That hasn't stopped the S&P futures from testing 2,700 (/ES) and Dow (/YM) from testing 2,4850 this morning as the new GOP tax bill seems to be "in the bag" and the House Speaker, Paul Ryan, is now promising us an "average" $2,059 tax break for a "typical" family of four making $73,000/year. If you take them at their word (and when has Congress ever lied to you?), then 100M housholds will save $200Bn a year yet, somehow, Corporations save another $200Bn AND the new tax cuts BOOST Federal Revenues because those companies will turn right around and put that money into building new factories and hiring millions of workers, which will boost total reciepts. What can possibly go wrong?

Nothing, according to the Index Futures, which are blasting higher about 0.5% this morning and that's lagging Europe, which is up over 1% – which seems kind of odd as the whole purpose of these tax cuts is supposedly to make us more competitive with Europs so wouldn't our gain be a detriment to them? Well, best not to think about logical things like that when we're trying to enjoy the rally, right?

Certainly, we don't want to read the actual bill, because it is one scary document! "The more you read, the more you go, 'Holy crap, what’s this?’” Greg Jenner, a former top tax official in George W. Bush’s Treasury Department, told Politico last week. “We will be dealing with unintended consequences for months to come because the bill is moving too fast.”

Certainly, we don't want to read the actual bill, because it is one scary document! "The more you read, the more you go, 'Holy crap, what’s this?’” Greg Jenner, a former top tax official in George W. Bush’s Treasury Department, told Politico last week. “We will be dealing with unintended consequences for months to come because the bill is moving too fast.”

On Friday, a group of 13 tax law professors and lawyers, many of whom have been vocal opponents of the Republican plan, published a 34-page paper offering a taste of what those unintended consequences might be. You know how people have been joking about incorporating themselves ever since these tax bills started kicking around? That’s almost certainly going to be a thing. Investors may be able to shelter their investment profits by stuffing them into C-Corporations, which are in line for a low, 20 percent tax rate.

Many individuals could save on their income taxes by gaming proposed tax breaks for passthrough businesses—firms like partnerships and LLCs that aren’t subject to the corporate rate. Baseball players will probably start separate companies to collect all of their endorsement and licensing royalties while saving on taxes. A law firm could split itself into multiple pieces in order to minimize its associates’ IRS bills. Here’s how that last scheme would work, according to Slate:

Law firm associates, LLC. Under the Senate bill, there is potentially a major problem as drafted: Employees may be able to benefit from the pass-through provision by forming a pass-through of which they are an owner. To achieve the tax savings, no longer be an employee (who cannot benefit from the provision); instead be an owner (who can benefit from the provision).

For example, law firm associates (and other employees of the firm) should no longer be mere associates. They should instead be partners in Associates, LLC—a separate partnership paid to provide services to the original firm. Their “profit share”—in lieu of salary—from Associates, LLC would then be given the special low pass-through rate. There are restrictions on lawyers—since they provide a personal service, which is disfavored in the bill—from benefiting from the special pass-through rate, but those restrictions would not apply to these associates.

So long as the associate (or really partner in Associates, LLC) makes less than $500,000 in taxable income (for a married couple) or $250,000 (for a single individual), they would be fully eligible. And that covers a lot of law firm associates, not to mention many other people who are now employees—but who may not be for long.

Far from making accountants and tax lawyers obsolete with this "simplified tax bill" – the GOP is creating a bonanza next year as everyone in America (who matters) will be rushing off to form Corporations or Partnerships to push ther income into that 20% Corportate Tax Rate. As noted on the chart above, people in the Top 1% households, who make an average of $1.26M/yr ($465,52 is the bottom of the 1%) will save about half of their $440,000 average tax bill. Paul Ryan's $2,059 deduciton example for housholds making a "typical" $73,000 actually already puts them in the Top 20% while the Top 10% begins at $133,445 and averages $295,845 and the Top 5% make $214,462 or higher and average $350,870.

It's the cut-offs that matter more than the average because the Top 1% pull the average up for each group far more than the acutal number of people earning anything like that in the category so MOST people in the 20-10% range make about $60-$90,000 but those are ALL of the people the GOP cares about above the line where they begin f'ing people over to get their money – otherwise known as the bottom 80%, 250M Americans who make less than $60,000 per household.

