Well, you can't say I didn't tell you so.

Well, you can't say I didn't tell you so.

Back on Aug 3rd our PSW Morning Report was titled: "Thursday Market Folly – You Need an AAPL a Day to Maintain Dow 22,000" and we began looking for AT LEAST a 500-point (2.5%) correction in the Dow as well as a 2.5% correction in the other indexes. My logic was that, without some market-moving stock like Apple (AAPL) pushing up every day, at this point we'd have a tendency to drift lower. We went over the monetary physics of the problem in this weekend's PSW August Portfolio Review as well.

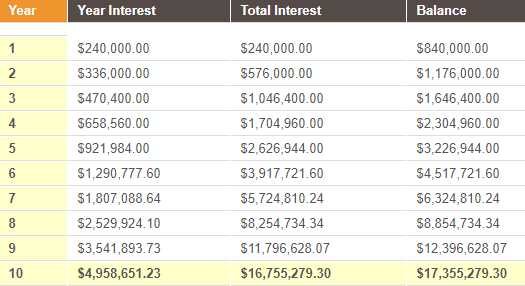

As we approach year 4 (11/26) for our paired Long-Term/Short-Term Porfolios, we are well on track to making 40% compounded gains off our original $600,000 investment, which should take us to $2.3M but next year – to make another 40%, we need $922,000. This is not a sustainable model because the economy isn't growing at a 40% pace yet the broad market is not that far behind us, having turned S&P 666 in 2009 to S&P 2,450 in 2017 – up 267% in 8 years which is a straight average of 33.37% a year.

As we approach year 4 (11/26) for our paired Long-Term/Short-Term Porfolios, we are well on track to making 40% compounded gains off our original $600,000 investment, which should take us to $2.3M but next year – to make another 40%, we need $922,000. This is not a sustainable model because the economy isn't growing at a 40% pace yet the broad market is not that far behind us, having turned S&P 666 in 2009 to S&P 2,450 in 2017 – up 267% in 8 years which is a straight average of 33.37% a year.

If the US market cap is now $85Tn, then a 20% gain requires $17Tn – that is just shy of the US's entire $18.5Tn GDP that needs to go into the stock market, just to feed a significant slowdown in growth. The market has become too big to succeed and that is why it's a bubble – we simply don't have the economy to feed such a beast!

The net effect is that every market misstep is now magnified and we're already seeing that as individual earnings reports are routinely sending companies down 10-25% if they displease. That's why I said in that 8/3 Report, to stay away from Tesla (TSLA), who are back below $350 and to buy Copper (/HG) instead, along with "Graphite, Nickel, Aluminum, Lithium, Cobalt and Manganese – that's what electric cars are made of." As you can see, copper has done well this month, adding 0.12 at $250 per penny, per contract and that's good for a gain of $3,000 per contract playing the better hedge of rising metals on the broad macro outlook, rather than trying to pick a specific electric car maker that will "win" the space.

Remember, I can only tell you what is going to happen and how to make money trading it – the rest is up to you!

The same goes for the Dow Ultra-Short ETF (DXD) trade idea we gave you on Aug 2nd or the Amazon (AMZN) short trade idea we gave you on 7/25, which is up 346% already and on track for the full 566% we expected by January expirations. When the S&P hit 2,480 on 8/1, we titled the Report: "Toppy Tuesday – Back to our Shorting Line on the S&P 500" – that was good, at 2,420 on Friday, for another $3,000 per contract gain (you're welcome) along with $1,500 per contract gains on the Dow (/YM), $4,000 per contract gains on the Nasdaq (/NQ) and $7,000 per contract gains on the Russell (/TF) – you're welcome!

Was that all? No, I'm not even going to bother telling you what we made on the next paragraph of that Morning's Report, where I said:

We're also shorting Oil (/CL) at $50 but long on Natural Gas (/NGZ7) at $3.07 and long on the Dollar (/DX) at $92.75 – all fun trades for a Tuesday morning.

It's not complicated folks – we read the papers, come up with a premise and then decde what things are going to be affected by the things we see that are about to happen. It's called Fundamental Investing and I know it seems like voodoo these days in a market that is 90% driven by technical trading – but it does work and it's a lot more relaxing than trying to guess which way the squiggly lines will bend next.

