Does anything bother investors anymore?

Does anything bother investors anymore?

To celebrate day 97 in office, President Trump told Reuters "There is a chance that we could end up having a major, major conflict with North Korea. Absolutely." Remember, this is the same Donald Trump that said during the campaign "Why can’t we use nuclear weapons" and, when asked by Chris Matthews why he would say such a thing, Trump replied: "Then why are we making them? Why do we make them?"

Oh sure, it was just a one-time thing. Except it wasn't. That was March 30th. The next day, Fox's Eric Bolling tried to get Donald off the hook by having him clarify, saying: "I understand they are not taking the cards off the table for ISIS or Islamic terror. But when Chris (Matthews) expanded to Europe, what about that?"

Oh sure, it was just a one-time thing. Except it wasn't. That was March 30th. The next day, Fox's Eric Bolling tried to get Donald off the hook by having him clarify, saying: "I understand they are not taking the cards off the table for ISIS or Islamic terror. But when Chris (Matthews) expanded to Europe, what about that?"

And, of course, you want your President to say "Of course not, that would be insane" but our President-to-be said: "Europe is a big place. I’m not going to take cards off the table. We have nuclear capability… I’m not going to take it off the table. And I said it yesterday. And I stay with it."

As I've noted yesterday, we're long on Oil Futures (/CL) as well as the Oil ETF (USO), which is now at $10.25 for both the normal summer bump and also because Bush's misguided wars against Iraq and Afghanistan consumed 1.5M barrels per day for the armed forces operations (tank mileage is measured in gallons per mile) and an escalation of Troops on that end of the World will be just as expensive. Good thing we boosted our military budget by $54Bn – looks like we're going to need it.

$54Bn is just a drop in the bucket compared to the $350Bn increase in military spending we had under Bush II, peaking at $750Bn before Obama took control and brought us back down under $600Bn but it took Bush 8 years to push $350Bn to his Defense donors and that's only $44Bn a year, Trump is ahead of him already in just 98 days!

This wasn't very hard to predict though. Republicans love war and love military spending. Back on Dec 23rd, we discussed this in our Morning Report: "Merry Trumpmas – Looking Forward to a Wild New Year" and at the time, we decided we couldn't beat them so we may as well join them and our trade ideas were:

Because of their work on nuclear fusion, Lockheed Martin (LMT) is our favorite US defense contractor and they've been down recently as Trump tweeted out his displeasure with F35 cost overruns but, overall, we think it's a nice opportunity to go long LTM:

- Sell 5 LMT 2019 $200 puts for $13 ($6,500)

- Buy 5 LMT 2019 $220 calls for $45 ($22,500)

- Sell 5 LMT 2019 $260 calls for $23 ($11,500)

That puts you into the $20,000 spread that's 80% in the money for net $4,500 so the upside potential, if LMT just manages to move up $10 in two years, then it's a profit of $15,500 (344%) and ordinary margin on the short puts is about $10,000 but those puts are a nice 20% discount to the current price – we're playing conservative because we do expect a market pullback.

We also like Raytheon (RTN), who get paid almost $2M every time the US fires a Tomahawk missile (and we do that a lot!). So, to bet on the escalating cold war (and the proxy wars we love to fight), we like:

- Sell 5 RTN 2019 $120 puts for $8.50 ($4,200)

- Buy 5 RTN 2019 $120 calls for $29 ($14,500)

- Sell 5 RTN 2019 $145 calls for $15 ($7,500)

In this case net $2,800 in cash buys us a $12,500 spread so the upside potential at $145 (where we are now) is $9,700 (346%). As with the LMT trade, we're being conservative in our initial entry, in case the market sells off but, if it doesn't, nothing wrong with "just" making a 346% return on cash. Margin requirement for 5 short $120 puts is just $6,000, so it's a nice, margin-efficient trade as well.

As you can see from the charts, both stocks have taken off. The LMT $220/260 spread is now $28.50 ($14,250) and the short $200 puts are $6 ($3,000) for a net $11,250 profit, which is already a 250% gain on cash but I see no reason to believe we won't collect our full $20,000, which is still almost a double from here.

The Raytheon 2019 $120/145 spread is also well in the money and is now net $19 ($9,500) and the short $120 puts are down to $4 ($2,000) for net $7,500 and that's a $4,700 gain on cash so far (167%) and, like Lockheed, I don't see any reason we won't collect the full $12,500 so this one is actually good for a new trade as you can still make net $7,800 off a $4,700 entry and that's another 165% – only it will take two years vs the 4 months we just did it in for you.

