There is a 100% chance the Fed will raise rates today.

There is a 100% chance the Fed will raise rates today.

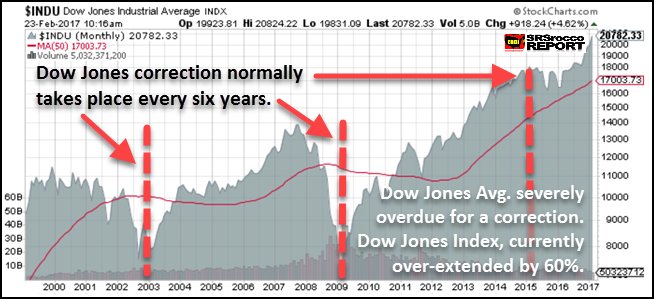

That's the consensus and I, of course, agree as I've been saying they HAVE to hike since the last meeting. Now that everyone agrees with me, let's move on to contemplating the result of the Fed hiking and what it means for the year ahead. Clearly, as you can see from the chart, the Fed is not hiking rates because the economy is booming. The Fed is hiking rates to ward off inflation because a stagnant economy with inflation (stagflation) is even worse than a recession from the Fed's point of view.

Also, the markets are what Allan Greenspan liked to call "irrationally exuberant," which is also clear from the chart and it's also not good to see so much money chasing so little profit as it's a classic misallocation of resources and, while investors may not feel the need to worry about the future consequences of their current actions – the Fed certainly does and it is their job to pop these bubbles – as gently as possible.

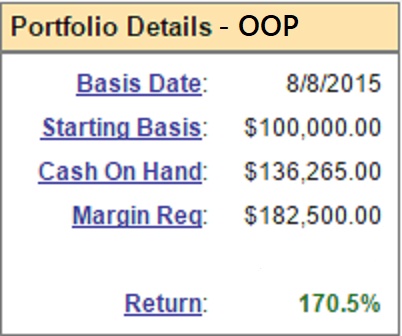

We are very well-hedged for a correction in our Member Tracking Portfolios and I began a full review last night in our Live Member Chat Room. In our Options Opportunity Portfolio, which is tracked over at Seeking Alpha, where we raised more cash and added more hedges on March 1st and that didn't stop our bullish positions from adding $7,000 over the past two weeks – with no adjustments – so I'd have to say we're very well-balanced at the moment.

We are very well-hedged for a correction in our Member Tracking Portfolios and I began a full review last night in our Live Member Chat Room. In our Options Opportunity Portfolio, which is tracked over at Seeking Alpha, where we raised more cash and added more hedges on March 1st and that didn't stop our bullish positions from adding $7,000 over the past two weeks – with no adjustments – so I'd have to say we're very well-balanced at the moment.

Having a well-balanced portfolio is the key to long-term success. You can't only make money in bullish markets or only make money in bearish markets or those dry spells can kill you. Smart Portfolio Management is more like surfing, where we look for a good wave to ride and then try to stay on board for as long as we can and try to cash out before the wipeout. When it's over, we paddle our cash back out to sea and look for the next exciting opportunity.

Though we are generally long-term investors, we are not adverse to taking short-term profits. We have even cashed in our beloved Apple (AAPL) stock from time to time, because nothing goes up forever and, unlike Buffett, we don't feel the need to "ride out" the corrections.

Though we are generally long-term investors, we are not adverse to taking short-term profits. We have even cashed in our beloved Apple (AAPL) stock from time to time, because nothing goes up forever and, unlike Buffett, we don't feel the need to "ride out" the corrections.

The other very important aspect to our portfolio strategy is HEDGING and it's surprising how many "investors" don't know how to hedge properly – including hedge fund managers! We adjusted our hedges in the OOP on March 1st, using the ultra-short Russell ETF (TZA) and the ultra-short Nasdaq ETF (SQQQ) as our primary hedges. TZA is now at $19.12 and it's a 3x ETF so a 5% drop in the Russell (to 1,294) would pop TZA 15% to $22.

$22 is, of course not a huge number but then we take that possibility and use options for leverage and then we can hedge our hedge with any stock that we'd REALLY like to buy if the market drops 20% so for example, we can set up a TZA hedge as follows:

- Buy 50 TZA April $18 calls for $1.65 ($8,250)

- Sell 50 TZA April $21 calls for 0.60 ($3,000)

- Sell 10 Taser (TASR) 2019 $20 puts for $2.90 ($2,900)

That nets you into the $15,000 spread for $2,350 in cash and the ordinary margin requirement for selling the TASR puts is $2,014, so it's a margin-efficient way to raise $2,900. You are, of course, obligated to buy 1,000 shares of Taser for $20 (now $23 so a 13% discount) if it falls below $20 but we love TASR – it's our Stock of the Decade with a $50 target for Jan 2020.

Since the spread is $1.12 in the money to start, if TZA finished flat, you collect $5,600 at April expirations so the only way you can lose is if the Russell goes higher and, if the purpose of this trade is to protect your longs – then that's not a big deal. Hedging our hedges with stocks we want to buy anyway is a core part of our strategy. Keep in mind that, if the market crashes and TZA is over $22, we have $15,000 of cash to spend on $20,000 worth of TASR – just within this trade set-up!

If all goes better, then we time our correction right, collect the $15,000 for a $12,650 (538%) return on cash in 37 days and then, by 2019, Taser is back over $20 and the short puts expire worthless – so we win on both ends, turning a 15% gain in TZA against a 5% drop in the Russell into a 538% return on cash – THAT'S A NICE HEDGE!

If all goes better, then we time our correction right, collect the $15,000 for a $12,650 (538%) return on cash in 37 days and then, by 2019, Taser is back over $20 and the short puts expire worthless – so we win on both ends, turning a 15% gain in TZA against a 5% drop in the Russell into a 538% return on cash – THAT'S A NICE HEDGE!

That's the advantage of the long-term short calls – they have time to heal. Still, we are PROMISING to buy 1,000 shares of TASR at $20 ($20,000) – this is not an obligation to take lightly so make sure it's a stock you REALLY want to own.

We have a Watch List for our Members with 21 stocks we like if they go on sale. TASR is one of them, Exxon (XOM) is another at $80. We'll be discussing some of these stocks as well as some more hedges in today's Live Trading Webinar at 1pm (EST) and we'll be reviewing our other portfolios in our Live Member Chat Room throughout the day while we wait for the Fed to rock our World.

Be careful out there!