1, 2, 3, 4 – I declare a trade war!

1, 2, 3, 4 – I declare a trade war!

Those of you who are students of economic history know that nothing is more damaging to an economy than a trade war and those of you who don't know enough history to believe there are "alternate facts" aren't worth trying to convince, so I won't waste time here. Our President, of course, is not one to let facts get in the way of a rash decision and Trump is proposing special taxes on Chinese imports, starting with aluminum but actually, this is a sneaky way to stop the flow of cheap solar cells into the US to boost Trump's beloved coal industry (and the Koch Brothers).

It is not unusual for the U.S. to punish businesses it deems to be “cheating” on global trade rules, and one should not be too quick to judge any specific punitive measure taken. But the fear is that we are now on a slippery slope toward a trade war, as China is certain to respond by taxing U.S. sales of goods in China.

All of this trade talk ignores the basic fact that China is our factory floor, the way the midwestern cities once were in the mid-20th century. They were dirty and polluted and the kind of jobs people had were not the kind of jobs people actually wanted, which is why the people in the Northeast were thrilled to export those jobs and the pollution out west. As the US developed and as World Trade became more efficient, we exported the jobs and factories all the way to Asia and China became the new Japan (who were our factory in the 70s) and now China is pushing those jobs and factories to Africa because, in the end – NOBODY ACTUALLY WANTS THEM!

Assembling IPhones is not a dream job but those are on the high end of of what we have exported overseas. I'm going to focus on the IPhone so I can explain to you what an idiot our President is, without making it too complex.

Assembling IPhones is not a dream job but those are on the high end of of what we have exported overseas. I'm going to focus on the IPhone so I can explain to you what an idiot our President is, without making it too complex.

Though the IPhone is an American product, it's assembled in China and those IPhones are counted as Chinese exports. This is not China doing anything bad to us, we ASKED them to make the phones for us and they do – 200M a year at an average price of $700 (not including accessories made in China or IPads or MacBooks). That's $140 BILLION of "Chinese Exports" to the US or roughly 1/2 of our "trade deficit" accounted for by a single product and, as I said, if you include all things Apple, well over $200Bn right there.

So, if we bring back the IPhone, we decrease China's exports by $140Bn and increase our exports (though not all to China) by $140Bn and the problem is solved, right? Well, aside from the pollution, we have the issue of wages. IPhone workers in China make about $750 a month, which sounds like $4 an hour but more like $3, because they work more hours than we do (2 12-hour shifts). So it takes the average IPhone assembler a month's salary to buy one of the thousands of phones they assemble each month.

Wages are roughly 30% of the price of an IPhone or $210 and we're talking about essentially tripling them so +$420 per IPhone is a 60% increase in the overall cost of the phone. That extra $84Bn will be paid by you, the IPhone user, for the privilege of knowing that the deadly toxic run-off from the manufacturing process will be polluting American rivers and not Chinese ones. America is going to be so great!

Will we create some US jobs? Sure, some crappy ones but it won't be 3.36M jobs, which is how many $25,000 jobs $84Bn pays for. So why doesn't Apple (AAPL) just charge $420 more for the phones made in China and use that money to build clean energy factories in the US or put 3.3M people a year through college (15% of all students), so they will be able to compete in the future economy – rather than clinging to the World's last manufacturing jobs before they are wiped out by machines.

Will we create some US jobs? Sure, some crappy ones but it won't be 3.36M jobs, which is how many $25,000 jobs $84Bn pays for. So why doesn't Apple (AAPL) just charge $420 more for the phones made in China and use that money to build clean energy factories in the US or put 3.3M people a year through college (15% of all students), so they will be able to compete in the future economy – rather than clinging to the World's last manufacturing jobs before they are wiped out by machines.

