Why we need to act on climate change now (updated 9-3-17)

[Interview with Jan Dash PhD, by Ilene Carrie, Editor at Phil’s Stock World.]

Updated in the wake of Hurricane Harvey on September 3, 2017.

Jan Dash PhD is a physicist, an expert at quantitative finance and risk management, and a consultant at Bloomberg LP. In his thought-provoking book, Quantitative Finance and Risk Management, A Physicist’s Approach, he devotes a chapter to climate change and its long-term systemic risk. Jan’s Climate Portal provides background. In this interview, Jan discusses climate change and the way inaction is threatening our future.

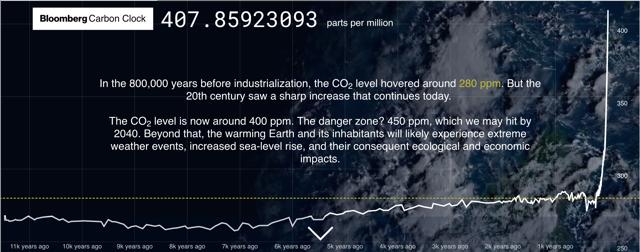

Ilene: Hi Jan. Thank you for taking the time to share your ideas on global warming. . . I’m looking at a graph, along with the current atmospheric CO2 level that you and Yan Zhang modeled for the Bloomberg Carbon Clock, which shows just how sharply CO2 levels have increased mostly in only the last 50 years relative to the last 12 thousand years. And I can see that CO2 levels are currently about 400 ppm – and that at 450 ppm, the text says we will reach a “ danger zone.” What happens when CO2 levels reach 450 ppm? Why is that level considered the “danger zone?”

Screenshot of Bloomberg’s Carbon Clock

Jan: If we can limit CO2 to 450 ppm, it is likely that we can limit the average global temperature increase to around 2 degrees Centigrade or 3.6 degrees Fahrenheit above pre-industrial levels. This is the goal of the Paris Agreement, designed to leave a livable planet to our descendants.

Ilene: Do you think we will be successful?

Jan: With present policies, it does not look like we will achieve that goal. Action must be increased urgently to avoid increasingly severe climate impacts on our grandchildren and their descendants. Solving the climate problem is prerequisite to any long-term solution to the many serious issues facing humanity today. Climate change is actually the outstanding moral, ethical, and survival issue of our time.

We are in a “ danger zone” now. Today’s CO2 level of around 400 ppm is going up rapidly and is already above CO2 levels since the beginning of civilization. The average global temperature is moving out of the stable balanced range that made civilization possible. The present increase in CO2 is outside of natural variation and this extra CO2 can be shown by rigorous physics analysis to be due to human activity, mostly burning fossil fuels. Future climate impacts mostly depend on what we do or don’t do to limit CO2 from burning fossil fuels.

We are now starting to see the effects of climate change (in statistical terms, the signal of climate change impacts is now apparent). Some of the impacts have already been very bad and out of statistics for natural variability. The effects so far, however, are only a small echo of the increasingly severe impacts our grandchildren will experience if we do not act substantially to mitigate climate change now.

Heron by Gellinger/Pixabay

Ilene: If we fail to get CO2 under control, what will the earth be like in the second half of the century?

Jan: We have always had disasters. Climate change makes them worse. Long-term climate impacts in the absence of action will include increasingly severe food and water shortages worldwide, climate-induced migrations due to rising sea levels that will make many coastal cities and regions unlivable, increasingly negative health impacts, increasing extreme weather, increasing political and military instabilities with potentially increased terrorism, increasingly damaged valuable ecosystems, more extinctions of species, and a whole host of other bad impacts. The US military has been writing for years about climate change negatively impacting US national security.

How increases in CO2 raise the average global temperature, what likely risks will follow, and what we can do to lessen those risks are all presented in comprehensive reports. The Intergovernmental Panel on Climate Change (IPCC) volumes run several thousand pages. I get reports every week from reputable universities and laboratories worldwide detailing the increasing dangers of climate impacts.

The real question is what legacy are we choosing to leave our grandchildren – will they have a decent way of life or will they have to deal with massive climate problems? We actually do not have a choice about finding climate solutions if we want to leave a livable world to our descendants. We should think in a risk-management framework.

.

This image was taken in Ulm, Germany, when the river Danube (Europe’s second longest river) caused flood damage following excessive rainfall in June 2013. Hans/Pixabay

Ilene: How do you apply the mathematics of risk management to climate change?

