It's always something, right?

It's always something, right?

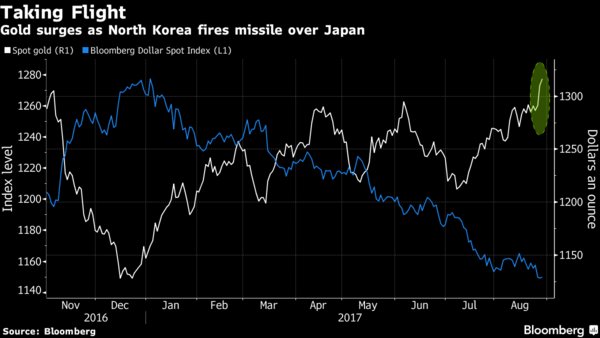

We don't know what specific event we are hedging against but mornings like this remind us WHY we hedge our portfolios. When the market is priced to perfection, it doesn't take a great deal of effort to bring it down and, this morning, all it took was North Korea firing a small test missile 1,700 miles, right over the top of Japan.

While the missile was still in the air, Japanese authorities sent an alert to northern areas near its path. “A missile has apparently been launched from North Korea. Please take refuge in a sturdy building or underground,” the alert said. The warning was lifted a few minutes later, after the missile went down in the Pacific. Japanese Defense Minister Itsunori Onodera said initial analysis suggests the missile was an intermediate-range ballistic missile of the same type that North Korea fired on May 14th.

Just last week U.S. Secretary of State, Rex Tillerson, praised North Korea for exercising “restraint” in not having conducted any missile tests during joint annual exercises between the U.S. and South Korean militaries, which began on Aug. 21st but are still ongoing – so much for that! “How the U.S. responds to this provocation will be closely watched by both Japan and South Korea, and could be a critical moment in alliance relations,” said Jenny Town, assistant director for the U.S.-Korea Institute at Johns Hopkins University’s School of Advanced International Studies. ?Given the administration’s strong response to the earlier threat against Guam, she said, “a tepid response now to this missile test further erodes U.S. credibility with our allies.”

There is nothing more terrifying than a power-mad authoritarian ruler with a bloated ego that has to constantly be stroked by his sycophantic followers who have to primp up even his smallest accomplishments to keep him in a good mood, to prevent him goes off the rails and doing something even crazier than usual. A "leader" like that thinks nothing of lying to his own people, restricting freedom of the press and blaming all of his administration's troubles on scapegoats – firing (or murdering) staff members whenever something goes wrong for them. Imagine having to live under the rule of someone that crazy!

When people have no faith in a country's leadership, they also tend to lose faith in its currency and the North Korean Won dropped 0.4% overnight but that could have been worse if the Dollar had not dropped 1% as gold shot up 2.5%, testing the $1,130 mark. Silver flew higher too, hitting $17.60 and that's going to be good for our Trade of the Year on WPM, as well as our early Tuesday morning list of mining stocks I liked for our Members.

When people have no faith in a country's leadership, they also tend to lose faith in its currency and the North Korean Won dropped 0.4% overnight but that could have been worse if the Dollar had not dropped 1% as gold shot up 2.5%, testing the $1,130 mark. Silver flew higher too, hitting $17.60 and that's going to be good for our Trade of the Year on WPM, as well as our early Tuesday morning list of mining stocks I liked for our Members.

Usually, when the Dollar drops, the market adjusts upwards but our Futures are down about half a point – indicating things could be worse if the Dollar were stronger. Europe is down 1-1.5% but the Global Markets have shaken off the increase possibility of nuclear war before – so let's not jump to conclusions as this is just the same channel pullback we've been playing for since last week (as we expected in yesterday morning's Report).

We took the usual Russell (/TF) Futures short yesterday and cashed in this morning at 1,370 for a gain of $640 per contract on 3 short contracts for a nice $1,920 gain to start our day. The Dow (/YM) gave us a nice 200-point drop from 21,850 and that was good for gains of $1,000 per contract at 21,650 while the S&P (/ES) fell from our 2,450 line to 2,420, which is a gain of $1,500 per contract and the Nasdaq came down from 5,850 to 5,780, which was good for gains of $1,400 per contract.

