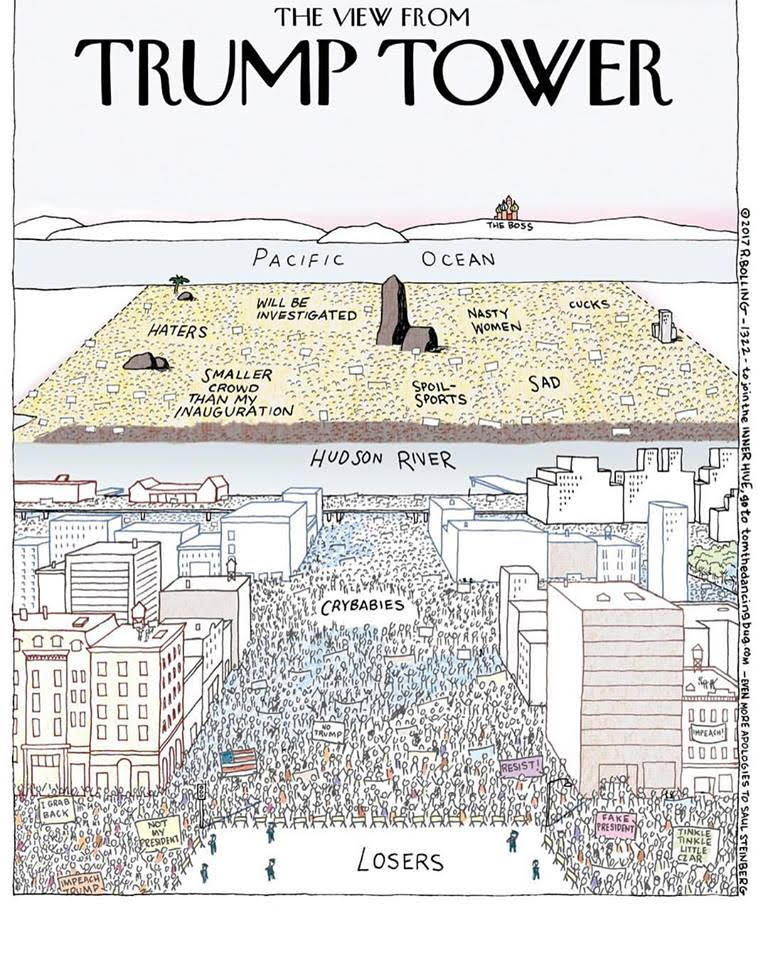

The World was shocked at the US's sweeping Muslim ban with another round of anti-Trump protests at home and abroad and the Global Markets are tumbling and the Volatility Index (VIX) is rising as even Green-Card Holders were banned from returning to the US on a sudden executive order that stranded thousands of legal immigrants overseas this weekend.

I'd love to not talk about politics but politics is driving the markets at the moment so responsible analysts NEED to discuss politics or they are doing you a tremendous disservices. I'm not going to get into the back and forth of the thing – that's all over the papers but we also declared a trade war with Mexico and China is now saying:

"'A war within the president's term', 'war breaking out tonight' are not just slogans, but the reality."

The commentary was first reported by South China Morning Post on Friday, and comes amid concerns about a trade war between the world's two largest economies. "The Chinese government is quite concerned about the potential for direct confrontation with the Trump administration," said Ian Bremmer of the Eurasia Group. "Chinese officials are preparing for the worst, and they expect to retaliate decisively in response to any U.S. policies they perceive as against their interests."

So happy Monday to you on Day 7 of the Trump Error. Over in Europe, Germany is now worried about too much inflation and is calling for the ECB to start tightening monetary policy but poor Italy is still having bank troubles (and Europe is down 1% this morning with Italy down 2%) and Greece and Puerto Rico are both heading into debt crises (again).

So happy Monday to you on Day 7 of the Trump Error. Over in Europe, Germany is now worried about too much inflation and is calling for the ECB to start tightening monetary policy but poor Italy is still having bank troubles (and Europe is down 1% this morning with Italy down 2%) and Greece and Puerto Rico are both heading into debt crises (again).

Peurto Rico got an extension but the IMF just said Greece's debt, at 275% of their GDP is "explosive and highly unsustainable". Explosive and unsustainable is what they say about collapsing stars – not economies inside the solar system! And if the IMF says this about Greece, then why are Japan and China still getting a pass – both of whom have over 250% debt to GDP (assuming you can even believe China's GDP number).

Perhaps Lord Trump is doing China a favor by starting a war to distract their population – giving the Communist Party someone to blame for their coming economic crisis. I don't think he's gotten around to pissing off Japan yet, maybe because they are still taking bids for casino rights over there – just like the 4 muslim countries Trump does business with were not included in his immigration ban (Azerbaijan, Egypt, Turkey and Saudi Arabia).

Perhaps Lord Trump is doing China a favor by starting a war to distract their population – giving the Communist Party someone to blame for their coming economic crisis. I don't think he's gotten around to pissing off Japan yet, maybe because they are still taking bids for casino rights over there – just like the 4 muslim countries Trump does business with were not included in his immigration ban (Azerbaijan, Egypt, Turkey and Saudi Arabia).

In fact, Trump was on the phone with Kind Salman of Saudi Arabia this weekend and reportedly spoke to him for an hour, maybe finding out why 11 of the 19 9/11 hijackers came from Saudi Arabia… maybe. Actually the call seemed to be about how we can help fighting Saudi Arabia's enemies,

“The Saudis welcomed Tillerson's appointment,” Teneo’s Holdings' Hawes said. “Tillerson is someone who has tremendous diplomatic experience in the region,” he said. “He is a known quantity. Right now, I think this is going as well as Saudi policymakers could have hoped.”