Jan: Climate Change Risk Management is the sensible paradigm that is increasingly being employed to act on climate change. We deal with all sorts of risk. Climate change is a risk. We can deal with the risk of climate change. We have the technology now. Climate risk management is not and does not have to be mathematically precise. We never have complete certainty for anything, and we do not need certainty to act. The analogy I like is that if you are sitting in a car stalled on the railroad tracks, you don’t need to know the exact velocity of the train that is approaching in order to act. The biggest uncertainty is what the human race will or will not choose to do to limit CO2. Climate risk management tools include figuring out corporate climate risk approximately using scenarios, for example the scenarios described by the Task Force on Climate Related Financial Disclosures. Other risk tools include the Social Cost of Carbon and the nascent Climate Change Value at Risk. In my book, I also describe how a formal approach to Climate Change Risk Management can be useful.

The basic math of risk management is to measure risk at a high confidence level among possible scenarios; this means a precautionary approach. I do want to point out a parallel with former V.P. Cheney’s “One-Percent Doctrine”: If there’s a 1% chance that climate change can be devastating to humanity, we have to treat it as a certainty in terms of our response.

Ilene: In your book, you discuss “the negatively ethically-based discount rate for valuation of future climate impacts.” Could you explain a little about that?

Jan: There are two ways to look at climate action today regarding discounting, generally used to quantify today’s perspective. The first way uses the profit rate a firm requires. If that profit rate is used as the discount rate to discount future impacts on our descendants, there is hardly any present value to us for the suffering of our descendants, and this discourages climate action. I think this view is unethical. The second (and I believe better) way to look at climate action today is simply the reduction of suffering for our descendants, by climate action, independent of any present value and discounting. Actually, if we do not act sufficiently, ethically we should put something aside for our descendants to cope with climate change. This would translate into an ethically-based negative discount rate.

We can solve the “ climate problem,” to mitigate climate change. We really can, and without too much cost, especially taking into account the costs of climate damage due to inaction. The solutions to climate risk will present opportunities, including more jobs, which will act as a counter to mitigation costs. We need leaders that will step up to provide incentives and long-range climate action plans.

Ilene: Speaking of leaders, Donald Trump’s decision to withdraw from the Paris Climate Agreement last month seems like an enormous setback to the worldwide effort to ultimately cap atmospheric CO2 levels. Will Trump’s exit from the Paris Agreement move the day of reckoning substantially closer?

Jan: The analogy I like is that all countries are in a badly leaking boat. All countries need to help bail out the water to survive. If a country becomes a bad agent and decides not to help, either the others have to work harder or we all sink. The Paris Agreement was the first to achieve international unanimity with the bottom-up approach of each country “doing what it can” to mitigate climate change with the “Nationally Determined Contributions.” To achieve the goals of the Paris Agreement, the world consumption of fossil fuel needs to level off in the next few years and drop to zero by mid-century.

Climate change will hit some countries harder than others – especially poor countries that are most vulnerable to climate change and that did the least to cause the climate problem, a huge moral and ethical issue. Vulnerable peoples are affected the worst by climate change because they have the fewest resources to cope with climate impacts. But in the end, if we do not act robustly, all countries will eventually be badly hit — there will no place to hide.

Trump’s decision to pull the US out of Paris is not the last word, but it adds substantially to the risk of going well past the 450 ppm level and missing the goal of transitioning to renewable energies by mid-century, which is necessary to leaving a livable planet to our descendants.

Ilene: Do you believe that states, cities, and corporations will make up for the lack of participation by the federal government?

Jan: The world’s governments luckily seem to have pulled together since the announcement, with additional motivation to act on climate change, including China and India. Many US local and state governments are being proactive, including mid-western states that have increasing wind energy (because wind is increasingly lower in price and economical). Many corporations are also stepping up significantly. I don’t know if it will be enough. The US federal government is also worsening the climate problem in other ways, including federal opposition to the renewable energy development needed to replace burning fossil fuels. This opposition is economically shortsighted, since renewable energies have the promise to open a new distributed energy economy with significant opportunities.

Transition to renewable distributed energies can have huge positive economic significance similar to the change from centralized computing (mainframes) to distributed computing (iPhones, Internet) that led to a new, more productive economic paradigm. In transitioning, we need to be mindful of those people who are tied to the fossil fuel sector, as well as others vulnerable to climate change, who will require assistance to survive.

Flood damage by the river Donau (Danube) in Ulm, Germany, in 2013. Hans/Pixabay

Ilene: I’ve read that as CO2 accumulates, future warming gets “locked in.” You appear to confirm that claim.

Jan: You are right about the persistence of CO2. A substantial fraction of CO2 emitted stays in the atmosphere on time scales of 100 years. The higher the cumulative CO2 level gets, the worse the impacts will likely be.

Ilene: Positive feedback mechanisms worsen any increase in temperature, as increased CO2 provokes other effects that lead to further warming. Are there significant negative feedback mechanisms as well?