It's the cut-offs that matter more than the average because the Top 1% pull the average up for each group far more than the acutal number of people earning anything like that in the category so MOST people in the 20-10% range make about $60-$90,000 but those are ALL of the people the GOP cares about above the line where they begin f'ing people over to get their money – otherwise known as the bottom 80%, 250M Americans who make less than $60,000 per household.

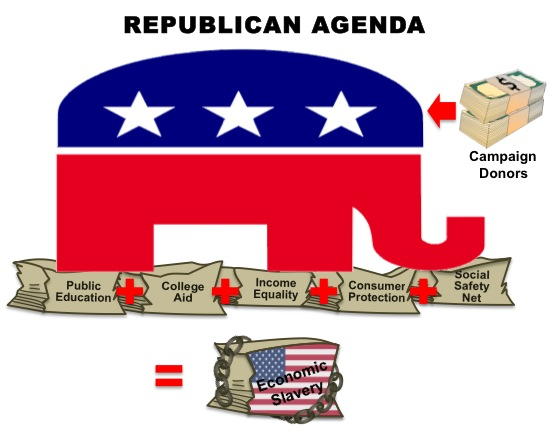

Those people are totally and completely screwed as they save no money in taxes and get hundreds of Billions of Dollars in benefits cut to pay for the tax cuts for their betters. The more loopholes there are now, the more benefits will have to be cut down the road to balance the budget. The typical base benefit cuts to those families is over $2,000/year and, over the course of their lives, it will simply put those families $80,000 more in the hole than they are now ($139,500 debt avg) which, of course, enslaves them to their creditors, which is step 1 to reversing the Emancipation Proclamation, which is really the GOP end game.

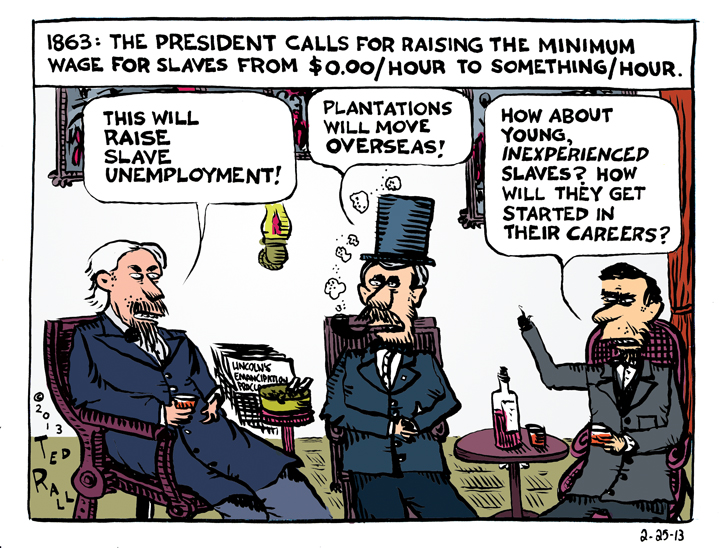

And I'm not saying the GOP is racist. They don't care if you are black or white – what matters is whether you are rich or poor and you either own people and businesses (which are legally people) or you are owned by them – THAT is the World this tax bill is making for us. As noted by Politicus:

Republicans completely support wage slavery and returning to pre-New Deal workers’ rights they have spent the past four years promoting by opposing every initiative aimed at relieving the suffering of low-wage Americans whether it is opposing unemployment benefits, workplace protections, blocking a minimum wage increase, destroying unions, or any one of the myriad other barbaric attacks on poverty-wage working families. However, they have advanced the interests of the rich whom have increased their wealth incredibly and it has come at the expense of low-wage employees and the middle class Republicans regard as chattel for their plutocratic paymasters.

The term wage slavery is often used to criticize economic exploitation defined as workers lacking bargaining power with employers that amounts to quasi-voluntary slavery where survival is totally and immediately dependent on poverty wages. When you create a class of people who will never have enough money to retire and must work every day of their lives in order to survive (because there is no Social Safety Net to protect them and offer them choices), then you have created SLAVES for yourself, the slave-owner.

The term wage slavery is often used to criticize economic exploitation defined as workers lacking bargaining power with employers that amounts to quasi-voluntary slavery where survival is totally and immediately dependent on poverty wages. When you create a class of people who will never have enough money to retire and must work every day of their lives in order to survive (because there is no Social Safety Net to protect them and offer them choices), then you have created SLAVES for yourself, the slave-owner.