We took the usual Russell (/TF) Futures short yesterday and cashed in this morning at 1,370 for a gain of $640 per contract on 3 short contracts for a nice $1,920 gain to start our day. The Dow (/YM) gave us a nice 200-point drop from 21,850 and that was good for gains of $1,000 per contract at 21,650 while the S&P (/ES) fell from our 2,450 line to 2,420, which is a gain of $1,500 per contract and the Nasdaq came down from 5,850 to 5,780, which was good for gains of $1,400 per contract.

You can join us later today for our Live Weekly Trading Webinar at 1pm, EST by SIGNING UP HERE. It will be open to the public today and we will demonstrate some of our Futures Trading Techniques, discuss our support and resistance lines and even discuss some hurricane trade ideas.

Early this morning (5:22 am), I put up a note to our Members to cash in on those index shorts as we expected a bounce and now we'll see if the bounces are strong or weak and that will determine how we play the day. We already took the opportunity to go long on Oil Futures (/CL) at $46.50 and Gasoline (/RBV7) at $1.565 and already those two contacts are up almost $1,700 at 8:30 – so the morning gets better and better for our early-bird traders.

Early this morning (5:22 am), I put up a note to our Members to cash in on those index shorts as we expected a bounce and now we'll see if the bounces are strong or weak and that will determine how we play the day. We already took the opportunity to go long on Oil Futures (/CL) at $46.50 and Gasoline (/RBV7) at $1.565 and already those two contacts are up almost $1,700 at 8:30 – so the morning gets better and better for our early-bird traders.

That one trade alone more than pays for almost 6 months of our Trend Watcher Membership, which allows you to view the comments in our Basic Chat Room, along with my trade ideas, every market day – it's our most popular Membership at the moment. We're also doing very well over at Seeking Alpha with our Options Opportunity Portfolio, which just had its 2-year anniversary on Aug 8th with 211% gained in two years. That does not, of course, include our Futures Trading – we consider that to be gambling and it's just something we do with fun money while we are waiting for our boring old options trades to bear fruit.

For example, Gary (gh123) over at Seeking Alpha suggested we look at Coeur Mining (CDE) back on March 23rd and we liked where they were going and thought the sell-off was overdone. That's the kind of OPPORTUNITY we look for and then we constructed the following OPTIONS trade to take advantage of it:

- Sell 10 CDE 2019 $7 puts for $2.05 ($2,050)

- Buy 15 CDE 2019 $5 calls for $3.90 ($5,850)

- Sell 15 CDE 2019 $10 calls for $2.10 ($3,150)

That's net $650 on the $7,500 spread that's $4,260 in the money to start. Worst case is owning 1,000 shares at net $7.43 (a bit cheaper than it is now) and best case is making $6,850 (1,053%) over $10. TOS says net margin is $1,110 so super-efficient too!

Though CDE is only up about 0.75 from where we started, our conservative spread gave us a very good net entry of $7.43 on 1,500 shares and, so far, after 6 months out of 20, the short puts are $1.35 ($1,350) and the 2019 $5/10 bull call spread is $2.70 ($4,050) for a net of $2,700 and a profit of $2,050, which is up 315% on cash in just 6 months but only "on track" for our full 1,053% expected gain. In fact, this trade, right now at $2,700 can still return $7,500 for a $4,800 gain (177%) in 16 months. Once again, even the leftovers from our trades are better than the best ideas from other newsletters!

That's how our Options Opportunity Portfolio is able to gain over 100% per year. No matter what the market, there are always opportunites that Fundamental Investors like us can take advantage of and options are simply a way to leverage (and hedge) our bets so that we make huge multiples when we're right and limit our losses when we are not.

Once you learn that you don't have to swing for the fences to make fantastic returns (you just need to use better trading tools!), you will enjoy trading a whole lot more. As we say over at PSW, it's "High Finance for Real People – Fun and Profits" – if you are missing either of those two in your trading day – come and give us a try!