Here we are again.

Here we are again.

Once again the Fed failed to raise rates and the Dollar dropped, sending the indexes and commodities higher. Boeing (BA) was the entire story for the Dow (DIA), as their $20 gain was good for 170 of the 97 points the Dow gained. That's right, without BA, the rest of the Dow components lost 73 points and the S&P ended up red (slightly) despite Boeing's boost.

We had a live Webinar yesterday and we talked about the internal market weakeness and decided to stick with our index shorts from Tuesday morning's Report, notably the Dow below the 21,650 line and the Russell below 1,445 – with tight stops over the line.

We're also still shorting Oil (/CL) Futures below the $48.50 line as that too, seems overdone after it's 15% run since Mid-June rom $42 to $48.50. Considering how much effort has been made to talk oil up – $48.50 is pretty pathetic, a strong indicator of general weakness. Also, we're getting into that time of year when there's already a tremendous overhang of fake, Fake, FAKE open contracts at the NYMEX from traders who have no intention of taking delivery. December already holds open orders for 342M barrels – that's 20 times the amount that will actually be delivered!

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Sep'17 | 48.70 | 48.94 | 48.25 | 48.34 |

08:05 Jul 27 |

– |

-0.41 | 216350 | 48.75 | 633860 | Call Put |

| Oct'17 | 48.79 | 49.03 | 48.35 | 48.43 |

08:05 Jul 27 |

– |

-0.42 | 11954 | 48.85 | 183845 | Call Put |

| Nov'17 | 48.89 | 49.16 | 48.48 | 48.55 |

08:05 Jul 27 |

– |

-0.44 | 4298 | 48.99 | 121836 | Call Put |

| Dec'17 | 49.02 | 49.28 | 48.57 | 48.67 |

08:05 Jul 27 |

– |

-0.44 | 19059 | 49.11 | 342448 | Call Put |

| Jan'18 | 49.10 | 49.35 | 48.70 | 48.73 |

08:05 Jul 27 |

– |

-0.49 | 5382 | 49.22 | 117183 | Call Put |

| Feb'18 | 49.13 | 49.41 | 48.78 | 48.78 |

08:05 Jul 27 |

– |

-0.52 | 3302 | 49.30 | 52578 | Call Put |

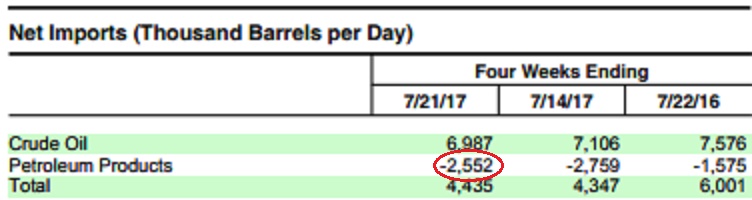

The front three months have fake, Fake, FAKE orders for a whopping 938M barrels yet only 45M of those barrels will actually be delivered to Cushing over the next 3 months in what is a constant con job played on the American people to fake demand. Another black mark on oil is the fact that the US is using 17.5M barrels less oil per week than we think because that's how much petroleum product we are EXPORTING to other countries.

Last year, US drivers consumed 9.75Mb of gasoline per day and this year it's 9.725Mb/d – a slight decrease yet gasoline is up 5% and oil is up 5% because we are artifically constraining our local supply by exporting 2.55M barrels of product per day to other countries. Why does the US import oil only to export other oil and gasoline? Because our refineries were operating last year at just 92.5% of capacity and this year they have upped it to 94% as the rules for exporting fuel have been relaxed.

This is not a demand story at all and, without a demand story, the bullish case for oil quickly falls apart – especially as we're already halfway through summer driving season and well past peak demand for the year. It's early in the September contract cycle, which terminates on 8/22, so there's not much pressure on those 600+M FAKE contracts yet but, when it does come time to roll them into 600+M FAKE October contracts, we may see a bit of panic because December is already an uncomfortably crowded month.

This is not a demand story at all and, without a demand story, the bullish case for oil quickly falls apart – especially as we're already halfway through summer driving season and well past peak demand for the year. It's early in the September contract cycle, which terminates on 8/22, so there's not much pressure on those 600+M FAKE contracts yet but, when it does come time to roll them into 600+M FAKE October contracts, we may see a bit of panic because December is already an uncomfortably crowded month.

You would think the President would be outraged that the American people are paying to subsize Mexico's oil. Not only that, but this affects our balance of trade and sends US Dollars to countries that sponsor terrorists for no reason as we import 20% more oil than we need to supplement our US production. 2.5M barrels, in fact, is more oil than we import from all of OPEC. Obviously, no one expects Donald Trump to keep a campaign promise but this is almost the exact opposite of making the US energy-independent and it turns into a tremendous tax on the American people – why do they stand for it?

As to the overall market, we're pretty much back at irrationally exuberant levels thanks to the Fed and their continued easy money stance. In yesterday's statement, the Fed said the economy is great and unemployment is low but, since there is not 2% inflation (by their measure) they are going to keep pumping $60Bn a month into the economy through their QE program (mostly bond rollovers).

Will they ever take the training wheels off the economy? Investors paying record-high multiples for stocks better hope they don't. For now, at least, there's been a reprive.