Jan: Positive feedbacks are bad because they increase global warming, and substantial positive feedbacks are known to exist. Negative feedbacks would be good. Unfortunately for us, no convincing evidence exists for negative feedbacks substantial enough to stop global warming. The relevant metrics including all feedbacks are the Equilibrium Climate Sensitivity and Transient Climate Response. The probabilities of various values of these metrics from many sources are documented in the IPCC 2013 AR5 Science report – see Ch. 12, Box 12.2, page 1110. The bottom line is that we should not be hypnotized by the remote chance that negative feedbacks will save us by producing low values for these metrics. Prudent risk management principles tell us that we should base our action using at least the average values for these metrics, even higher than average. Regardless, climate impacts will worsen sooner or later without substantial action. The message is unchanged. We need to act to mitigate climate change now.

Ilene: Do you have a solution to climate change in mind?

Jan: We will need a portfolio of actions. Instead of thinking about a single 100% solution that does not exist, think of twenty 5% solutions which do exist and which provide practical ways of solving the climate problem. This portfolio of risk-motivated solutions will need action from individuals, corporations, investors, NGOs, including faith groups, and governments at all levels to be successful. There are many things we can do. For a start, people can call their representatives to urge climate action. A good idea is to put an honest price on carbon in the US, as suggested by the conservative Climate Leadership Council and by the Citizens Climate Lobby. I repeat, we (humanity) are already in the “danger zone”; we can solve the climate problem, but we must ramp up our efforts now.

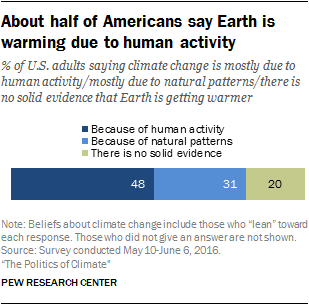

Ilene: Many people believe that there’s no such thing as climate change; others believe that, while climate change may exist, it’s due to natural processes over which we have no control. According to a recent Pew Research Center study, slightly less than half of US adults believe that climate change is mostly due to human activity.

Source: Pew Research Center

What do you think the primary reasons are for such widespread skepticism despite an enormous body of scientific evidence?

Jan: In 2002, a Republican strategist Frank Luntz wrote a very influential memo that recommended deliberately attacking climate science by emphasizing “doubt” as a way to avoid acting on climate change. The same strategy had formerly been used by the tobacco industry that attacked the science demonstrating the dangers of tobacco to protect cigarettes. We now have a whole industry of disinformation on climate change and a destructive politicization of climate science. Careful climate research papers from universities and laboratories worldwide are opposed by scientifically invalid disinformation from right-wing think tanks. This disinformation – distorting the very nature of science – contains factual errors, flimsy erroneous arguments, and cherry-picked data used with false generalizations, among other fallacies. The Trump administration is mostly saturated with climate disinformation and ignorance, obstructing climate action. Trump appointees now unfortunately running the EPA and other agencies spout climate disinformation, ignoring or suppressing valid climate science.

I believe that as the impacts of climate change become more evident, people will stop trusting the media and politicians that loudly push climate disinformation, in spite of tribal loyalties and confirmation bias.

The good news is that most people do want action on climate change. Prudent risk management on climate would say that action is warranted. People who believe climate change is not a problem might ask themselves “what will I tell my grandchildren if I’m wrong?”

Arctic Ice Free-Photos/Pixabay

Ilene: How are the impacts of global warming most likely to destabilize the worldwide financial system? Given that there are multiple, serious consequences of climate change, what are the most worrisome pathways to an economic crisis?

Jan: I believe that financial and economic systems worldwide are, to use the language of physics, in unstable equilibrium. Economic and financial systems can be thrown into crisis by any sufficiently strong perturbations. The 2008 crisis is the latest example. I believe that climate change unfortunately has the potential to generate deep economic and financial crises, and I am not alone in that belief. Pathways to an economic crisis if we do not act sufficiently will include physical climate impacts and transition impacts from fossil fuels to renewables. The physical effects will negatively affect supply chains and business generally. If transition risk is not handled reasonably, severe economic problems can result. For large systemic worldwide climate impacts, recovery from crisis could be very long, if it happened at all. Estimates in economic models of future GDP levels generally do not include the climate-induced crisis effect I am talking about.

Ilene: Are there any investing themes we should be aware of?

Jan: Dominant future investment themes are pretty clear – notably renewable energies (wind, solar, batteries, etc.), which are rapidly becoming economically more and more competitive. Electric cars, better electric grids, and energy efficiency are others. Technologies currently in research (fourth-generation nuclear energy, fusion energy, as well as carbon sequestration), are promising long-term investment opportunities. Divestment from fossil fuels will avoid financial losses in the transition from fossil fuels to renewable energies. As mentioned before, transition should be largely completed by 2050 if we are to leave a livable world to our descendants, with large amounts of carbon remaining in the ground as useless “stranded assets.”

Ilene: What about just adapting to climate change? Is adaptation viable on a long-term basis without mitigating climate change?

