In yesterday's Morning Report, we decided the sell-off was overdone and went for the Russell (/TF) Futures longs at 1,480 and yesterday afternoon they blasted back to 1,520 for a $2,000 per contract gain on the day and this morning at 1,530 for another $500 per contract and NOW we are flipping short – but more on that later. Remember, we are still playing the bounce lines from the charts we made for your last week – so none of this is a surprise and none of this, so far, including this morning's pop in the Futures, is indicating a true recovery yet.

The S&P Futures (/ES) this morning are topping out at 2,720 and our 5% Rule™ Bounce Chart from last week (2/9) has, so far, predicted the moves perfectly:

All we are doing, so far, is topping out at the same place we bounced on 2/7 and that's being mirrored on the other indexes so the lines we need to be over now – in order to call today "bullish" are Dow 25,200, S&P 2,715, Nasdaq 6,700 and Russell 1,520 and, so far, the Russell and Nasdaq are a bit over but the Dow and S&P are below. Don't forget, we topped out at 2,872 on Jan 26th so there's really nothing impressive about 2,720 – other than the fact that we came back from 2,600 but it's only a halfway recovery (not even) at this point and, if we fail to get over these lines, it's as likely we're consolidating for a move down after 2 weeks as it is we're moving back up.

Fundamentally, nothing has changed and you saw how quickly the market can still move down (and recover) yesterday. Our 5% Rule™ takes into account that it's easy to manipulate a rally that recovers 20% and 40% of a drop if it's done quickly enough and we take into account the idiocy of dip buyers as well. Not that all dip buyers are idiots – we had a field day adding stocks to our portfolios over the past two weeks – it's just that we added well-hedged positions and now it is time to improve our hedges, many of which we flipped bullish since the big drop.

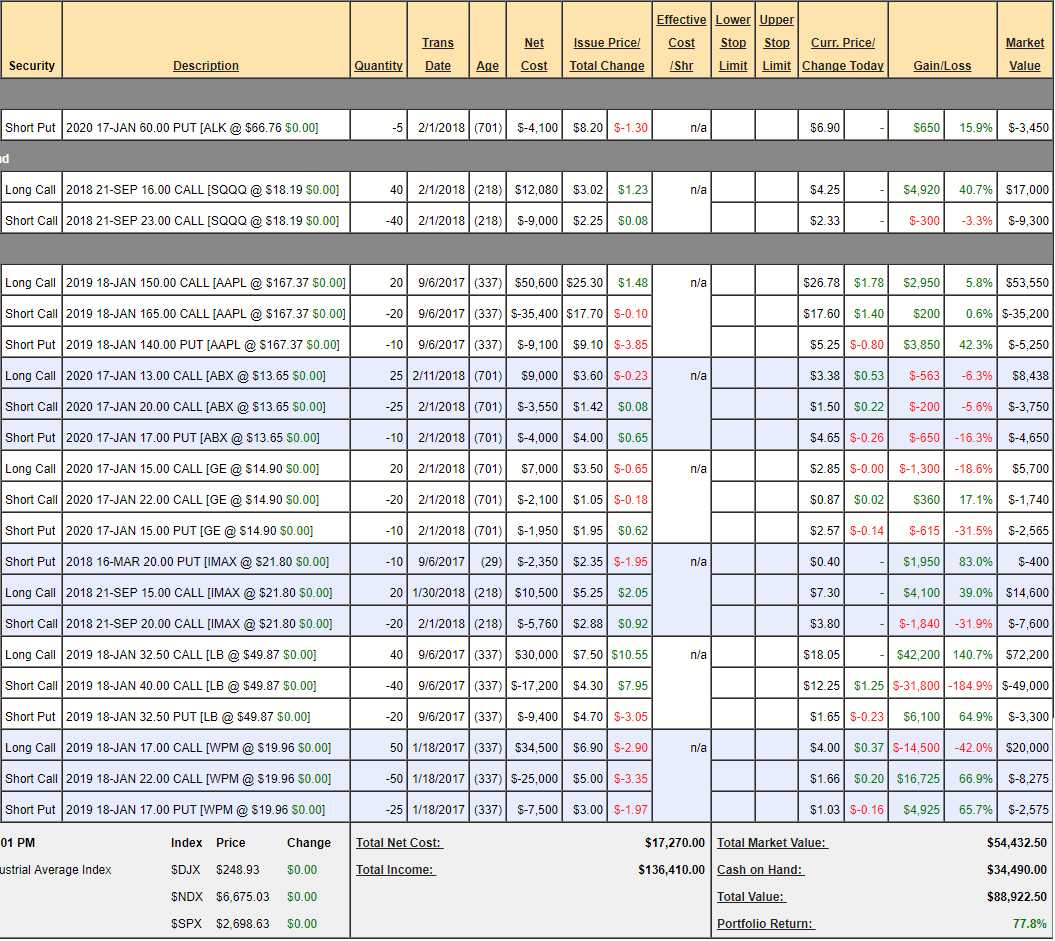

To that end, since there's no news and since I have 5 Portfolios to Reveiw for our Members today, let's start with a review of our public portfolio, which we only add to and change live on BNN's Money Talk and it's called, aptly, the Money Talk Portfolio, which was initiated with $50,000 on Jan 18th of 2017 and is already up to $88,922 (up 77.8%) after just over a year and, more importantly, up $2,000 since our last Review on Jan 31st, so our hedges have been well-tested and passed with flying colors!

