Wheeee – this is fun!

As you can see from JackDamn's index chart, the Russell Small Caps have now given up ALL of their gains for the year and, even a little bit lower and we won't be looking at a small correction anymore. Generally, we like to "short the laggard" – or the index that has fallen the least but the Nasdaq is a strange animal and all of it's outperforming gains are due to Apple (AAPL) – and we think AAPL deserves to be at $160, so we don't see it as particularly overpriced compared to the Dow or S&P, though there are certain components in the Nasdaq (AMZN, NFLX, TSLA) that have ridiculous values and those may correct and drag the index down with them.

As you are well aware, we've been discussing options hedges and futures shorts all month so I hope you enjoyed yesteray's dip as much as we did. Our two key shorts in our portfolios are the Ultra-Short Russell ETF (TZA) and the Ultra-Short Nasdaq ETF (SQQQ) and the Nasdaq is 4.5% off the top and the Russell is 7% off. By the way, we have the SQQQ hedges, not because we thought the Nasdaq would drop more but because our biggest long position is AAPL – so it gave us the best protection to lock in our gains.

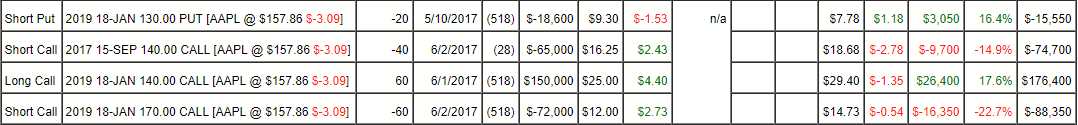

In fact, we just did a review of our Options Opportunity Portfolio, which is up an impressive 211% as of our two-year anniversary (8/8/15 was our start date with $100,000) and it is, by far, the best-performing portfolio in the Seeking Alpha Marketplace. That portfolio has the following AAPL position that, if successful will, by itself, make us $180,000 by Jan 2019.

Our net entry on the trade was a $5,600 credit, mostly in June and, though the short puts obligate us to buy 2,000 shares of AAPL for $130 ($260,000), which would use $130,000 of ordinary margin, AAPL is already far enough out of the money where the net margin requirement in the short puts is just $20,000 – so it's a non-issue in our now $311,000 portfolio.

The Bull Call Spread pays 60 contracts x 100 options per contract x $30 at $170 and that's $180,000 so, if this trade works out well, we will have a net profit of $185,600 (as we had the net credit) just 18 months after we started. The trade is now a net credit of $2,200 so we're up $4,400 (78.5%) in just over 2 months but that's only "on track" to our goal and it's still a great trade if you could use an extra $182,200.

Of course, we didn't start with a trade this large, we reinvested profits from older AAPL trades and this is the posiiton we worked our way up to. Notice that we sold $65,000 worth of calls to protect our investment (as we think AAPL is short-term toppy) and, as I mentioned, we have our QQQ hedges because, even though we can afford it – we really don't want AAPL to be 20% of our Portfolio – especially if it crashed back below $130 for some actual reason (as opposed to being dragged down with the Nasdaq, which wouldn't bother us).

We have a similar trade in our Long-Term Portfolio but that one is for PSW Members only. That portfolio is also up almost 200% (193.2%) but it's 18 months older and tends to be more conservative. As you can see from the AAPL spread – it's really not that hard to make good money in a bull market but that's why a market like this is unsustainable. What if we turn $0 cash ($5,600 credit) and $20,000 of margin into $185,600 every 18 months? What if the market never goes down and we take that $185,600 and re-inverst 1/3 and then turn $60,000 in to $550,000 and then reinvest $150,000 and turn it into $900,000, etc?

We have a similar trade in our Long-Term Portfolio but that one is for PSW Members only. That portfolio is also up almost 200% (193.2%) but it's 18 months older and tends to be more conservative. As you can see from the AAPL spread – it's really not that hard to make good money in a bull market but that's why a market like this is unsustainable. What if we turn $0 cash ($5,600 credit) and $20,000 of margin into $185,600 every 18 months? What if the market never goes down and we take that $185,600 and re-inverst 1/3 and then turn $60,000 in to $550,000 and then reinvest $150,000 and turn it into $900,000, etc?

While it sounds nice, it means that we can be much richer than Warren Buffett after getting returns like this for 40 years and where is that money going to come from? Where is this wealth being created except on stock market paper and what if all of us wealthy traders decide to cash in our paper gains? Where is the cash from economic activity to back it up? That's why markets like this become bubbles – at a certain point, financial physics do kick in and the gains simply can't be sustained.

