Good golly, what a mess!

Good golly, what a mess!

The Dow gave up another 1,000 points yesterday and President Trump is now presiding over the worst week in stock market history. Was it because he blew up the budget? Was it because he got rid of Janet Yellen? Was it because he's likely to be indicted and impeached? Was it just because he was caught cheating on his wife with a porn star and then bribing her to cover it up using campaign donations? Who can say – so many scandals, so little time.

What is clear is that the US looks a little scary to investors, both foreign and domestic and it's not the kind of thing that can be fixed by having a huge military parade so money is coming out of funds and those funds are forced to sell their assets at whatever price and down we go.

As noted during the week, we're in a bot-selling pullback and it's following the script of our 5% Rule to the letter but that's not good news as the S&P finished right at our 2,596 (weak retrace) line yesterday and is only just above it this morning. We needed to go the other way, up to 2,728 and that's not likely to happen today but we are playing bullishly in our live Member Chat Room as follows:

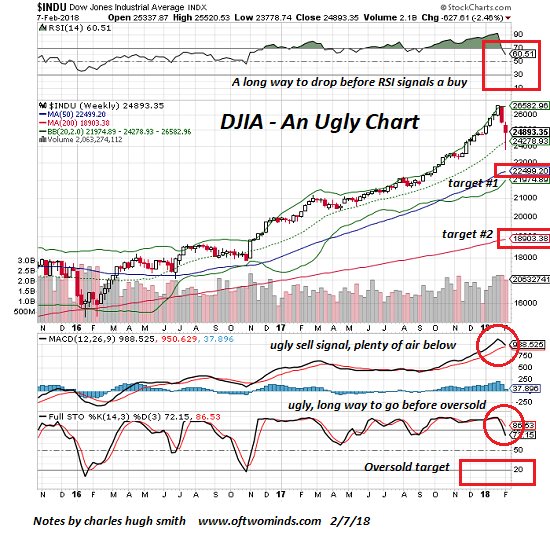

Well here's the test of 24,000 and we're failing that and 2,600 and 6,350 and 1,470 but those are now the lines we want to play long if we move back up but very ugly if we're failing that.

As long as 2,596 holds, we're willing to have a long on the S&P Futures (/ES) but it would be nice to have a confirmation from the others to let us know we're on track. It's sad that I have to say this for the 4th time this week but yes, we still like Gasoline (/RB) long at $1.755, which is the 2.5% pullback line from $1.80, which we certainly expect to be back to into NEXT WEEK's holiday and that will pay about $1,800 per contract if we're right.

As long as 2,596 holds, we're willing to have a long on the S&P Futures (/ES) but it would be nice to have a confirmation from the others to let us know we're on track. It's sad that I have to say this for the 4th time this week but yes, we still like Gasoline (/RB) long at $1.755, which is the 2.5% pullback line from $1.80, which we certainly expect to be back to into NEXT WEEK's holiday and that will pay about $1,800 per contract if we're right.

We were right yesterday with our gasoline trade in the Morning Report and, as you can see here, 4 contracts made us a very quick $2,104 so you're welcome for that one and now our FREE Futures Trade Ideas are up well over $10,000 for the week – not bad! Keep in mind we're only following our 5% Rule™ but that's how I wwas able to tell you yesterday morning, pre-market:

Bear (oops, don't say "bear"!) in mind 2,684 is likely to be rejected on /ES, so that's the point at which we want to take profits on /NQ (6,605) and /TF (1,510) and then, if we brake over, /ES becomes a good play over 2,685 with tight stops below along with the others (and /YM should be 2,850). That's all it takes to play the Futures and we call that our Pony Express Strategy, where we ride a horse up to resistance and then get a fresh horse for the next leg up. All the futures contracts pay similar amounts for similar moves, so it doesn't matter which one we play so we go for the one with the best lines at any given moment.

Not much else to do but watch and wait today. Unless we're over our strong bounce lines tomorrow, we'll be re-hedging into the weekend (we're a bit bullish at the moment) but I'll be surprised if we clear 2,700 – let alone 2,728 and that means we're back to the same hedges we were using before the crash.

Meanwhile, enjoy the bounce but "Don't get excited!"

Remember, I can only tell you what the market is likely to do and how to profit from it – the rest is up to you.

Using the same rules, we called the downturn in our Live Member Chat Room at 9:49, saying:

Ouch, there goes 1,500 (/TF) – no bullish plays if that's failing and, as I said, good lagging short below that line with /NQ 6,550 a good long on the way up.

.jpg) The Russell pays $50 per point, per contract so the fall from 1,500 to 1,465 was good for $1,750 per contract but we took $1,000 at 1,480 in the afternoon and started playing for longs instead. That yeilded a very messy $6,125 in profits after going in and out of /NQ positions 30 times by 1:50 pm – NOT for beginner traders but I had warned our Members right at the opening bell:

The Russell pays $50 per point, per contract so the fall from 1,500 to 1,465 was good for $1,750 per contract but we took $1,000 at 1,480 in the afternoon and started playing for longs instead. That yeilded a very messy $6,125 in profits after going in and out of /NQ positions 30 times by 1:50 pm – NOT for beginner traders but I had warned our Members right at the opening bell:

Friggin /NQ is moving up and down 5 points at a time – that's not normal at all! I would avoid futures unless you can shake off a big loss as it's one of those days.

