.jpg) I love to say "I told you so" – it means I got something right.

I love to say "I told you so" – it means I got something right.

We did the math for you last Tuesday and predicted the S&P would drop to 2,730, which was a 2.5% pullback from 2,800 and 70 points down on the S&P Futures (/ES) pays $3,500 per contract but, even if you missed that call, we gave you another chance to cover on Friday with our call that the Dow would drop 600 points (at $5 per point, per contract) to 25,400 and we pretty much hit that one on the button for the day for gains of over $3,000 per contract so you are very welcome and what a great way to end our month of free trading tips!

So yes, we know what the market will do today only we're not going to tell you – that was reserved for our Members this morning in our Live Member Chat Room. What I can tell you is we're not worried and this is simply the pullback we expected – albeit a bit later than we expected it in January, since it's actually February at this point.

Keep in mind that we're not Futures traders, we just use the Futures to make quick adjustments to changing market conditions and, of course, for fun during boring trading days. Friday was aqnything but boring and this morning we'll have some follow-through to the downside but, as long as we hold 25,000 on the Dow – we're probably going to survive and turn around by mid-week.

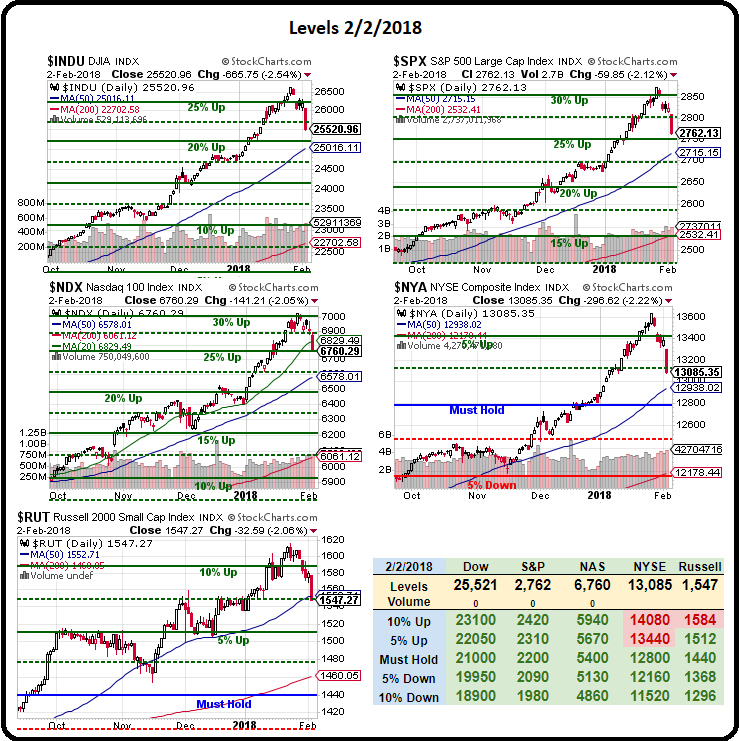

Meanwhile, we look for bounces and, according to our 5% Rule™ (the same one that told us exactly what to play for last week), 2,640 on the S&P (/ES) should be the worst-case before getting a nice bounce off the fall from 2,860 and that's 220 points so we'd look for a 44-point weak bounce to 2,684 and another 44 points takes us to the strong bounce line at, Ta Da!, 2,728 – close enough to 2,730 that we can call it a strong confirmation of our theory.

If the S&P is going to stay away from 2,600, then we expect there to be good resistance at the strong bounce line (2,730) and, if we don't cross below it, we can even begin to look for a reversal, though I'm not seeing much Fundamental support for a quick turn-around, in this crazy market – who can say?

There's not much in the way of data this week but there are 6 Fed speakers scheduled and they can put out the fire if today goes badly. We get PMI and ISM data this morning, Consumer Credit on Wednesday, Chain Store Sales and Consumer Comfort on Thrusday and Wholesale Trade on Friday so ho-hum data but still lots of earnings, with over 100 S&P 500 companies reporting:

Speaking of Tuesday, in case this little dip in the markets made you realize hedging isn't such a terrible idea after all, you can still play the hedge we laid out for you in that post as it's a slow-moving hedge designed to protect you against a long-term collapse in the market, not a quick dip. Our trade idea on Tuesday was:

(SQQQ) is the ultra-short Nasdaq ETF that's a 3x inverse of QQQ. So, if the Nasdaq drops 10%, SQQQ goes up 30% (in theory, it's not perfect). I'm going to add the following trade as a hedge and WE EXPECT TO LOSE MONEY ON THIS ONE – it's like life insurance, you pay for it but you hope that, each year, it's a waste of money!

