Treading water for two weeks.

Treading water for two weeks.

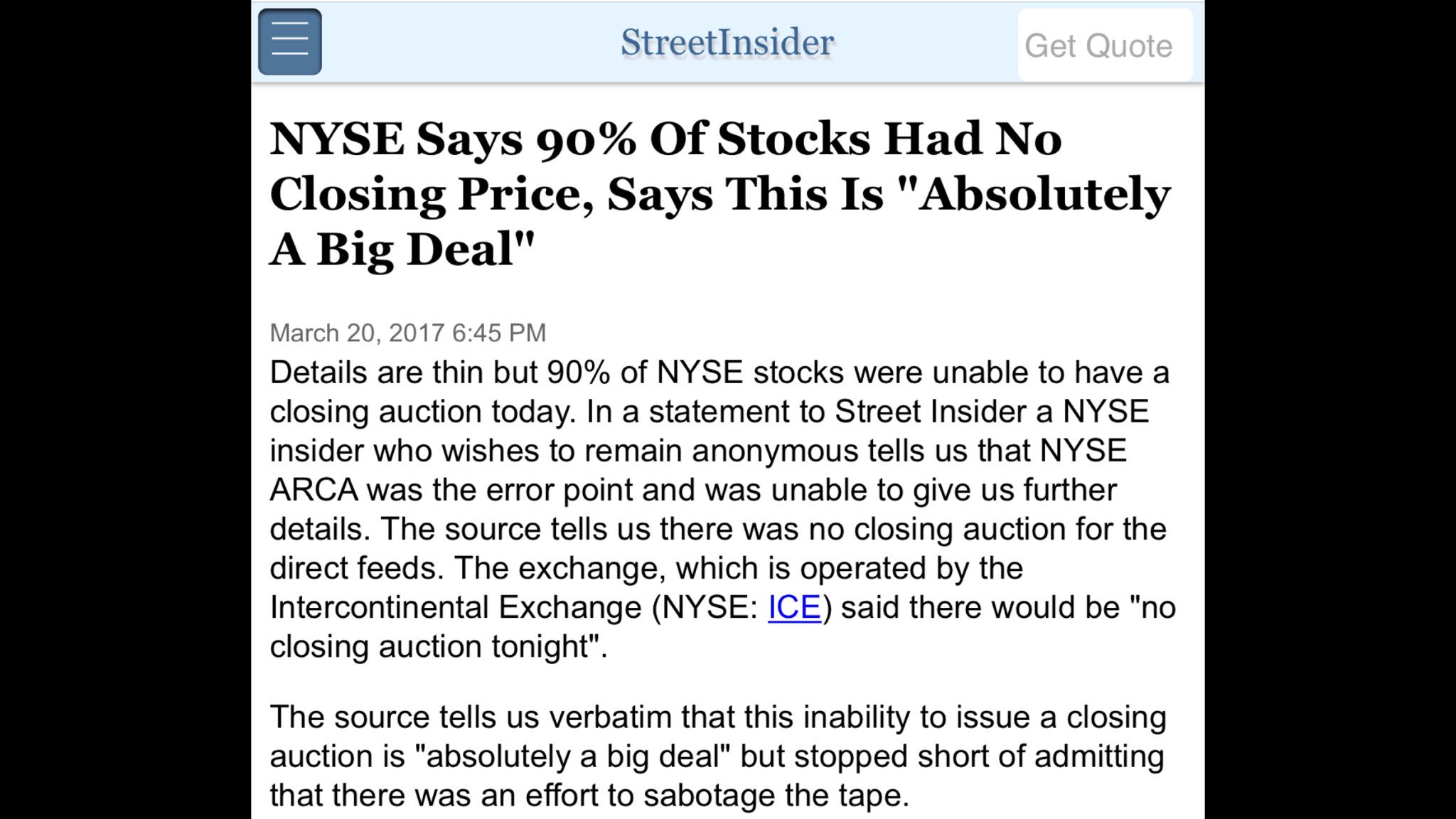

On March 7th, I wrote: "Testy Tuesday – 11,550 or Bust on the NYSE" and yesterday the NYSE closed at 11,556.9 so no harm in waiting around for the Fed. At the time we pointed out that declining volume was greater than advancing volume and that was still the case yesterday with 1.86Bn shares in decline vs. 1.15M shares moving higher in light trading but yesterday's action was tainted by a failure at the closing auction. After-hours trading was suspended at 4:13 and all open orders were cancelled.

It seems to be working again this morning but it's very scary when a major market system – THE major market system, fails on you. If that had happened during a trading day – it would have been total chaos of the "flash-crash" variety. Have I mentioned how much I love CASH!!! lately? Hedges too!

Our well-hedged Long-Term Portfolio is up over $9,000 since our 3/10 review despite the market not making any progress. That's because we SELL risk to stock market gamblers using our system which teaches our Members to Be the House – NOT the Gambler. Notice we are 75% CASH!!! (have I mentioned how much I love CASH!!!) but the positions we do have are on track to make $250,000 this year as they use options to both hedge and leverage the cash we do have in play. You don't need to risk a lot to make a lot.

Our well-hedged Long-Term Portfolio is up over $9,000 since our 3/10 review despite the market not making any progress. That's because we SELL risk to stock market gamblers using our system which teaches our Members to Be the House – NOT the Gambler. Notice we are 75% CASH!!! (have I mentioned how much I love CASH!!!) but the positions we do have are on track to make $250,000 this year as they use options to both hedge and leverage the cash we do have in play. You don't need to risk a lot to make a lot.

