Bottom’s Up?

Courtesy of Scott Galloway, No Mercy/No Malice, @profgalloway

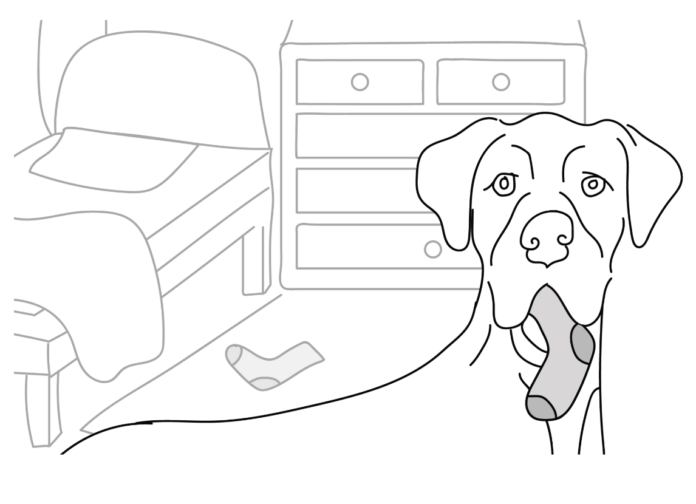

“Sock!” wails my oldest son. We spring into action. Finding the door to my youngest son’s room open, we proceed inside to validate our fears. Our Great Dane, Leia, lies still on her dog bed, bigger than most queen mattresses, looking guilty. “Where is the other one, why did you leave your door open?” our oldest, holding up a singular Bombas sock, queries his younger brother. It’s painfully clear what’s happened. Leia has, again, eaten a sock. This revelation inspires a crisp trip to the vet.

The vet injects Leia with a small dose of apomorphine, which stimulates dopamine receptors located in the area of the brain reserved for vomiting. She’s uncomfortable for a few minutes, heaves, and we get the sock back. Bombas claims they give a pair to someone in need every time they sell a pair. I wonder if that person feels nauseated when this happens, similar to a rabbit’s blood pressure rising after a sibling rabbit dies. The previous sentence is ghoulish even for me.

But this isn’t a dog post.

Debbie Downers

Only 10% of the nation feels positive about the economy, and last month consumer sentiment hit a record low. Americans are more anxious than they were even in 2008. Inflation is raising our collective blood pressure, and the media’s love of bad news is tipping us into hypertension. Anyone with a phone and a New York Times subscription has seen, over the past six months, 20 headlines regarding rising gas prices vs. 1 on their equally precipitous fall.

We’re witnessing similar pessimism among investors. Six in 10 fund managers say they’re taking less risk, the largest share … ever. Cash vs. stock allocation has surged to its greatest level since 2001, and more than half of managers say recession is likely.

We’re witnessing similar pessimism among investors. Six in 10 fund managers say they’re taking less risk, the largest share … ever. Cash vs. stock allocation has surged to its greatest level since 2001, and more than half of managers say recession is likely.

Both And

A difficult concept to grasp is that contradictory things can exist concurrently. This is partly what makes markets so challenging: A company reports significant revenue growth but the stock declines, as price is a function of millions of signals creating a set of expectations that are reflected in the stock leading up to earnings. It’s impossible for the human brain to process all of them. So we cling to binaries — up/down, good/bad — wherever possible. But binaries are black and white, and markets are in color.

U.S. GDP just contracted for the second quarter in a row — and for some people, that means a recession has already arrived. But … it hasn’t. I know this, because I just paid $140 for one adult and two kids tickets to “The Color Factory.” After waiting an hour, we were exposed to a “one-of-a-kind experience that immerses you in joy and color.” Not sure much joy was registered, but I did find out my “spirit color” is Majestic Gazpacho. Point is, there were several hour-plus lines in SoHo this past weekend so you could jump in ball pits, sample beauty products, or try on running shoes. Other anecdotal evidence: It’s become a foregone conclusion we were going into recession, which often means … we’re not.

A more robust determination will eventually be rendered by the National Bureau of Economic Research, and according to its chairman, the whole negative-GDP-in-two-consecutive-quarters thing “doesn’t make any sense.” Per the NBER, a recession is “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” And even that’s just a rough guide. Case in point: The group identified the early days of the pandemic as a recession, though the contraction lasted only two months.

Employment has risen every month this year. We added more than 500,000 jobs in July, and the unemployment rate is near a 50-year low. Personal consumption (70% of the economy), adjusted for inflation, has been up in five of the last six months. (See above: “The Color Factory.”) Over half the S&P 500 has now reported second-quarter earnings — two in three companies have beaten Wall Street’s revenue estimates, and three in four have beaten earnings estimates. Our fears, one economist says, are “completely at odds with the reality. I’ve never seen a disjunction between the data and the general vibe quite as large as I saw.”

The red lights on the dashboard: Inflation is still high, household debt levels are rising (because of inflation), we need the GDP growth number to turn positive, and the war in Europe presents real risk to everyone everywhere. That consumers and investors are so anxious is itself cause for concern. Mass feelings of pessimism (warranted or not) can become self-fulfilling prophecies.