- Buy 40 SQQQ Sept $16 calls for $2.80 ($11,200)

- Sell 40 SQQQ Sept $23 calls for $1.20 ($4,800)

- Sell 5 ALK 2020 $60 puts for $8.20 ($4,100)

That's net $2,300 and $2,620 in margin (from the short puts) to protect our current $36,975 gains and our potential profits – not a large price to pay and, if the Nasdaq drops 10%, then SQQQ (now $16.25) should climb 30% to $21.12 and put the $16 calls $5.12 in the money for $20,480, so we'd be up $18,180 and the max pay-out on the spread is $28,000 so about $26,000 of downside protection – which is half of what we started with!

ALK held up well, still at $64.46 and the 2020 $60 puts are still $8.50 so down 0.30 is $150 while the SQQQ Sept $16s have popped to $4 ($16,000) and the short $23s are $2 ($8,000) for net $7,850, which is up $5,550 (240%) but still miles away from the full $28,000 payout so still a good hedge if you missed out on our multiple warnings to cover while it was 240% cheaper to do so!

The other major hedge we gave away to the free readers recents was our Russell Ultra-Short (TZA) hedge from Jan 17th, which was:

We still like the Russell for a hedge into earnings and, in the Live Member Chat Room, we chose the following hedge at 11:25, just in time for the massive 100-point drop in the Russell but we're back to 1,585, so you can still make the hedge on the Ultra-Short ETF (TZA) as follows:

- Sell 30 TZA 2020 $10 puts for $2.50 ($7,500)

- Buy 40 TZA July $10 calls for $1.80 ($7,200)

- Sell 40 TZA July $15 calls for 0.60 ($2,400)

That gives you a net credit of $2,700 and a $20,000 upside on the July spread if TZA pops from $11.40 to $15 (31%) and, since it's a 3x short ETF, that would mean the Russell would have to drop about 10%, back to 1,425, which doesn't seem like much of a stretch after yesterday's quick plunge. If the Russell doesn't fall, then we take the remaining $2,700 and invest it in rolling the long July calls to something lower in January and then cover with short Jan calls and then we have a full year of insurance in exchange for our promise to buy 3,000 shares of TZA for $10. The idea, of course, is that our longs make much more money than our TZA shares would lose – hedges are all about balance.

As you can see, TZA popped up to almost $12 on Friday and should open above it this morning. As of Friday's close, the July $10/15 bull call spread was net $1.30 ($5,200) and the short 2020 $10 puts are $2.45 $7,350 so a $2,150 credit is only up $550 (20%) so far and still a massive $22,150 (1,000%) upside if TZA marches on to $15 between now and July expirations (20th).

The hedges are not meant to be an immediate pay-off, what they do is let you plan for the future and make intelligent decisions about your longs.

For instance, if your portfolio is down 10% on Friday's sell-off, you are maybe down $10,000 but you know you have $8,000 coming if TZA holds $12 and another $12,000 coming if TZA hits $15 so there's really no need to panic out of your longs just because they took a little hit.

See how this strategy works? Now, imagine if you combine that with a quick $3,000 here and $3,500 there on the Futures and now you are hedging with style!

Futures trading is how we raise quick cash in a sell-off, our hedges are there to protect our long-term positions from long-term damage and, as we did the math for our Money Talk Portfolio last weekend – if we DON'T end up needed the protection of the hedges, our planned gains on the long positions more than make up for the difference. The primary value of the hedges is that they allow us to follow-through on our trading plan and even make beneficial adjustments along the way – rather than getting chases out of perfectly good positions just because the market has a mild correction.

We will be reviewing our portfolios this week and looking for where we can improve our current positions.

Meanwhile, with the 120-point drop in the S&P to 2,740, we'll want to see a 25-point bounce just to call it weak so 2,765 is our immediate goal and we have to get over 2,790 (strong) before we even consider it a proper bullish move.