Sometimes it's easy and sometimes we have to work for our money. Our Dollar trade, which we have now been discussing for the entire month, is now up over $1,500 per contract and halfway to our goal at 92 and that one was a "set and forget" trade idea that I put out on TV (Money Talk) on Jan 31st – which I reiterated in the Morning Report on Feb 1st.

Also in the Money Talk Portfolio, we added a hedge that was meant to protect our gains so let's check in on that and see how it's doing. The trade idea was:

(SQQQ) is the ultra-short Nasdaq ETF that's a 3x inverse of (QQQ). So, if the Nasdaq drops 10%, SQQQ goes up 30% (in theory, it's not perfect). I'm going to add the following trade as a hedge and WE EXPECT TO LOSE MONEY ON THIS ONE – it's like life insurance, you pay for it but you hope that, each year, it's a waste of money!

- Buy 40 SQQQ Sept $16 calls for $2.80 ($11,200)

- Sell 40 SQQQ Sept $23 calls for $1.20 ($4,800)

- Sell 5 ALK 2020 $60 puts for $8.20 ($4,100)

That's net $2,300 and $2,620 in margin (from the short puts) to protect our current $36,975 gains and our potential profits – not a large price to pay and, if the Nasdaq drops 10%, then SQQQ (now $16.25) should climb 30% to $21.12 and put the $16 calls $5.12 in the money for $20,480, so we'd be up $18,180 and the max pay-out on the spread is $28,000 so about $26,000 of downside protection – which is half of what we started with!

(ALK) is a stock we feel is very underpriced but you can use any stock you'd REALLY like to buy as an offset on these hedges but, keep in mind, if the market does tank, you REALLY will be buying that stock!

SQQQ has already shot up to almost $22, just $1 shy of our target but, since it's a spread, we won't get the full amount yet. At the moment, the 40 Sept $16 calls have jumped up to $7.20 ($28,800) and the 40 short Sept $23 calls are now $4.60 ($18,400) while ALK has held it's ground and the 5 short 2020 $60 puts are still $8.50 ($4,250) so our net on the spread is now $6,150 and we're up $3,850 (167%) overall but keep in mind we REALLY want to own ALK so the only thing we care about is the $10,400 we get to extract from the bull call spread on SQQQ – that's the real hedge.

Keep in mind that if the Nasdaq goes any lower and stays low into September, we'll end up collecting the full $28,000 on the spread so lots and lots more to gain from here and it's more than covering for what is, so far, light damage to our positions. If we were more confident that the market was going to recover, we could sell about 10 of our $16 calls to become less bullish and cash in $7,000 to lock in profits.

The spread was designed to protect us from the 10% pullback we expected but now that we're down 10% and, so far, only managing to bounce weakly off that 10% line – we're a little more concerned about an additional 10% pullback so we'll need an additional hedge. This hedge is easy to pay for because we can, as I just said, set stops on our original hedges longs to lock in profits that will pay for both hedges should the market turn back up or, if we turn lower – the we'll be well-covered with 2 hedges:

All the indexes are down about 10% so it's hard to pick a favorite. I think we should stick with the Nasdaq because Apple (AAPL) hasn't really corrected yet ($155 = 13.8%) and if they fall to $140, they will take everything with them. Also, there are still stocks like Amazon (AMZN), Tesla (TSLA) and Netflix (NFLX) that are trading at hundreds of times earnings and those tend to get hit hard in 20% market corrections. Also, it's easier to manage if we choose another SQQQ hedge so:

- Buy 40 Jan $20 calls at $6.40 ($25,600)

- Sell 40 Jan $30 calls at $4.30 ($17,200)

- Sell 5 AAPL 2020 $130 puts for $10 ($5,000)

That nets us into this $40,000 spread for $3,400 so the upside is $36,600 (1,076%) and we're obligated to buy 500 shares of AAPL for $130, which requires $4,325 of ordinary margin (any stock you REALLY want to own at a lower price will work) – so it's a very efficient way to protect yourself. We can pay for the spread by simply putting a stop on 10 of the SQQQ Sept $16 calls (now $7.20) at $6 to collect $6,000 and we'd still be 3/4 covered on the original hedge with an additional $40,000 protecting us if the Nas turns back up. And, if we do stop out the long Sept $16s, we then put a stop on 10 short Sept $23s (now $4.60) at about $4 (they would be lower too if the $16s stop out) so we are, in the least, getting a small profit on those 10 – even if we time it wrong.

Remember, this morning we are betting on a bounce but, if it's a weak one, we'll be adding the hedge officially to all of our portfolios and anything but a finish over our strong bounce lines at the close will probably have us adding another hedge as this market is crazy and there's no sense taking unnecessary risks.

Have a great weekend,

– Phil