Oh, and there’s this:

Gag Reflex

Gag Reflex

Just as we all became virologists when the pandemic hit, many of us now fancy ourselves economists. Every third tweet is a hot take on supply chains, and interest rates are cocktail party conversation. With the exception of a brief pandemic lapse, the market has been on a more than decade-long bull run. We saw “up and to the right” as the natural backdrop for stocks. Now that we’re seeing red, we’ve convinced ourselves that the market is suffering some sort of severe illness. Recession? Depression? Global collapse? Maybe. But more likely: The market is vomiting up stocks that should never have been ingested.

If we look at the stock market by sector, things aren’t that bad. Energy (albeit a Russia-Ukraine anomaly) rose 65% over the last 12 months. Utilities climbed 14%. Most other sectors, including real estate, industrials, and tech, are down, but not by much — and no more than 10%. There is, however, a vast force pulling the market down: unprofitable tech companies. Think Snap (down 86% in the last 12 months), Peloton (down 90%), and Roku (down 80%).

Within a year of the pandemic hitting, unprofitable tech stocks rose an average of 250%. These price movements made branded speculators, including Cathie Wood, wealthy. But the market’s mania for these sorts of equities was neither healthy nor normal. Most of these companies showed little-to-no evidence they could reach profitability, yet valuations promised sector domination, and many Web3 ventures were leveraged Ponzi schemes. The market’s apomorphine is fundamentals, and many companies, tokens, and platforms (e.g. Robinhood, most SPACS, all tokens sans BTC/ETH, and Celsius) were regurgitated by the market. This is healthy. And the healing may have begun: Many enduring tech companies just registered one of their best months in history.

Within a year of the pandemic hitting, unprofitable tech stocks rose an average of 250%. These price movements made branded speculators, including Cathie Wood, wealthy. But the market’s mania for these sorts of equities was neither healthy nor normal. Most of these companies showed little-to-no evidence they could reach profitability, yet valuations promised sector domination, and many Web3 ventures were leveraged Ponzi schemes. The market’s apomorphine is fundamentals, and many companies, tokens, and platforms (e.g. Robinhood, most SPACS, all tokens sans BTC/ETH, and Celsius) were regurgitated by the market. This is healthy. And the healing may have begun: Many enduring tech companies just registered one of their best months in history.

The pain we’re seeing in the stock market is the autoimmune response of a healthy, functioning economy. We thought we had an iron stomach, that we could digest anything — from synthetic shitcoin derivatives to Opendoor shares — but these were unwholesome, even pestilential.

Floor

In recent weeks, markets have rallied. The S&P 500 and Nasdaq hit lows in mid-July and have since risen 13% and 18%, respectively. Bitcoin appeared to hit a floor of $19,000 — it seems to have now stabilized at around $23,000. Ethereum’s up 50% for the month. The NFT market crashed spectacularly in early 2022; but I recently got an update from a crypto cold-storage company I’m invested in, Ledger: The company listed 10,000 NFTs for sale that will allow owners to get first access to a marketplace they’re launching — and sold out in 24 hours, generating more than $4 million.

Put another way, there’s still a market for many of these assets, which signals they’ll be enduring. Crypto and growth stock bubbles popped, but people still want Bitcoin and Ethereum and many tech companies are muscling through. Uber, for example, is a serially unprofitable business whose stock was halved between January and July. This week, however, the company posted positive free cash flow of $382 million in the most recent quarter — and the stock rebounded 20% in a day.

Digging in the Wrong Place

About a month ago I spoke with Ian Bremmer, President of Eurasia Group, on the Prof G Pod. Ian made a great point: We’ve all been talking about inflation and interest rates, but we’re focused on the wrong recession.

Ukrainian troops are camped along the front lines outside Kherson awaiting gunfire and airstrikes. Climate change is submerging or parching dense and developed regions all over the globe: The Rhine river is 14.5 inches away from being too shallow for cargo to pass through, half of the EU is at risk of drought, and the death toll from mass flooding in Kentucky is 37 and counting. Six in 10 Americans view members of the other political party not as political opponents, but as their enemy, and that number continues to climb. The greatest threat to our nation isn’t an economic recession, but losing the script re: what it means to be a country and a citizen. We have forgotten that Americans’ greatest allies will always be other Americans.

Our innovators shitpost the government when things are good and then expect a bailout when things get real. Just as the far right is attempting to conflate Christianity and masculinity with extreme conservatism, there is a dangerous smell of false equivalence emanating from the Valley, where a lack of respect for institutions and flouting any code of conduct correlates to innovation.

We each need our own stimulus, to be more enduring friends, neighbors, and citizens. To be kinder to each other, to realize our government is us, and to demonstrate more reverence for the most noble organization ever assembled, the U.S. government.

Rear Window

We’ve left the vet, headed home. Leia lays in the back, still queasy, and sulks for a few minutes. Unable to resist the open rear window, she soon has her ears flapping in the humid Florida breeze, taking breaks only to lay her head on the center console. Gas is $6, my stocks are down, and my sons’ socks no longer match. But Leia knows better — she’s focused on what’s important. I see her ears in the side-view mirror and have one thought: We’re going to be fine. We get back home, where the boys greet her and return to their devices. A sense of relief washes over me. Then Leia sprints up the stairs to my youngest’s room.

Life is so rich,

![]()

P.S. If you’re a product manager, you probably know Netflix’s Gibson Biddle — the guy who spearheaded many of the features that keep you glued to your couch. His next workshop, Measuring Product Success, is coming up on Tuesday. Don’t miss it.