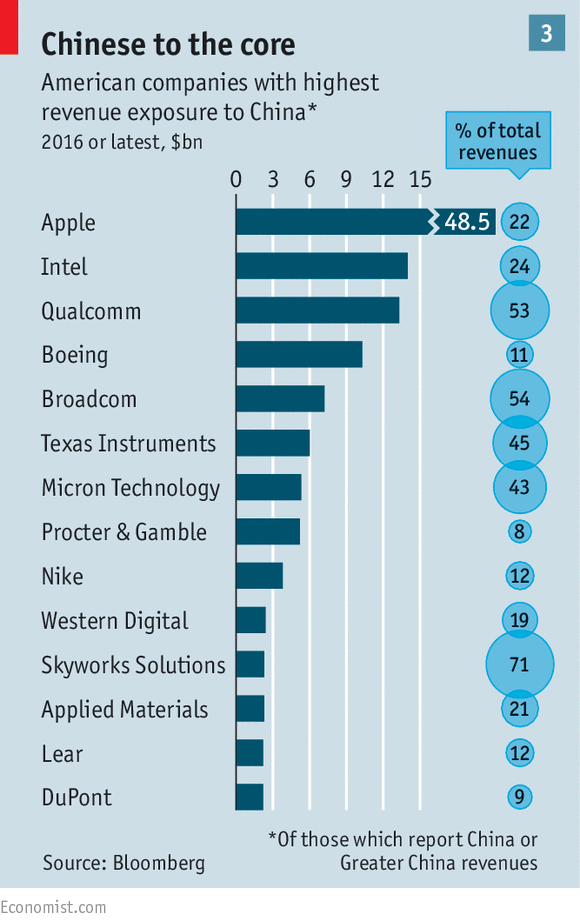

And remember, there aren't 3.3M people assembling 200M IPhones, it's not even 100,000 so it's costing you, the consumer, over $840,000 for each $25,000 job President Trump wants to force back to America – that's just stupid! Meanwhile, if you back out those factory orders from China's exports, we have a massive trade surplus with China, who buy tons of US goods and that's money that flows into many companies that really need the money (see above chart). Even AAPL makes 22% of their Global sales in China and, if China retailiates with their own tarrifs, we're talking devastation for US retailers across the board.

While the rah, rah, anti-China rhetoric plays well at Trump rallies – it sucks as a policy. Something Obama learned early on in his own administration:

Meanwhile, talk of trade war is strengthening the Dollar, which may even break back over 94 today and that unintended consequence of sabre-rattling is not good for the markets so we took advantage this morning and put in those short orders on the Futures in our Live Member Chat Room at Dow (/YM) 22,000, S&P (/ES) 2,470, Nasdaq (/NQ) 5,925 and Russell (/TF) 1,400. As usual, we wait for two of them to cross under than then short one of the laggards with VERY TIGHT STOPS – because this market be CRAZY!

Speaking of crazy, quite the brouhaha down in Charlottesville this weekend and yes, Trump did finally condemn the actions of the fascist right-wingers – so thanks for that – but, to those of you who don't understand what the big deal is to us "lefties" – you really need to watch yesterday's coverage of the rally, including the car attack, that was on Vice last night. How long would it take you to condemn these people?

This is what's going on in our country folks. This is the violence that's about to erupt in any American city at any moment because people are very angry on both sides and we don't have any leaders who are bringing us togehter – they are simply fanning the flames and making very poor examples of themselves in the process.

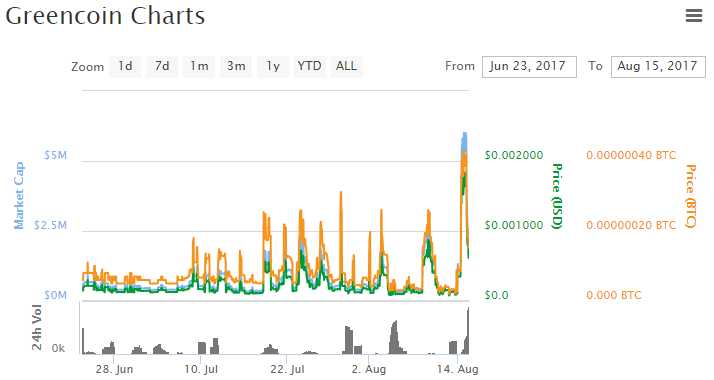

This is why Bitcoin is hitting $4,400, nearly a double in a month and those GreenCoins I told you about last month are now up 500% at 0.0017 with over $5M in market cap already (you're welcome!) – definitely our Currency of the Year and PSW will soon be accepting GreenCoin as payment, which should build up the volume quite nicely. Here's a link to my original article explaing the currency and why we think it will be a breakout Cryptocurrency star. As noted by InvestFeed's Ron Chernesky:

This is why Bitcoin is hitting $4,400, nearly a double in a month and those GreenCoins I told you about last month are now up 500% at 0.0017 with over $5M in market cap already (you're welcome!) – definitely our Currency of the Year and PSW will soon be accepting GreenCoin as payment, which should build up the volume quite nicely. Here's a link to my original article explaing the currency and why we think it will be a breakout Cryptocurrency star. As noted by InvestFeed's Ron Chernesky:

“We’re seeing investors transferring their funds into cryptocurrencies as they try to diversify their risk in case of a severe downturn in the market. The space has gone from niche to more widely adopted with one of the main draws being that cryptocurrencies are seen as less correlated with other assets.”

We're excited about this new market, a new safe haven asset in times of turmoil and, by gaining expertise early in the adoption cycle, we at PSW will be able to take advantage of new products and trading vehicles as they come out. That's why I would encourage you to put some fun money to work in Crytocurrencies – just so you can educate yourself so that, down the road, you'll be educated, practiced and ready when they begin to become serious investment vehicles.

We're excited about this new market, a new safe haven asset in times of turmoil and, by gaining expertise early in the adoption cycle, we at PSW will be able to take advantage of new products and trading vehicles as they come out. That's why I would encourage you to put some fun money to work in Crytocurrencies – just so you can educate yourself so that, down the road, you'll be educated, practiced and ready when they begin to become serious investment vehicles.

Right now, no one has more of a ground floor entry into Cryptocurrency than you do. This is the birth of a new asset class and you're right there – don't let it pass you by!