It's never enough to just pick a bunch of positions and toss them in a portfolio, you have a plan for each position and then you need to regularly review that plan to make sure each position is on track and then, to make sure that the portfolio of positions are working together – well-balanced enough to steer you safely through shifting market conditions and most importantly, you have got to have good hedges!

- Alaskan Airlines (ALK) – These short puts were a way to raise cash to offset the cost of our SQQQ hedge. We love ALK and would be happy to buy them for $60/share but, if they go higher, we just keep the $4,100. So far, the position is up $650 (16%) and we fully anticipate collecting the other $3,400. Still good as a new trade.

- Nasdaq Ultra Short (SQQQ) – This is our hedge and we paid net $3,080 for $28,000 of potential protection but we offset that cost with a $4,100 credit selling ALK but, for review purposes, we fully expect to lose the $3,080 if the market behaves and, of course, we expect the longs to make much more than that, so no worries. Meanwhile, the hedge is doing its job and we're up $4,650 (150%).

- Apple (AAPL) – This is a $30,000 spread that cost us $6,100 in cash to initiate and the margin required on the short puts is $8,541 but worth it as we had very little fear Apple would fail $140 so the risk was deemed low. Currently, the spread is net $13,100, which is up $7,000 (114%) but we still have another $16,900 left to gain so, even as a new trade, this makes a very nice 12-month return from here.

- Barrick Gold (ABX) – We couldn't resist them this month as they got so cheap – even cheaper now but one of my favorite bottom picks and good for a new trade. We netted into this one for $1,450 cash and a margin requirement of $1,757 on the $17,500 spread. So far, no good and we have a loss of $1,413 (97%) but that means you can now enter this trade for just $37 cash! You live by the leverage and you die by the leverage but keep in mind it's a $17,500 spread and we have 2 years for it to play out so, essentially, we're down 10% on our target. In this case, we fully expect to make our $17,500 for a net gain, from here (net $37) of $17,463.

- General Electric (GE) – Another bargain find from my recent TV spot and this one also got cheaper and also we expect it to recover. We entered this $14,000 spread for $2,950 in cash and $1,425 in margin and, so far, we're down $1,555 (53%) with the spread an even better deal today at net $1,395 and we have no reason t think we can't hit our goal and make $12,605 by Jan 2020 as GE is ridiculously undervalued at $15.

- IMAX (IMAX) – This one is over our goal but still cheap at $21.80. The March puts should expire worthless and I would sell the Sept $21 puts for $2 ($2,000) to pick up some more cash but I don't think I'll be on the show by then so it's not an official move for the portfolio. Meanwhile, we paid net $2,390 and used $1,600 in margin on the short puts for the $10,000 spread which is now up $4,210 (176%) at $6,600 but still has $3,400 left to gain by September so, if you want a nice way to make 50% in 7 months (even more if you sell the Sept puts), you might want to consider this.

- Limited Brands (LB) – This was our 2018 Trade of the Year in Sept but, by the time Thanksgiving came around, it has already taken off and we officially went with HanesBrands (HBI). Still, LB is my favorite and this spread is deeply in the money well ahead of schedule. Our outlay was $3,400 cash with $3,728 in margin but it's a $30,000 spread and already at net $19,900 which is up $16,500 (485%) since Sept 6th but still has another 50% ($10,100) left to gain by Jan, so still good for a new, conservative trade – though I'd sell higher puts.

- Wheaton Precious Metals (WPM) – This was our 2017 Trade of the Year and the first trade in the Money Talk Portfolio. Again, our Trade of the Years' are big trades and this one is a $25,000 spread we paid net $2,000 cash for along with $1,312 in margin on the short puts. At the moment, we're at net $9,150, which is up $7,150 (357%), so this spread has $15,850 (173%) more to gain if we hit our mark in January.

We have 8 positions in our Money Talk Portfolio with 6 winners and 2 losers so 75% success is a little worse than our Top Trade Alerts (82%) but we are very happy with our losers as new positions. Our gains after year one are $34,490 and, if all goes well, our current postions should gain another $76,638 over the next 2 years so we're on track to add another $35,000 (70%) of our original $50,000 this year and next.

For today, however, we're calling a short-term top and we'll be making adjustments in all our portfolios to turn a bit more bearish (we can't change this one as we're not on TV but it's already well-hedged). In the Futures, I see 25,100 on the Dow (/YM), 2,720 on the S&P (/ES), 6,725 on the Nasdaq (/NQ) and 1,530 on the Russell (/TF) as good shorting lines and our rule of thumb is to wait for 2 to cross under than then short one of the other two as they cross and then either the 4th confirms the drop and, either way, you stop out if any of them pop back over for a small loss. Keeping the losses small is the key to playing intra-day moves.

I will be giving a 4-hour "Master Class" on Hedging, Options Trading Strategies, Portfolio Management and Fundamental Analysis at the opening of the New York Traders Expo on Sunday, Feb 25th at 9am at the Marriott Marquis – so register now if you'd like to hear a lot more about these strategies.

You're welcome

You're welcome