By selling risk premium, we don't need an up market to make money – flat or even slightly down works for us and anything less than slightly down kicks in our hedges and keeps us from losing too much. You don't hit a lot of home runs following this strategy but your batting average usually leads the league!

Balance is also key in this kind of market, we're slightly bearish overall, maybe 60:40 but we're moving towards 70:30, which is as extreme as we ever get in our positions. If you are 100% bearish and you are wrong, and the market goes 20% against you – you have 80%. If, on the other hand, you are 70:30 bearish and the market goes 20% against you, you end up 56/36, which is 92 – 18% better off and you only need an 8% gain to recover but, from 80%, you need a 25% gain to recover. 20% in your favor gives yields 84/24, which is 108 but you have that 108 when the market is at 80 – so plenty of money to take advantage of the dip. See: "How To Get Rich Slowly."

Balance is also key in this kind of market, we're slightly bearish overall, maybe 60:40 but we're moving towards 70:30, which is as extreme as we ever get in our positions. If you are 100% bearish and you are wrong, and the market goes 20% against you – you have 80%. If, on the other hand, you are 70:30 bearish and the market goes 20% against you, you end up 56/36, which is 92 – 18% better off and you only need an 8% gain to recover but, from 80%, you need a 25% gain to recover. 20% in your favor gives yields 84/24, which is 108 but you have that 108 when the market is at 80 – so plenty of money to take advantage of the dip. See: "How To Get Rich Slowly."

I noted in yesterday's Report that we are getting more aggressive on the short side, using Tesla (TSLA) and Amazon (AMZN) as short-term focused shorts and we got great entries on both as they moved higher (which is what we hoped for) but now we'd like them to stop, please.

Speaking of stopping please – last night President Trump was speaking in Louisville, KY and he repeated his pledge to "roll back drug prices" and that his administration intends to add pricing legislation to the current healthcare bill, or one coming up "right after." Trump said: "The cost of medicine in this country is outrageous, many times higher that in some countries in Europe and elsewhere. Why? You know why? Campaign contributions. Who knows. But somebody's getting very rich. Medicine prices will be coming down. Way, way, way down."

The Biotech Index (IBB) is probably the most sensitive to drug prices and look at the hit it took into the election as fear of Hillary coming down on prices took hold. Now Trump, desperate to build his horrible approval ratings, is dipping into his greatest hits list – even if they are Hillary's. While it's all just talk at the moment, a fun way to play yet another huge dip in IBB would be to buy the Sept $250 puts at $4.50 because the decay over 6 months is about 0.75/month and IBB should have a hard time getting over $300 while the Delta is 0.15 so a $10 drop in IBB will pay $1.50 for a quick (33%) gain.

The mistake most people make in buying puts is they try to buy cheap ones that decay so rapidly that they don't have time for their gains to materialize. Here we're simply reading the news and reacting to it with an appropriate bet that we are likely able to pull with very little damage should the narrative change.

Freeport McMoRan (FCX) is one we have in our LTP already and they got some good news (as we expected) today and should be taking off. The recent trade ideas from our Live Member Chat Room are still playable at the moment and they were:

Submitted on 2017/02/21 at 12:26 pmFCX down 5.4% on big volume with DB downgrade ($12 target). We'll wait but happy to get back in on them. We do have a 2019 $7/12 bull call spread in the LTP but nothing in the OOP.

Submitted on 2017/03/16 at 10:39 amFCX/Albo, Hanj – I do like them and no reason they should fall all the way back to $10. In the LTP, we already have the 2019 $7/12 bull call spread with short $8 puts at net nothing (25) and that's on track but I suppose as a new play, you could use the following:

- Sell 20 FCX 2019 $10 puts at $1.70 ($3,400)

- Buy 20 FCX 2019 $10 calls for $5 ($10,000)

- Sell 20 FCX 2019 $15 calls for $2.80 ($5,600)

That's net $1,000 on the $10,000 spread that's $5,500 in the money to start with a potential gain of $9,000 at $15 (900%) and worst case is we own FCX at net $11, which is still about $2 off (15%) the current price. ToS says margin is $2,000 so it's a nice, efficient trade and FCX is back to being 73% copper and 20% gold/molly with just a little oil and gas left.

The reason I wouldn't add them to the OOP is that they just restructured and I'd want a better look at them before taking a big stand and a small stand (5-10) isn't worth taking up a slot when there are unknown factors in their valuation.

Submitted on 2017/03/20 at 3:19 pm

GLNCY/Pat – Well Zinc is hot right now and Glencore is huge but into a lot of stuff besides Zinc. It's a good, steady, long-term hold but a crap dividend so I'd rather have FCX, which is $12.62 but you can sell 2019 $12 calls for $3.60 and $10 puts for $1.60 and that nets you in for $7.42/8.71 so you make $4.58 (62%) if called away at $12 (flat) or higher or you own 2x for $8.71, which is a 32% discount as your worst case. To make that on GLNCY, it has to hit $13.77 but then the next cycle – it has to do it again while you can make your 62% every other year on FCX whether it's up or flat. As a bonus, FCX used to pay a nice dividend, it was 0.56 in 2015 but they killed it last year and this year as they dumped out of that bad oil investment. If they put it back on, you'll be in great shape.

And that is how we trade at PhilStockWorld – Read the news, find a good stock, pick a good strategy, hedge the strategy. After all that work we can go back on vacation until something else catches our eye.