And, just like old-time slave-owners used to quote the scriptures to justify their dominion over their slaves, modern slave owners worship Capitalism to justify their mistreatment of the lower classes because, whether your God is Jesus or Adam Smith – it's all in their plan that you should have plenty while others have nothing and, simply because they have nothing – it is therefore natural that they serve your needs. In 1763, the French journalist Simon Linguet published an influential description of wage slavery:

The slave was precious to his master because of the money he had cost him … They were worth at least as much as they could be sold for in the market … It is the impossibility of living by any other means that compels our farm labourers to till the soil whose fruits they will not eat and our masons to construct buildings in which they will not live … It is want that compels them to go down on their knees to the rich man in order to get from him permission to enrich him … what effective gain has the suppression of slavery brought him? He is free, you say. Ah! That is his misfortune … These men … have the most terrible, the most imperious of masters, that is, need. … They must therefore find someone to hire them, or die of hunger. Is that to be free?

The abolitionist and former slave Frederick Douglass initially declared, "now I am my own master", upon taking a paying job. But later in life, he concluded to the contrary, "experience demonstrates that there may be a slavery of wages only a little less galling and crushing in its effects than chattel slavery, and that this slavery of wages must go down with the other".

The abolitionist and former slave Frederick Douglass initially declared, "now I am my own master", upon taking a paying job. But later in life, he concluded to the contrary, "experience demonstrates that there may be a slavery of wages only a little less galling and crushing in its effects than chattel slavery, and that this slavery of wages must go down with the other".

Douglass went on to speak about these conditions as arising from the unequal bargaining power between the ownership/capitalist class and the non-ownership/laborer class within a compulsory monetary market. "No more crafty and effective devise for defrauding the southern laborers could be adopted than the one that substitutes orders upon shopkeepers for currency in payment of wages. It has the merit of a show of honesty, while it puts the laborer completely at the mercy of the land-owner and the shopkeeper."

I know it's a heavy topic for a Monday. I meant to publish this on the weekend but I was busy gearing up for a consumption orgy with my high net-worth family but, as I have daughters, I found myself with a lot of free time in the Mall and I spoke to people who worked at the stores and asked them what they thought of the stock market (they could care less) and the Trump Tax Plan (they think it will save them) and it put me on this introspective path. Of course the poor will always hold out hope and, sadly, their hope is currently that Donald Trump and the GOP will fix their lives. Boy are they in for a surprise!

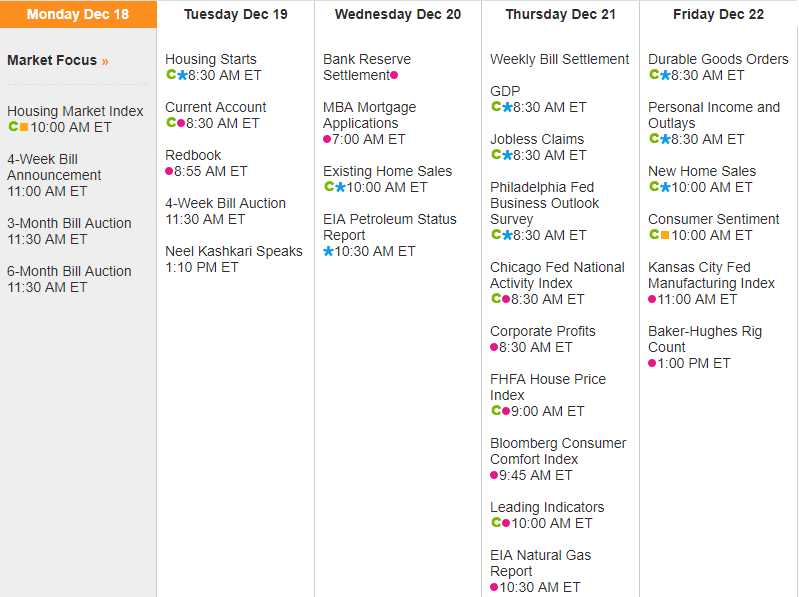

Getting back to the markets (because if we don't stay on the ball and make money, we might end up on the wrong side of that cut-off line!), the market is already on vacation this week, with very little date coming through and next week is a complete joke so it's likely we drift into the end of the year up at these record highs. Neel Kashkari is the only Fed speaker all week but we do get a final number on Q3 GDP, which was last notched at 3.3% and is expected to hold steady. November Durable Goods are expected to bounce back from -1.2% in October – bad sign if they don't.

Be careful out there!