In our 8/8 Report, it was still: "Trendless Tuesday – Stuck at the Market Top" and we reiterated our call to short the S&P (and other indexes) at 2,480 while adding the following bearish spread for the Futures-challenged:

We've been talking about hedges and a good way to hedge the S&P, other than simply shorting /ESFutures with tight stops above, is a bear put spread on SPY options, which we can accomplish with the following:

- Buy 20 SPY Sept $247 puts for $2.50 ($5,000)

- Sell 20 SPY Sept $242 puts for $1.35 ($2,700)

- Sell 5 TEVA 2019 $20 puts for $4.40 ($2,200)

That spread is net $100 and pays $5,000 (up 4,900%) if the S&P drops below 2,420 (2.5%) into Sept expirations. You have an obligation to buy 500 shares of TEVA for $20 ($10,000), but that's a stock we really love at this price so, essentially, free money for promising to buy it. Ordinary margin on the short puts is just $900, so it's a very margin-efficient way to raise cash but you can use any stock you REALLY want to own as an offset.

I was on a cruise that week, so not too many new trade ideas but we added a bullish spread on Macy's (M), which is still around $20 and I mentioned I liked Chigago Bridge and Iron at $12, now $10 (down 16.66%). That brings us to last week's action and you are all caught up for August, where we are now looking for a bounce per our fabulous 5% Rule™, which tells us:

Remember, the 5% Rule™ is not TA – it's just match – we only use charts to illustrate it. A failure at the weak bounce line today, after failing the strong bounce on Friday, would be a strong indicator that we will be breaking below 2,420 and legging down to the -5% line at 2,356 so playing /ES short below 2,420 with tight stops above can make another $3,000 per contract if we get it right.

If we do pop up to the strong bounce line (2,442.50) on low volume, however – we're likley to also place a short bet there, along with the lines on the other indexes that I will draw out for our Members in today's Live Chat Room.

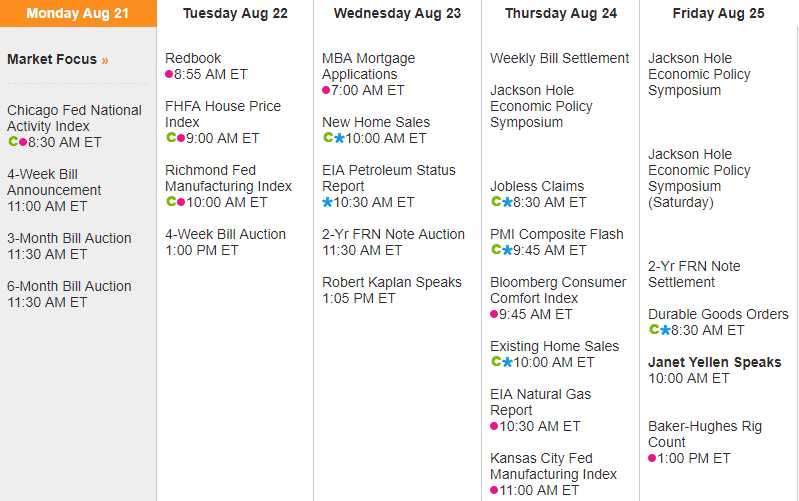

Yellen is speaking from the Fed's Jackson Hole Meeting on Friday but, between now and then, there's not too much going on for the week, data-wise:

Watch out for Durable Goods on Friday, from what we're hearing during the earnings reports, those are shaping up to be a negative number. Speaking of earnings, there are still quite a few companies who haven't reported yet, including heavy-hitters like BHP Billiton (BHP), Medtronic (MDT), Toll Brothers (TOLL), Cree (CREE), Intuit (INTU), Salesforce.com (CRM), Express (EXPR), Royal Bank of Canada (RY), Broadcom (AVGO), Tiffany (TIFF), Smucker's (SJM), AutoDesk (ADSK), VMWare (VMW), HP (HPQ) – not a week to ignore!

But also, they are not really the kind of stocks who can move the markets by themselves so this is a good week to watch those bounce lines and see if this is yet another minor pullback that is quickly corrected or, if this is something we haven't seen in over a year – a 5% or more pullback!

Have a good week,

– Phil