To 3(%) or not to 3(%).

To 3(%) or not to 3(%).

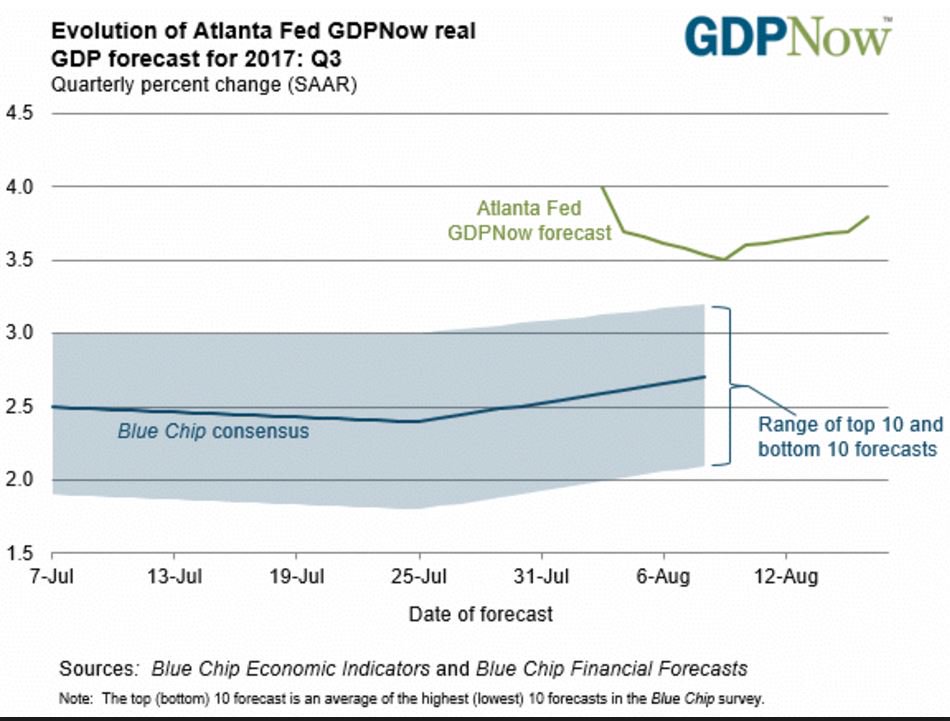

As you can see from the Fed's GDPNow forecast, it's raging ahead of the forecasts of our leading Economorons by a wide margin. Usually, I bet against the Economorons but the Fed is full of them too so it's a toss-up as to who is likely to be more wrong but we have a short bet on the Dow Futures (/YM) at 21,900 that says it's the Fed.

We took that bet in our Live Trading Webinar yesterday afternoon and added to it this morning as the Dow popped in early morning trading, getting all excited about a European open that's fading fast as of 6:35. To some extent, it's a hedge against our long Oil (/CL) bet at $46.15, which is a double-dip from the bet that made us gains $500 per contract in the first hour of our live webinar (you're welcome!).

This morning, Gasoline (/RB) is looking cheap again at $1.63, so I like a long there with tight stops below $1.625, which would still be a $210 loss as gasoline contracts are expensive at $420 per penny – so be very careful trading them. We'll see if the oil inventories (10:30) can get both to break higher, the API Data was encouraging for the bulls, showing a 5.78Mb draw in crude, up from 3.6Mb last week but that data was through Friday – ahead of the storm.

Oh, and don't cry if you missed yesterday's PSW Report (subscribe here and never miss one again) but you know those Gasoline (/RBV7) contracts that were up $1,755 early yesterday morning at $1.585 and I said you missed the first 0.02 of the move? Well, this morning we got the rest of the 0.10 to $1.655, so that's another $7,020 gained on our 2 long contracts, up $3,510 per contract – wasn't that easy?

Oh, and don't cry if you missed yesterday's PSW Report (subscribe here and never miss one again) but you know those Gasoline (/RBV7) contracts that were up $1,755 early yesterday morning at $1.585 and I said you missed the first 0.02 of the move? Well, this morning we got the rest of the 0.10 to $1.655, so that's another $7,020 gained on our 2 long contracts, up $3,510 per contract – wasn't that easy?

Remember, I can only tell you what is likely to happen and how to make money playing it – the rest is up to you…

That's right, while I was writing this post (now 6:56), the /RB contracts popped another 0.02. The fluctuations are due to changing assessments of the storm damage and all we have to do to make money is stay ahead of those assessments by paying attention to the news flow and figuring out what's likely to be the story that gets distributed by the press. Since I am the press AND an analyst – I have a good knack for figuring out which way the analysts will be leaning ahead of time and how it will be interpreted in the headlines.

That's what futures trading is all about – PAYING ATTENTION! This information is out there but 99.999% of investors wait for someone to read it for them and explain it to them before making a decision. Hell, they even wait for someoene like me to read the news for them and come up with a trading idea. At PSW, we practice the philosophy of "Teach a Man to Fish" because it's much better when everyone is a good trader and our Members learn to come up with great trade ideas that they then, in turn, share with the group.

That's what futures trading is all about – PAYING ATTENTION! This information is out there but 99.999% of investors wait for someone to read it for them and explain it to them before making a decision. Hell, they even wait for someoene like me to read the news for them and come up with a trading idea. At PSW, we practice the philosophy of "Teach a Man to Fish" because it's much better when everyone is a good trader and our Members learn to come up with great trade ideas that they then, in turn, share with the group.

Getting back to Gasoline, we could see another 0.10 move in /RB, which is about 6% higher than we are now and the Gasoline ETF (UGA) at $28.06 so 106% is $29.74 and that's up $1.68 so we can buy the low-premium Sept $26 calls at $2.15 and hopefully collect at least $3 but don't be greedy – take the quick money and run and I'd set a stop if UGA fails to hold $27.50, probably a loss of 0.50 (25%) as the Delta is nearly 1.00 on those contracts. That gives you almost the same leverage as a Futures trade.

See, trading isn't hard, just do the math and it becomes very clear which play is going to be right for the occasion. Speaking of math, ours finds the GDP is likely to come in well below the Fed's forecast, probably below 3% based on the earnings reports we've been checking in on. Very simply, we are still a consumer-driven economy and the consumer was not doing a lot of shopping in Q2.

There are, however, signs that that might be turning around and we called a long on XRT for our Options Opportunity Portfolio subscribers last Thursday morning at $38.80 and now they are back after failing an attempt to get over $40 but it's a Jan trade idea that has the potential to make 222% on cash between now and then – so well worth checking out!

The GDP report might send XRT back to the lows but it's data that, by definition, cut off on June 30th and we're betting on Q3, not Q2 and those are the kind of mismatches we love to take advantage of as traders (and many analysts) are not too bright and simply read the headlines before buying high or selling low.

Speaking of analysts you should listen to (and do the complete opposite), we should have known the rally had more legs when Dennis Gartman "staked his reputation" that "the bull market has come to an end" on Aug 11th. Even though I agree with him (see Aug 10th's "Faltering Thursday – Terror at Dow 22,000"), his record suggested making the contrary bet would be much more profitable. My prediction on the 10th was that we'd have a 550-point correction from 22,000, which would be 21,450 and, so far, I'm off by 150 as we bottomed out on the 21st at 21,600. We're not out of the woods yet as no one said it would all happen in less than a month and, as noted above – we are shorting the Dow here:

I have to go to the Nasdaq this morning for an interview so I'll miss the GDP fun but it's only 4 contracts short ($20 per point), so wish me luck!