Jan: Adaptation to some extent will be necessary along with any amount of mitigation, with increased adaptation needed for less mitigation. The impacts that I mentioned will get worse and worse if we do not mitigate climate change substantially. Some people will adapt, though in a damaged world. The poor and vulnerable will be forced to adapt the most to survive, if they can. Many people will die early. If we have business as usual, BAU (with at most a token amount of climate mitigation), the planet in 2100 will be very different from what it is now. It will be a hostile place. I wouldn’t want to be there. Eventually the planet under BAU basically will become unlivable. It’s that simple. Again, right now we are moving out of the balanced temperature range that has made civilization possible. We need a simple message. The message is “act now.” Anything else is too risky.

Hurricane Harvey

The frontage road surrounding the Houston Chronicle on three sides, submerged in water due to Hurricane Harvey, August 28, 2017. Al Lewis, Houston Chronicle

Ilene: Do you believe the hurricane in Houston, particularly its severity, is a symptom of climate change and a preview of what to expect in the future?

Jan: Yes. The quick answer is that hurricanes now occur in a background of climate change and global warming, tending to make them more intense than they would be otherwise. Unfortunately, future extreme weather events will be made increasingly more extreme by man-made global warming simply because they will have more energy to wreak havoc. Warmer water gives hurricanes more energy when they form, and warmer air can hold more moisture, producing more rain. Sea level rise increases storm-surge flooding. There is evidence that the jet stream is being modified by climate change, potentially increasing the time that hurricanes may stall over a given region.

All these effects were present with Harvey, which increased the hurricane’s destructiveness. In particular, Harvey did stall, producing record rain and flooding, with horrible consequences. We saw similar effects with Hurricane Sandy in 2012. (For a discussion of interrelated factors that together intensify a storm’s capacity for destruction, read It’s a fact: climate change made Hurricane Harvey more deadly.)

We are starting to see regular dangerous occurrences of what would have been “100-year events” without climate change. In risk management, this is called “tail risk.”

Ilene: By “tail risk” do you mean that what was once considered unlikely is becoming increasingly more likely?

Jan: Yes. Climate change is increasing the tail risk and, moreover, moving the new average risk up toward the old tail risk, with increasingly bad consequences.

Ilene: One stock market “guru” proclaimed a few months ago that because Warren Buffett suggested insurance prices were not factoring in climate change, there was no climate change. I’m not sure if the guru was wrong about Buffett and/or insurance companies, but if so, is that about to change?

Jan: The National Association of Insurance Commissioners (NAIC) recognizes climate change – see the NAIC’s Climate Change and Risk Disclosure and Emerging Risks: Climate Extremes in the U.S. Reinsurance companies are starting to factor in climate change. Munich Re estimates that climate change has already increased the probability of major U.K. flood loss events by 1.4 to 2 times.

Property and Casualty Insurance companies tend to be reactive, simply raising prices and cancelling policies after an extreme event. Ceres, a sustainability nonprofit organization composed of large investors, reports that “while more U.S. insurers are improving their disclosure and management of climate risks, most are still giving it minimal attention, both in terms of risks and opportunities.”

The real message is that the insurance industry – along with other industries – is starting to wake up to climate risk. Maybe the guru will also wake up.

Ilene: Are you hopeful?

Jan: Yes. I am optimistic; I have no other choice. I do not want to have a conversation with my grandsons when they get older and ask me “Grampa, what did you do for climate?” and I say, “Well I got depressed and stopped.” I am not going to have that conversation. I will continue to do my best to make sure the world is livable for them and for their grandchildren. I am hopeful that we (humanity) will make the necessary adjustments before it’s too late.

We need to act with more urgency now. The costs of inaction are too great.

Thanks for reading this. You can help.

Jan Dash managed quant/risk groups at Bloomberg LP, Moore Capital Management, Citigroup/Salomon Smith Barney, Fuji Capital Markets, Eurobrokers, and Merrill Lynch. His prior finance and physics academic positions included Adjunct Professor with the Courant Institute (NYU), Visiting Research Scholar at Fordham University (Graduate School of Business Administration), Directeur de Recherche at the Centre de Physique Théorique (CNRS, Marseille, France), and Member of Technical Staff at Bell Labs. He has published over 60 scientific papers, and holds a BS from Caltech in engineering and a PhD in physics from UC Berkeley. The 2nd edition of his book, Quantitative Finance and Risk Management, A Physicist’s Approach, devotes a chapter to climate change and its long-term systemic risk. Jan is also the primary author of the handy list of quick responses to climate contrarian fallacies and the Managing Editor of The Climate Portal.

Ilene Carrie is editor and content manager at Phil’s Stock World, a popular website for learning about investing and option trading strategies.

The opinions expressed in this interview are those of the author and do not necessarily reflect those of any institution mentioned.