If you want to get trade ideas like this every week, SUBSCRIBE to Philstockworld or SUBSCRIBE to our Options Opportunity Portfolio over at Seeking Alpha – it's not complicated, we read the news, make an appropriate trade and then sit back and wait to cash out…

Of course, it's difficult sometimes to be a Macro Fundamentalist and discuss the news when you get censored for "political content" (like Wednesday's post, where I discussed the new Tax Plan). How can you ignore politics when playing the markets? On Dec 23rd, we knew we had elected a juvenile narcissist to be the Commander in Chief of the Armed forces and, on the campaign trail, he had been waving his nukes around like a schoolyard bully so of course we concluded it would be a good time to go long on Defense Contractors – especially since it was obvious Trump, like Bush II, would have no trouble at all lying to Congress to push us into an expensive war under false pretenses.

That's called an investing premise and yes, it happens to involve a politician but how can you possibly invest in Defense Contractors without discussing geopolitics?

Fortunately, yesterday's post was published because we nailed the bottom on Oil Futures (/CL) at $48.50 and, this morning, we're already back to $49.50 which is good for a $1,000 per contract gain (you're welcome) but I think we'll do better so I'd take 1/2 off the table and put a stop on the rest at $49.20 (bumping the stop up 0.25 with each 0.25 of progress).

Fortunately, yesterday's post was published because we nailed the bottom on Oil Futures (/CL) at $48.50 and, this morning, we're already back to $49.50 which is good for a $1,000 per contract gain (you're welcome) but I think we'll do better so I'd take 1/2 off the table and put a stop on the rest at $49.20 (bumping the stop up 0.25 with each 0.25 of progress).

USO was $10.12 yesterday when we called the long and our option play is in great shape. Gasoline (/RB) fell a bit below our $1.55 long target but already it's at $1.586 and, at $420 per penny, per contract, that's a $1,512 per contract winner but that one we should take the money and run or for sure cash 1/2 and put a stop at $1.575 on the rest (penny trail) so we lock in $1,250+ gains. Our UGA play should do well for you also – you are very welcome!

In our Live Member Chat Room this morning, I reiterated my call to short the Russell Futures (/TF) at 1,420 with tight stops above and we also liked the Nasdaq short (/NQ) at the 5,600 line and, so far, we nailed that one, with the Nas already back to 5,587. Our favorite trade idea of the morning is shorting Amazon (AMZN), now at $950, by buying the May $900 puts for $5(ish). I think the negative guidance will sober people up once we open and plenty of people will take advantage of the pop to lighten up (we sold the June $900 calls for $50 – so it's a nail-biter for us).

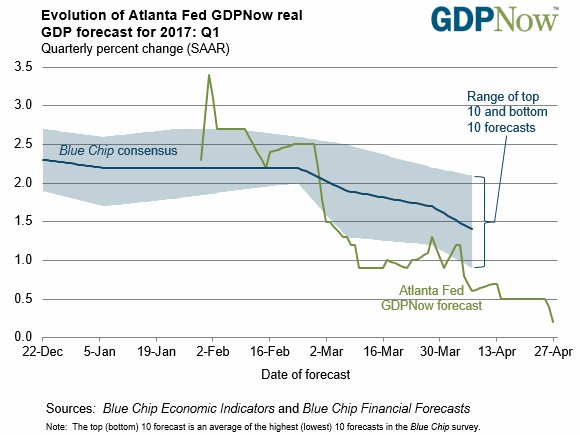

GDP came out this morning and it was bad, at 0.7% vs 1.2% expected by leading economorons – but not as bad as the Atlanta Fed's most recent GDP Now forecast, which pegged GDP at 0.2%. Unfortunately, the Atlanta Fed gets their data very early and they tend to be ahead of the curve in their forecasts but, as you can see from the chart – they tend to end up being right as well. This does not bode well for Q2 – especially as consumer spending growth fell 90% from 3.5% to 0.3%. And this is only the first estimate of GDP, it might be revised lower next month.

GDP came out this morning and it was bad, at 0.7% vs 1.2% expected by leading economorons – but not as bad as the Atlanta Fed's most recent GDP Now forecast, which pegged GDP at 0.2%. Unfortunately, the Atlanta Fed gets their data very early and they tend to be ahead of the curve in their forecasts but, as you can see from the chart – they tend to end up being right as well. This does not bode well for Q2 – especially as consumer spending growth fell 90% from 3.5% to 0.3%. And this is only the first estimate of GDP, it might be revised lower next month.

Neither does a Government shutdown, which is looming this weekend and the best we can hope for is that they extend the deadline to next Friday – so we can enjoy the drama all over again.

Have a great weekend,

– Phil