Anyway, back to China! China is essentially closed this week for the Lunar New Year and that's a good thing as they've been approaching a liquidity crisis all month and a week break will, hopefully, give the PBOC a chance to print up a bunch of money. As you can see from the chart, capital has been fleeing China since 2014 with estimates of $3-5 TRILLION leaving the country and bubbling into foreign stocks, bonds and especially real estate.

More and more of that capital is flowing through China's unregulated "Shadow Banking" system, which now dwarfs the banks that are under state control. That means that, in a crisis, there is no way for the Government to control what happens – scary! With borrowing costs rebounding in 2017, firms will likely run into trouble again as the real-estate cycle winds down – this time with even more debt in play.

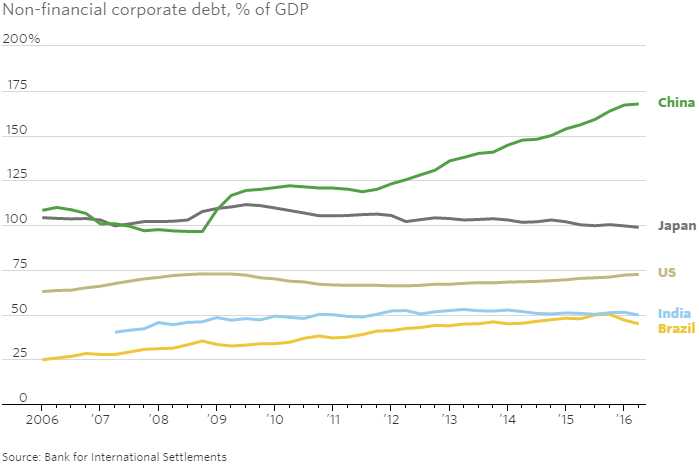

In some respects, China is much worse off than Japan with 170% of their GDP in Non-Financial Corporate Debt alone but, of course, those corporations are mostly owned or controlled by the Government so running the presses is a short-term solution to that problem too.

In some respects, China is much worse off than Japan with 170% of their GDP in Non-Financial Corporate Debt alone but, of course, those corporations are mostly owned or controlled by the Government so running the presses is a short-term solution to that problem too.

My big concern with China (and the World) is that they are one of the largest drivers of the Global Real Estate Recovery and rising rates my depress home prices and then panicky Chinese property investors may decide to dump their holdings and suddenly we're back in a crisis as home prices begin to drop rapidly, setting off more panic.

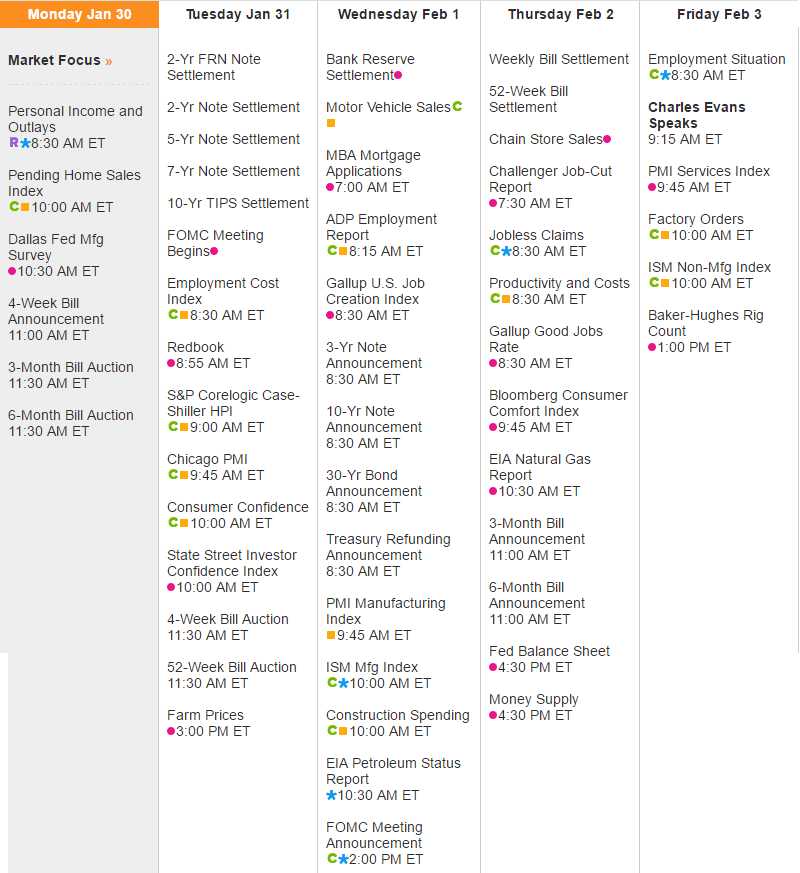

Needless to say, we're a bit skeptical of the Real Estate sector in 2017, even though we do see a US-based housing recovery, with rates holding back some of the enthusiasm. Nothing matters this week ahead of Wednesday's 2pm Fed Statement and we don't expect them to do anything so anything else would be a surprise:

Notice no Fed speak to move the markets and just Evans (dove) after the meeting on Friday morning, presumably to salvage the week with some encouraging words. We're still waiting for some encouragement from the earnings reports. So far, there hasn't really been much to justify the 10% "Trump Rally" and nothing Trump has done so far has justified buying stocks for 25 times earnings or higher. We'll see if this week's reports can tip the scales (doubt it):

We're still short (see last week's posts) and this morning, in our Live Member Chat Room, we added shorts back on the Oil Futures (/CL) at $53.25 to go with our Dow (/YM) Futures shorts from our Live Trading Webinar last Wednesday. We've already hit $52.75 for $500 per contract gains on the oil shorts – isn't it a good thing you saved $3 today by not subscribing!

Be careful out there!