Meanwhile, we're happy to play the game for as long as it lasts but we have on hand firmly on the exit door at all times and we ALWAYS have our hedges – just in case days like yesterday happen. What's the point of making 78.5% in two months if you don't lock in your gains? That's what hedging is – insurance for your portfolio. Aside from our short-term Futures shorts (and you don't even want to know how much profit you missed if you didn't read our Morning Report yesterday), we use index options to hedge as well. For example, in our Monday Morning Report, we suggested re-using our 8/8 trade idea, which was:

We've been talking about hedges and a good way to hedge the S&P, other than simply shorting /ESFutures with tight stops above, is a bear put spread on SPY options, which we can accomplish with the following:

- Buy 20 SPY Sept $247 puts for $2.50 ($5,000)

- Sell 20 SPY Sept $242 puts for $1.35 ($2,700)

- Sell 5 TEVA 2019 $20 puts for $4.40 ($2,200)

That spread is net $100 and pays $5,000 (up 4,900%) if the S&P drops below 2,420 (2.5%) into Sept expirations. You have an obligation to buy 500 shares of TEVA for $20 ($10,000), but that's a stock we really love at this price so, essentially, free money for promising to buy it. Ordinary margin on the short puts is just $900, so it's a very margin-efficient way to raise cash but you can use any stock you REALLY want to own as an offset.

The $247 puts finished the week at $5 ($10,000) and the $242 puts jumped up to $3.13 ($6,260) but TEVA got worse and those $20 puts are now $5.10 ($2,550) but that's still net $1,190 for a $1,090 (1,090%) profit for the week and THAT, my friends, is how you hedge! The S&P may not stay down and, if it doesn't – then we don't need the hedge money but we're thinking this is just a bounce – as we predicted would happen in Friday morning's report, when we flipped bullish (so the above trade was cashed but can be re-entered on the bounce).

SPY pulled back to $243 yesterday, just short of our goal and ahead of schedule. The TEVA puts are now $5 ($2,500) for a $300 loss but the bear put spread is now $2.42 ($4,840) so net $4,540 is up $4,440 (4,400%) for the week and well on the way to the full $10,100 payoff. You're welcome!

That's why we LOVE the dips in the market. If they last, then we get to use the cash our hedges make to buy more stock while it's cheap – it's a system that effectively enforces the entire concept of buying low and selling high.

On August 2nd, in our PSW Morning Report, our hedging idea was even better as we focused on shorting the Dow as it tested 22,000:

Dow 22,000 is our shorting spot (predicted last week) and we hit that that yesterday after Apple (AAPL) announced their earnings and popped $10 after hours, adding 85 points to the Dow. This gave institutional sellers the perfect cover to dump everything else and the index is back below 21,950, despite Apple's help. 50 points on the Dow (/YM) Futures is $250 (you're welcome) but we can do much better than that and we will be taking advantage of today's pop to add to our hedges (while it's cheap) and that's for Members Only but, for you, the cheapskate reader, we can give you a new hedging idea using the Dow Ultra-Short (DXD), which is a 2x inverse ETF:

- Buy 100 DXD Oct $11 calls for 0.45 ($4,500)

- Sell 100 DXD Oct $13 calls for 0.12 ($1,200)

- Sell 5 AAPL 2019 $120 puts for $4 ($2,000)

DXD is at $11.24 so in the money and $13 is $1.66 away or 15% so a 7.5% drop in the Dow will pay you back $2 x 10,000 options (100 per contract) or $20,000 and the net cost of the spread is $1,300. That's a profit of $18,700 (1,438%) if the Dow drops 7.5%, and stays down, into the October expirations. You are obligating yourself to buy 500 shares of AAPL at $120 ($60,000) so make sure you REALLY want to own AAPL if it drops 20% but, chances are your will be safe with that bet if the Dow stays up and, if the Dow falls and puts AAPL in the money, then you have an extra $20,000 to buy the shares with!

DXD hasn't actually moved very much but sentiment sure has and the Oct $11 calls are now 0.60 and the $13 calls are 0.15 for 0.45 on the spread x 100 = $4,500 and the AAPL puts are now 5.20 ($2,600) for a net of $1,900 which is up $600 (46%) so far and still very playable as a nice market hedge with a potential gain of $8,100 (426%) if the correction continues.

Meanwhile, the Dow Futures short (/YM) we played in Member Chat made $1,500 per contract on the 300-point drop and that's the quick money we can take off the table while we let our hedges run overnight. This morning, we're back on our index shorts from our bounce lines, which I outlined for our Members our early morning Live Chat Room.

We expect to complete the 2.5% sell-off we expected but, after that, it's up to the Central Banksters, who meet in Jackson Hole this weekend and are likely to do SOMETHING to calm the markets. We'll see if it works.

Have a great weekend,

– Phil